Hey bank, get onto my cloud!

Chris Skinner

JULY 22, 2020

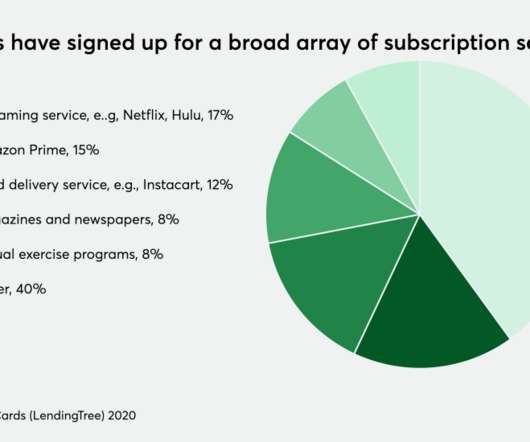

I’ve seen a few big deals signed this month to get banks onto the cloud, such as National Australia Bank (NAB) switching to Microsoft’s Azure, and Deutsche Bank moving to the Google Cloud. McKinsey expect that cloud usage will rise from less than a quarter of banks business being cloud-based to … The post Hey bank, get onto my cloud! appeared first on Chris Skinner's blog.

Let's personalize your content