Reviewing Bitcoin ATMs: LibertyX

ATM Marketplace

AUGUST 17, 2021

Bitcoin ATMs are making a big splash, but how do they line up when it comes to customer experience? In this series, we will take a look at Bitcoin ATMs, starting with LibertyX's line.

ATM Marketplace

AUGUST 17, 2021

Bitcoin ATMs are making a big splash, but how do they line up when it comes to customer experience? In this series, we will take a look at Bitcoin ATMs, starting with LibertyX's line.

BankInovation

AUGUST 17, 2021

From simplifying loan processing to streamlining customer onboarding, intelligent document processing (IDP) captures, extracts and processes data for banks and other financial institutions. To succeed with IDP, it’s critical to start with a clear business goal. Bank Automation News reached out to experts for best practices. Banks need to know which documents they’re targeting for […].

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

BankUnderground

AUGUST 17, 2021

Federico Di Pace and Christoph Görtz. There is ample evidence that a monetary policy tightening triggers a decline in consumer price inflation and a simultaneous contraction in investment and consumption (eg Erceg and Levin (2006) and Monacelli (2009) ). However, in a standard two-sector New Keynesian model, consumption falls while investment increases in response to a monetary policy tightening.

BankInovation

AUGUST 17, 2021

SenseTime Group Ltd., China’s largest artificial intelligence company, is working with HSBC Holdings Plc to arrange its planned Hong Kong initial public offering that could raise at least $2 billion, according to people familiar with the matter. China International Capital Corp. is also arranging the share sale for the SoftBank Group Corp.-backed company, said the […].

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

CFPB Monitor

AUGUST 17, 2021

A Utah federal district court recently ruled in two cases that the Petition Clause of the First Amendment of the U.S. Constitution provides immunity to debt collectors from FDCPA claims. The two cases are Holmes v. Crown Asset Management, LLC and Reyes v. N.A.R. Inc. and Olson Associates, P.C. Both decisions were issued by Judge Howard C. Nielson, Jr.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

CFPB Monitor

AUGUST 17, 2021

Last week, the FTC filed an administrative complaint against Fleetcor Technologies, a marketer of fuel cards, and its CEO in which the FTC alleges that the respondents violated the FTC Act’s prohibition on unfair or deceptive acts or practices. The complaint’s allegations mirror those in the lawsuit filed by the FTC against the respondents in 2019 in an Atlanta federal district court.

CB Insights

AUGUST 17, 2021

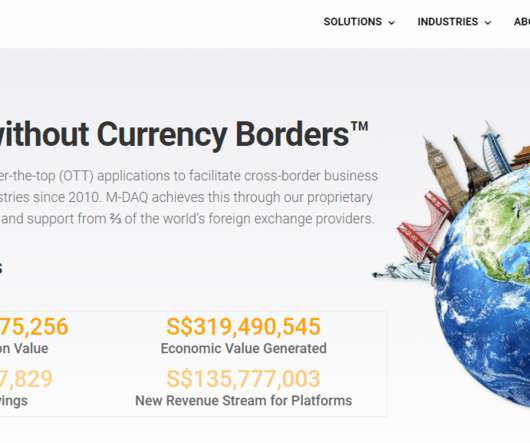

M-DAQ, a cross-border transaction platform for e-commerce and technology companies, has raised $147.4M in a Series D with participation from Affinity Equity Partners. HOW’S THE COMPANY PERFORMING? Singapore-based M-DAQ provides a platform that enables users to price and trade any exchange-traded products in more than one currency. The company maintains crucial ties with national exchanges and global FX banks.

The Paypers

AUGUST 17, 2021

Austria-based cryptocurrency broker Bitpanda has raised USD 263 million at a valuation of USD 4.1 billion in a funding round led by Valar Ventures.

ABA Community Banking

AUGUST 17, 2021

In response to the COVID-19 pandemic, the number of debit transactions declined 2.5% in 2020, the first dip in the 16-year history of the Pulse debit issuer survey released today. The post Survey: Debit Transactions Decline for First Time on Record appeared first on ABA Banking Journal.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

The Paypers

AUGUST 17, 2021

Kroo , a UK-based neobank, has received a UK banking licence with restrictions from the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA).

The Paypers

AUGUST 17, 2021

Žltý melón , a Slovak P2P lending platform, joined forces with Salt Edge , a player in developing Open Banking solutions, to implement PSD2-integrated access to clients’ bank data.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Financial Brand

AUGUST 17, 2021

Every financial offering must be as painless as Amazon, as mobile-friendly as hailing an Uber, and as free of manual processing as possible. The post 3 Ways to Build Consumers’ Comfort Level With Digital Banking Tools appeared first on The Financial Brand - Banking Trends, Analysis & Insights.

The Paypers

AUGUST 17, 2021

BCB Group , a crypto-dedicated provider of payments, business accounts, and trading services for the digital asset economy, has chosen Napier for its AI technology.

The Paypers

AUGUST 17, 2021

ANNA Money has joined forces with Currencycloud to add to the international banking experience for entrepreneurs and small businesses.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

American Banker

AUGUST 17, 2021

The Paypers

AUGUST 17, 2021

UK-based fintech company Truevo has launched its new ecommerce payment solution ‘Truevo Account’

American Banker

AUGUST 17, 2021

The Paypers

AUGUST 17, 2021

Payment solutions and service firm QuickFee has integrated its payments and payment plan functionality with cloud accounting system provider Xero.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Financial Brand

AUGUST 17, 2021

Total debit card spending passed that of credit cards for the first time in 2020. The pandemic was a big reason, but not the only one. The post Debit Cards Dethroned Credit Cards – Here’s Why That’s Likely to Stick appeared first on The Financial Brand - Banking Trends, Analysis & Insights.

The Paypers

AUGUST 17, 2021

US-based Coupa Software , a player in Business Spend Management (BSM), has launched the Coupa App Marketplace.

The Paypers

AUGUST 17, 2021

myPOS has introduced myPOS Online, a service that offers a set of features, including pre-designed store templates, hosting, customisation, inventory tracking, secure checkout, shipping options, in-store pick up, and tools such as gift-card preparation.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content