Banking startup Chime reports it has 8 million customers

Bank Innovation

FEBRUARY 19, 2020

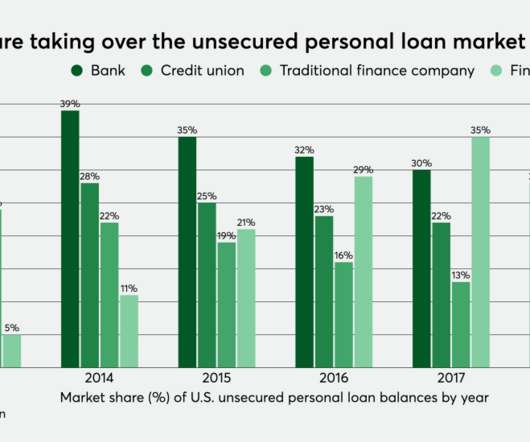

In Silicon Valley, entrepreneurs and venture capitalists are making big bets that the future of banking is digital, doesn’t have fees, offers a high savings rate—and might not technically be a bank at all. Chime Inc. is part of a fast-growing class of well-funded financial technology startups offering debit cards, checking accounts and other financial […].

Let's personalize your content