3 keys to understanding blockchain

Payments Dive

SEPTEMBER 11, 2020

Blockchain technology can be very difficult to understand, but it doesn't have to be. You just have to grasp three basic key facts.

Payments Dive

SEPTEMBER 11, 2020

Blockchain technology can be very difficult to understand, but it doesn't have to be. You just have to grasp three basic key facts.

Perficient

SEPTEMBER 11, 2020

Even in trying times, opportunity presents itself to those that are vigilant and watchful. The US ecommerce food and grocery industry is growing at an accelerated rate as a result of the COVID-19 crisis. Online spending and grocery shopping rates have doubled since 2019 and is projected to increase throughout 2020 as end-users exercise caution while procuring their groceries.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accenture

SEPTEMBER 11, 2020

What drives change in an industry? Businesses? Consumers? Government regulations? In the case of touchless payments in the United States, change has mostly moved at a glacial pace—until COVID-19. Touchless payments have expanded rapidly in countries throughout the world—and the benefits are significant—so why did it take a global pandemic to move the needle in….

PYMNTS

SEPTEMBER 11, 2020

The great digital shift in the quick-service restaurant (QSR) space shows no signs of stopping. To that end, Bloomberg reported that Chipotle Mexican Grill CEO Brian Niccol estimated the firm’s digital sales could be as much as $2.4 billion in 2020, leagues higher than the $1 billion seen in the previous year. And in a nod to the fact that mobile and online orders are here to stay, Niccol said sales digital sales could be as much as 40 percent to 50 percent of revenues, which Bloomberg noted wo

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Accenture

SEPTEMBER 11, 2020

When our researchers were in the field for our annual Technology Vision survey, COVID-19 was not yet a global pandemic. Since then, the virus has transformed our lives and challenged many long-held assumptions about how business operates. For banks, the effects can be seen everywhere: in their revenues, credit losses, and profits, in the behavior…. The post Banking Tech Vision: Is your bank ready for the post-COVID world?

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Source

SEPTEMBER 11, 2020

American Express Co. began reopening offices in New York and London this week even as it told employees that they can continue working from home through June 2021 if they wish.

PYMNTS

SEPTEMBER 11, 2020

In its efforts to grow into a full-service financial company, Nubank has come to the decision to buy broker Easynvest. Nubank Founder David Vélez said the Brazilian finance startup agreed to an arrangement that involved cash and shares, Reuters reported. “Since its foundation, Nubank wanted to offer a full-service financial platform because we see much inefficiency in the banks,” Vélez told Reuters.

Payments Source

SEPTEMBER 11, 2020

The Philippines’ anti-money laundering authority has identified 57 “people of interest,” including foreigners and local bank officers and government officials, whose links to Wirecard AG are being scrutinized.

PYMNTS

SEPTEMBER 11, 2020

The Business Payments Coalition (BPC) is asking for industry input on the kinds of data connected with the most utilized invoice exchange processes in North America as the next phase in a digital invoicing initiative, according to an announcement. The Federal Reserve is collaborating with the BPC to organize a program to last multiple years with those in the industry to evaluate and offer suggestions for a digital invoicing exchange blueprint for the domestic market, according to the announceme

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

Payments Source

SEPTEMBER 11, 2020

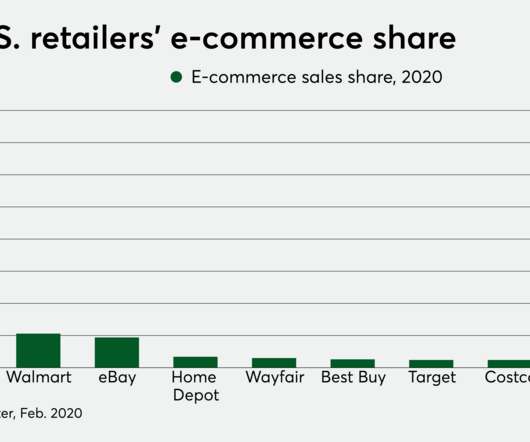

Citi has teamed with home furnishings giant Wayfair on a pair of credit cards—one cobranded with Mastercard and a private label version—capitalizing on the pandemic-accelerated e-commerce boom.

PYMNTS

SEPTEMBER 11, 2020

Now if only they could recreate the smell of the hotdogs, the taste of the flat overpriced beer — or pipe in the obnoxious play-by-play patter of the guy behind you. The pandemic, you know by now, has changed everything — especially events that hinge on crowds, and the energy of crowds, to be whole and authentic. Sporting events come to mind, of course.

Payments Source

SEPTEMBER 11, 2020

American Express is expanding into the fast-growing European market for open banking-based payment initiation services with its Pay with Bank transfer platform.

PYMNTS

SEPTEMBER 11, 2020

Railsbank has signed a deal to buy Wirecard Card Solutions Ltd. in the United Kingdom, the company announced Thursday (Sept. 10). The Newcastle, England-based FinTech has signed an agreement to buy the U.K. subsidiary of Wirecard, the German payments company that collapsed amid scandal. Financial terms were not disclosed. Under the deal, Railsbank will acquire Wirecard’s card technology, clients and some employees.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

Payments Source

SEPTEMBER 11, 2020

When Jane Fraser takes the reins of Citigroup in February, she will have to tackle the company’s cards slump, lagging performance metrics and challenges presented by employees’ return to the office.

PYMNTS

SEPTEMBER 11, 2020

Instagram ’s CEO has added his voice in criticizing Apple Inc. 's business practices. Adam Mosseri told CNBC on Friday (Sept. 11) that Apple’s plan to change its iPhone operating system will hurt businesses with its ad tracking limits. On “Squawk Box,” Mosseri said he will make the case against the update, which would impact how the Facebook-owned app and other mobile advertisers track users. .

Payments Source

SEPTEMBER 11, 2020

Blockchain's cross-border power eliminates the intermediary and solves the problem of rendering the traditional processing system redundant, and processes the payment on a chain with no middleman intervention, says ForumPay's Joshua Tate.

PYMNTS

SEPTEMBER 11, 2020

Before the anticipated deployment of iOS 14 later in September, Apple updated its App Store guidelines on Friday (Sept. 11). Staffers of the tech company use the framework to approve or turn down programs and revisions, CNBC reported. The tech company now indicates that game-streaming platforms like Microsoft xCloud and Google Stadia are expressly allowed.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

ATM Marketplace

SEPTEMBER 11, 2020

ATM Marketplace talks with Sanjay Gupta, ACI Worldwide executive vice president, regarding an ACI study that sheds light consumer preference in regards to digital payments and billing.

PYMNTS

SEPTEMBER 11, 2020

It’s the end of another work week, and the PYMNTS Weekender is here to catch you up on the latest news. We have deep dives on Main Street, disbursements and quick-response (QR) code payments. . Top News. Apple Pay Eyeing QR Code Transactions. Users of Apple Pay might have the ability to harness a Wallet app function in the near future to make payments with the help of a QR code.

Payments Source

SEPTEMBER 11, 2020

Integrated payments have rapidly become critical to maintaining, and in some cases improving, operational stability, says Paya's Jeff Hack.

Bobsguide

SEPTEMBER 11, 2020

Tech vendors are urging market participants to adopt end-to-end consolidated audit trail (CAT) solutions as phased deadlines complicate implementation. “It always comes down to the time and project pressures… We do the end-to-end so we control the mapping as well as the exception.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

BankInovation

SEPTEMBER 11, 2020

Banking and fintech leaders came together for the fully virtual Bank Innovation Build this week. The conference featured speakers from Wells Fargo, Ally, TD and more, as well as a fireside chat with Vanessa Colella, chief innovation officer at Citi and head of Citi Ventures. Discussions revealed that banks and fintechs alike are not slowing […].

MerhantsBanks

SEPTEMBER 11, 2020

Nicole Williamson has joined Merchants Bank as a Mortgage Lender, according to Dave Engstler, Branch Manager for Merchants’ Rochester-Green Meadows location. “Nicole brings valuable experience to our team that will be a benefit to families and individuals across the Rochester area looking for their first or next home,” said Engstler. “With mortgage and refinance rates incredibly low, […].

BankInovation

SEPTEMBER 11, 2020

The coronavirus pandemic has undoubtedly altered the financial services technological landscape, but which changes will be permanent after the pandemic ends? This is the question bank and fintech panelists tackled during the Bank Innovation Build virtual conference yesterday, and the predictions spanned commercial and retail banking, the role of banks in facilitating financial health, and […].

BankDeals

SEPTEMBER 11, 2020

Sandia Laboratory Federal Credit Union (NM) has added a new deposit tier to its 24-month CD with a very competitive rate for both the regular and IRA CD.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content