Beyond Responsible AI: 8 Steps to Auditable Artificial Intelligence

FICO

JUNE 21, 2021

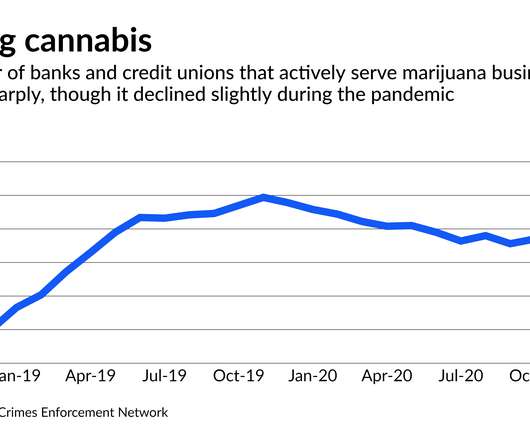

With novel artificial intelligence (AI) applications multiplying like rabbits these days, it may seem like the current wave of AI innovation is all beer and skittles. Lawsuits have a way of sobering up any metaphorical party and, in the wake of numerous high-profile racial bias and fairness cases, The Wall Street Journal reports that companies including Google, Twitter and Salesforce say they “plan to bulk up ethics teams responsible for evaluating the behavior of algorithms.”.

Let's personalize your content