The benefits of Click to Pay

Payments Dive

NOVEMBER 10, 2020

Jed Danbury, vice president at Computop, a global payments service provider, explains the benefits of using Click to Pay

Payments Dive

NOVEMBER 10, 2020

Jed Danbury, vice president at Computop, a global payments service provider, explains the benefits of using Click to Pay

Perficient

NOVEMBER 10, 2020

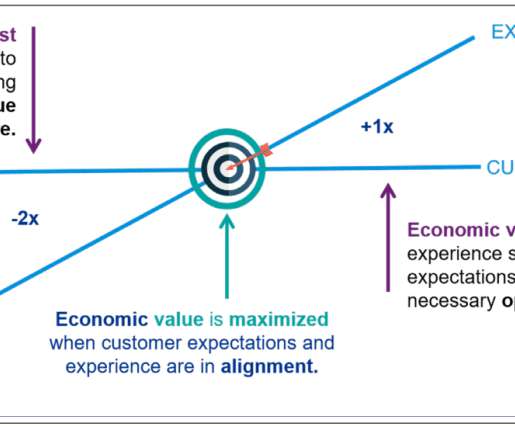

I talk with a lot of companies who want to up their game in delivering a better customer experience. Yet, I’m always struck by the impediments companies always put in front of themselves that negatively affect that experience. “We can’t do that because…” is always the first part of a long set of internal issues that we just can’t seem to overcome.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

PYMNTS

NOVEMBER 10, 2020

The use of artificial intelligence (AI) and machine learning (ML) isn’t some futuristic idea. It’s here now and being used to make good banks better — whether to eliminate discrimination in lending decisions, add stability to existing screening systems or drive loan growth and profits. “It’s not an idea, it’s not a postulate. It is a fact — and we can prove it,” Zest AI CEO Mike de Vere told PYMNTS in a recent interview.

Perficient

NOVEMBER 10, 2020

For the vast majority of hospitals, a redesign is triggered by three events: An organizational-wide rebrand or rename. Acquisition or merger with another entity. Annual funding cycle catches — e.g. “it’s been too long” or “we’ve asked two budgets ago”. However, this funding decision is just the starting place. Your website is the first — and sometimes only — experience most people have with your system.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Accenture

NOVEMBER 10, 2020

When it comes to digital, middle market banks want what the big banks have. But they assume it’s out of reach. The refrain I hear from leaders goes something like this: “I’d love to be more digital, but we don’t have a big bank sized technology budget.” Banks go so far down the rabbit hole…. The post Digital power for middle market banks appeared first on Accenture Banking Blog.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

PYMNTS

NOVEMBER 10, 2020

Cryptos are having a moment. Scan the headlines over the past few weeks and cryptos, well beyond the marquee bitcoin, are making inroads into mainstream consumer and business activities. PayPal is opening its network to allow consumers to shop using cryptocurrency. Square bought $50 million of bitcoin. J.P. Morgan said late in the month that it has gone live with JPM Coin.

Perficient

NOVEMBER 10, 2020

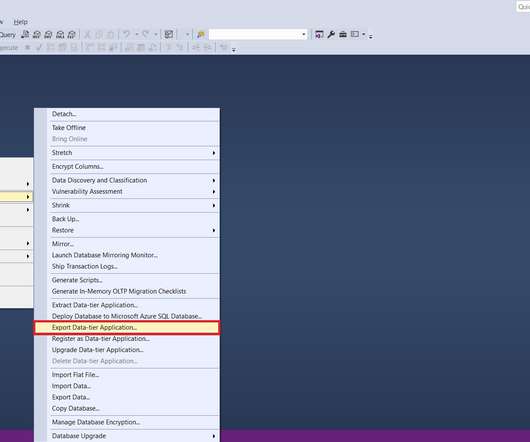

I will be going over how you can export your local SQL Database to Azure SQL within SSMS. If you have not created your SQL server and database on Azure, here is a tutorial I found on Youtube that guides you through the process. Open your SQL Sever Management Studio and enter the Azure SQL server name from above and the credentials you have configured for the server.

PYMNTS

NOVEMBER 10, 2020

Real-time payments aren’t just an opportunity for consumers to send and receive money more quickly. Interest in faster payments is also on the rise for corporates, though their adoption of real-time payments won’t look the same as it does in the B2C world. For financial service providers, instant payments offers a chance to open up new revenue streams and develop new services for corporate clients.

Perficient

NOVEMBER 10, 2020

Today’s uncertain environment has caused the Office of the CFO to think outside typical business parameters and seek investments in finance capabilities that enable the bold moves needed to become more agile during times of ambiguity. The first step in becoming a more agile finance organization requires transforming the people, processes, and technologies.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

PYMNTS

NOVEMBER 10, 2020

Nothing counters disruption like another disruption. Take weddings, for example. Before the pandemic, the fitting for the bride and bridesmaids was a happy social event at a bridal shop, maybe over a shared bottle of prosecco. Then COVID hit, and now masks and social distancing have made wedding planning an entirely different experience. David’s Bridal has countered that disruption with another disruption: augmented reality (AR).

Perficient

NOVEMBER 10, 2020

Both OneStream and Oracle EPM cloud provide the data file batch functionality to load the data. The common ground is that they both need a specific file name format, others are different. For OneStream, here are the steps: Create batch processing extender business rule. Batch file processing is executed by creating an Extender Business Rule that calls the OneStream API function Utilities.ExecuteFileHarvestBatch.

PYMNTS

NOVEMBER 10, 2020

Lyft reported on Tuesday (Nov. 10) as part of its third quarter earnings results that active riders had risen to 12.5 million from 8.7 million in Q2 on the heels of a major regulatory victory for the gig economy. On Nov. 3, California passed Proposition 22 , which lets app-based firms like Lyft, among others, categorize workers as contractors instead of as employees.

Perficient

NOVEMBER 10, 2020

Following his recent appointment to the board of directors of St. Luke’s Hospital, a faith-based, nonprofit healthcare provider headquartered in St. Louis, I chatted with Jeff Davis , Perficient Chairman and CEO, about the distinction and his goals for working with the healthcare provider. Jeff, thanks for the time. A Board of Directors appointment is an honor.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

PYMNTS

NOVEMBER 10, 2020

Payments FinTech Alacriti has announced a partnership with Glia , which works in digital customer service, for new customer service options for payments needs, according to a press release. The partnership, according to the release, will let financial institutions (FIs) use Ella, Alacriti's payments-based artificial intelligence (AI) chatbot, in Glia's customer service program.

Payments Source

NOVEMBER 10, 2020

As the pandemic transforms the way corporations pay suppliers, many banks are watching nimble fintechs rush in with streamlined solutions customized for remote workforces. U.S. Bank didn’t want to risk getting cut out of that equation.

PYMNTS

NOVEMBER 10, 2020

Global payments startup SumUp announced it has been granted a new electronic money (eMoney) license from the Central Bank of Ireland. Gareth Walsh , chief executive officer for SumUp Ireland, said small firms are the backbone of a strong economy and getting a license “during this critical time” amid the ongoing pandemic lets the firm continue “to empower those small businesses” and help them thrive. .

Payments Source

NOVEMBER 10, 2020

Even given the huge jump in digital transactions from e-commerce, card brands are holding out for COVID-19 vaccines as a path out of the payment declines that have accompanied 2020’s health and economic crises.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

PYMNTS

NOVEMBER 10, 2020

Apple , in what a company press release calls a "momentous" day on Tuesday (Nov. 10), has rolled out the "next generation" of Macs, including a new MacBook Air, a 13-inch MacBook Pro and a Mac Mini powered by the M1 chip specifically designed by Apple for the Mac. According to Apple, the M1 is the most powerful chip the company has made so far, with high performance per watt.

Payments Source

NOVEMBER 10, 2020

The Interac debit network is expanding online and in-store options for Walmart customers throughout Canada, looking to have new technology in place by spring of 2021.

PYMNTS

NOVEMBER 10, 2020

Atlanta payments encryption firm Bluefin is partnering with New York mobile payments processor PAAY to advance eCommerce security. “The combined Bluefin/PAAY solution set is as close as we can get to a silver bullet in payment security for eCommerce transactions,” Ruston Miles , co-founder and chief strategy officer at Bluefin, said in a statement on Tuesday (Nov. 10). .

Payments Source

NOVEMBER 10, 2020

As the pandemic transforms the way corporations pay suppliers, many banks are watching nimble fintechs rush in with streamlined solutions customized for remote workforces. U.S. Bank didn’t want to risk getting cut out of that equation.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

PYMNTS

NOVEMBER 10, 2020

The late Roy Ash , financial advisor to U.S. presidents and instrumental in establishing the government’s Office of Management and Budget (OMB) is quoted as saying, “An entrepreneur tends to bite off a little more than he can chew hoping he’ll quickly learn how to chew it.”. Get a pack of gum for chewing practice, because Ash’s aphorism is being mightily tested.

ATM Marketplace

NOVEMBER 10, 2020

What is the future of money? ATM Marketplace interviewed William Budde, Vice President, Product Marketing for Hyosung America to hear his insights and the company’s ideas on future of money.

PYMNTS

NOVEMBER 10, 2020

Accounts payable (AP) and payment automation provider AvidXchange has rolled out a connection with Concur® Invoice for vendor payments. The connection lets Concur Invoice clients make bill payments more efficiently by providing digital payment choices to vendors through the AvidPay Network, with the inclusion of AvidPay Direct and virtual card, according to a Tuesday (Nov. 10) announcement.

Payments Source

NOVEMBER 10, 2020

Michael Moeser, Senior Analyst at PaymentsSource, talks to Ginger Siegel, North America Small Business Lead at Mastercard, about how smaller shops are managing through the coronavirus pandemic.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content