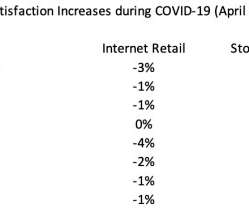

Were online customers more satisfied during the COVID-19 pandemic?

Perficient

DECEMBER 30, 2020

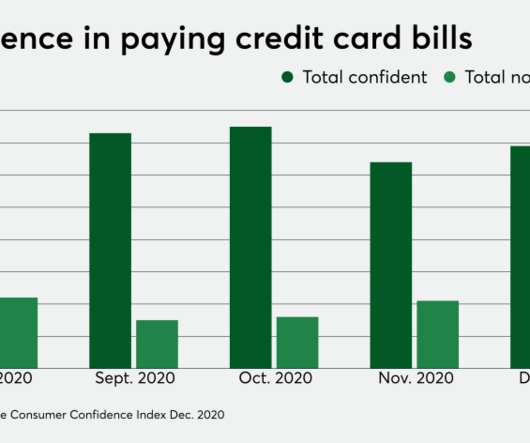

The COVID-19 pandemic stressed everyone in 2020. Many of our clients had prepared their digital businesses ahead of time and survived. Other companies who were late to creating digital customer experiences suffered as people stayed away from traditional stores and shopped online. But even the best companies struggled to keep customer satisfaction levels high during 2020.

Let's personalize your content