Top 10 Announcements from Microsoft Ignite Day 1 #MSignite

Perficient

SEPTEMBER 22, 2020

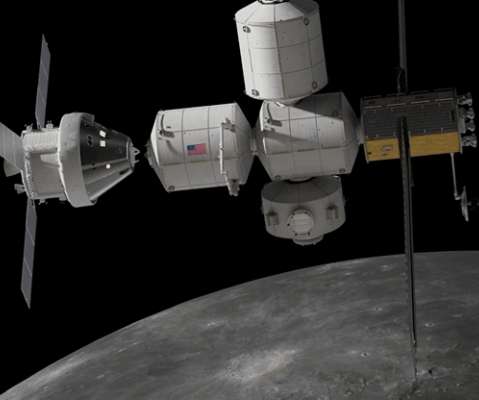

While Microsoft had some out of this world updates including the Underwater Datacenter project data released. The project was a success with only 1/8 th the issues of the equivalent land based datacenter. Many reasons why this project will continue from a sustainability and reliability perspective. The outerspace update took the events to even further heights.

Let's personalize your content