Q2 2021 US retailer payments commentary

Accenture

OCTOBER 4, 2021

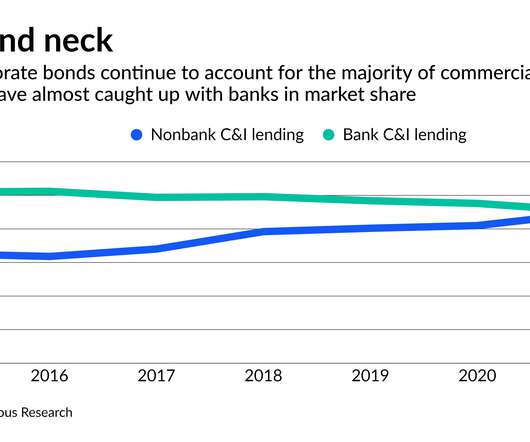

Credit Product Penetration of Retail Sales Shopping experience refresh “We are excited to pilot a virtual store staffed by dedicated associates … but with no physical customers. Customers can interact via chat and screen sharing to see physical products.” – Best Buy “Piloting a new holistic market approach … to leverage all our assets across…. The post Q2 2021 US retailer payments commentary appeared first on Accenture Banking Blog.

Let's personalize your content