Driven by Data

ABA Community Banking

JUNE 24, 2021

For Bernard Tynes, realizing the power of marketing takes the perfect combination of gut feeling and hard information. The post Driven by Data appeared first on ABA Banking Journal.

ABA Community Banking

JUNE 24, 2021

For Bernard Tynes, realizing the power of marketing takes the perfect combination of gut feeling and hard information. The post Driven by Data appeared first on ABA Banking Journal.

Jack Henry

JUNE 24, 2021

Over the past year, the banking industry has seen many unprecedented events that have resulted in both margin- and capital-related challenges. The flat, ultra-low yield curve coupled with the bloated growth of non-maturity deposit balances have many banks considering how to best deal with the current reality. To forecast strategic and economic impacts on key metrics, banks continue to rely heavily on financial modeling using various tools available.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Banking Exchange

JUNE 24, 2021

As the economy recovers we are seeing an emergence of the usage of commercial cards by businesses Payments Duties Lines of Business Mobile Online Cards Covid19 Feature Feature3.

CFPB Monitor

JUNE 24, 2021

In AMG , SCOTUS ruled that Sec. 13(b) of the FTC Act does not give the FTC authority to seek equitable monetary relief (e.g. restitution or disgorgement). After reviewing AMG’s history and SCOTUS’s analysis, we discuss the reasons for the FTC’s infrequent use of administrative hearings, AMG’s implications for pending and settled cases, the FTC’s current authority to seek civil money penalties, efforts to amend the FTC Act, and the FTC’s approach to new cases, including potential partnering with

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

BankInovation

JUNE 24, 2021

As the banking industry continues to innovate and as the lines between fintechs and financial institutions continue to blur, open banking is booming, with the market size estimated to reach $43.15 billion by 2026, at 24.4% CAGR, according to Allied Market Research. It’s easy to see what’s so appealing about the benefits that open banking […].

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankInovation

JUNE 24, 2021

While legal ideas of fairness in credit have been long established by fair lending laws, adding artificial intelligence (AI) into the mix can complicate matters. There are about “24 definition of fairness,” in mathematics, said Janine Hiller, professor in finance and business law in the Pamplin College of Business at Virginia Polytechnic Institute and State […].

CB Insights

JUNE 24, 2021

Oyster , a virtual HR platform for distributed workforces, has raised $50M in a Series B with participation from Stripes Group, Capital Partners, and Slack Fund among others. How’s the company performing? Delaware-based Oyster’s HR platform provides tools for payroll, benefits, hiring, onboarding, and salary management services for contractors and employees globally.

BankInovation

JUNE 24, 2021

Digital card payment platform provider Moca announced Tuesday a $3 million series B funding round that will allow the platform to expand its foothold in Latin America and the Caribbean. The end-to-end solution is both a gateway to Visa and the card management system — functions that are typically handled by different vendors. The investment […].

BankDeals

JUNE 24, 2021

Abound Credit Union (easy membership requirement) is currently offering competitive rates on its 13-month CD Special, 47-month CD Special, and 59-month CD.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

JUNE 24, 2021

Lendbuzz, an auto lender focused on foreign-born borrowers with thin credit, announced this week it has secured an additional $360 million in debt and equity funding following a 200% year-over-year growth in origination volume in the first half of 2021. Wellington Management, joined by Goldman Sachs & Co and MUFG Innovation Partners, led the Series C $60 million […].

BankDeals

JUNE 24, 2021

Cross County Bank (Arkansas) offers its competitive Kasasa Cash Checking, Kasasa Cash Bank, and Kasasa Saver accounts on a statewide basis.

BankInovation

JUNE 24, 2021

Goldman Sachs rolled out transaction banking in the U.K. yesterday through a modernized, API-enabled platform built on the cloud, entering a crowded space dominated by the likes of Citigroup and JPMorgan Chase. Transaction banking refers to cash management and treasury services for corporate and institutional clients. The $1.2 trillion Goldman Sachs will offer traditional products […].

The Paypers

JUNE 24, 2021

INNOPAY , a Dutch consultancy firm specialised in digital transactions, has teamed up with ‘Team Data Spaces’ to facilitate the development of European data spaces which are at the heart of the EU's data strategy.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

CB Insights

JUNE 24, 2021

Mollie , a digital payments service provider, has raised $800M in a Series C. The round drew participation from Blackstone, General Atlantic, HMI Capital, Alkeon Capital Management, and EQT, among others. HOW’S THE COMPANY PERFORMING? Amsterdam-based Mollie helps e-commerce stores integrate payments solutions through its APIs. The firm reportedly expects to process payments of €20B ($24M) in 2021.

The Paypers

JUNE 24, 2021

Atlantic-Pacific Processing Systems (APPS), a US-based technology and financial services solutions provider, and Switch Commerce , a debit processing platform provider, have formalised a strategic partnership to provide a suite of payment tools and integrations.

CB Insights

JUNE 24, 2021

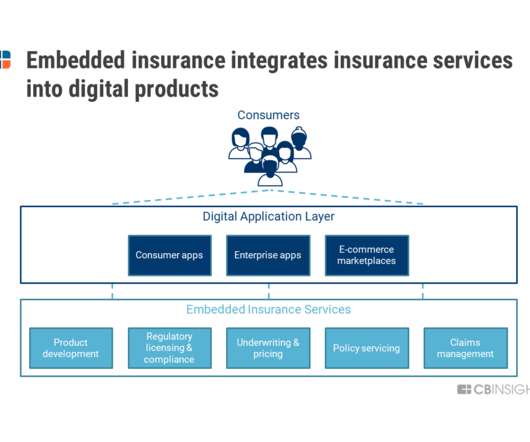

Embedded insurance — the integration of insurance into a digital product on a third-party platform or marketplace — is growing, and even the longest-standing incumbents want in on the action. Although relatively new, embedded insurance products are emerging across all lines of business, including health, life, auto, and commercial insurance.

The Paypers

JUNE 24, 2021

India-based alternative lender Finflux has announced the launch of Buy Now Pay Later, a new software product for financial services providers.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

JUNE 24, 2021

Majority has raised USD 19 million in its seed funding round led by Valar Ventures with participation from Avid Ventures , Heartcore Capital , and several Nordic fintech founders.

The Financial Brand

JUNE 24, 2021

21 deals with neobanks and fintechs like Aspiration, Ellevest and Greenwood sent a community bank down an unexpected (and profitable) path. The post Community Bank Builds Future on ‘Banking as a Service’ & Google Plex appeared first on The Financial Brand - Banking Trends, Analysis & Insights.

The Paypers

JUNE 24, 2021

US-based AI-powered auto finance platform Lendbuzz has bagged USD 360 million in funding, comprised of debt and equity.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

JUNE 24, 2021

Samsung Pay+ has announced a newly launched proposition allowing customers to earn from 1 to 20% cashback with major UK brands, through the use its digital card, powered by Curve.

The Paypers

JUNE 24, 2021

Oracle and Deutsche Bank have announced a multi-year collaboration to modernise the bank's database technology and accelerate its digital transformation.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content