Finance now! Opportunities for embedded lending and leasing

Accenture

FEBRUARY 23, 2022

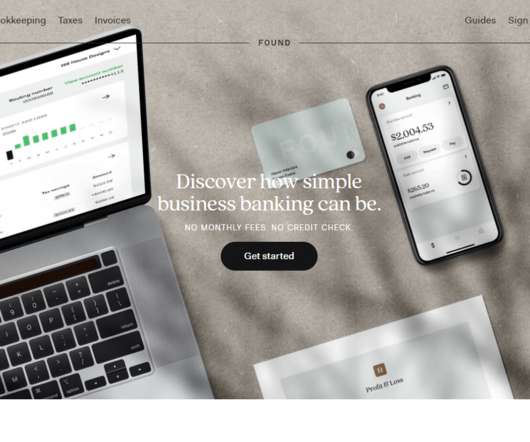

When I was shopping online recently, a new option appeared on the checkout screen that presented me the opportunity to finance my purchase. This new offering is becoming pervasive across all asset types, from laptops to lift trucks, and including services such as vacation travel, on B2C, B2B and even P2P shopping sites. The goal…. The post Finance now!

Let's personalize your content