Healthcare Distribution & Manufacturing Companies Will Have Another Record Year in 2021

Perficient

NOVEMBER 23, 2020

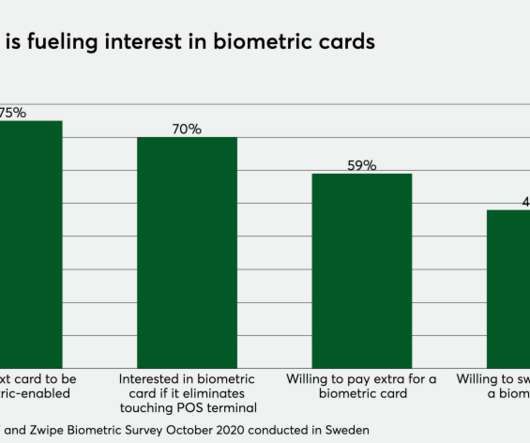

An eMarketer article reported that “US B2B Digital Healthcare Ad Spend will grow by 41.2% in 2020 to reach $848.1 million. That is the highest growth rate out of all the sectors for which we track B2B digital ad spending.” Now, I can’t say I’m surprised by this statistic. As eMarketer accurately points out, not only is there an increased demand for healthcare products (specifically PPE) within healthcare facilities, new customers have entered this vertical who have never purchased these types of

Let's personalize your content