Data Architecture: 10 Reasons Why It Should Be In Your Strategic Plan

In 1983, Commodore International, with its Commodore 64 commuter, was the largest personal computer manufacturer in the market controlling over 50% of sales. By 1992, the Company was an afterthought, and by 1995 it was liquidated. Commodore’s demise is a case study of how NOT to care about your customers and why business intelligence through proper data architecture is critical. Banks are on the verge of the same dilemma. If you already have a data warehouse or plan to sell the bank in the next 12 months – please skip this article. If not, this article explains why a data lake house should be central to your strategic plans.

The Demise of Commodore

There were several critical strategy errors in Commodore’s history, most of them stemming from management not caring and taking the time to collect and analyze data. The biggest issue was that it failed to collect, quantify, and react to what its dealers and customers were telling them.

Commodore was critically late designing a machine for games while Apple, Atari, and Sega stole market share. The company slowly pivoted to offering business computers but failed to realize that businesses don’t need high-end sound and graphic cards like gaming computers do. IBM ate its lunch by delivering a better machine at a better price point.

In addition to not noticing major changes in the marketplace, Commodore failed to drop its cost structure fast enough and mispriced the computer models it did bring to market. When it realized these issues, it was too late.

The lesson – a lack of business intelligence can kill you.

Commodore didn’t know about its customer and didn’t have enough feedback from operations to understand its margins were inadequate. Poor planning of materials, inventory, and staffing plagued the Company. The result was that marketing was always inadequate, and production was a step behind. With high fixed costs and flagging sales, the Company destroyed what was a billion-dollar revenue stream at its height.

While banking moves slower than the technology industry, Commodore’s problems are affecting banks across the country.

Preparing For the Future Through Data Architecture

Information is critical for any business, but few more so than banking. While banking doesn’t move as fast as technology, the rise of fintechs and neobanks are speeding things up. A bank is also much more leveraged than your average technology company, so its business decisions have more impact.

A longer sales cycle than most industries and longer duration in its risk profile all contribute to why if any industry should have better information about its operations or its customer base, it should be banking. Bankers’ decisions stay with their capital for a very long time.

On top of business intelligence, a bank needs to answer to the regulators to run a business.

Every bank has the data it needs to be a top-performing data-driven bank, but because it is fragmented, called by various names, and not easy to get to, the data essentially goes unused.

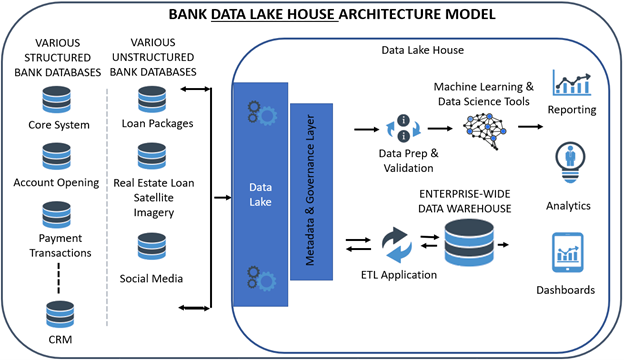

When it comes to data architecture, banks have various options. We discuss the value of a data lake house compared to a data warehouse and data lake HERE and have a free webinar on August 23rd at 4 pm ET that you can attend to hear our story and ask questions. You can register HERE.

As you can tell, we firmly believe banks are overlooking the importance of data and business intelligence and are not investing enough in data architecture. There are over 500 key performance indicators that a bank needs to manage its business, and the only way to efficiently pull this reporting off is to consolidate your data. While there are several ways to accomplish this, starting on a data lake house we believe is the best path.

Below are our top 10 reasons, in reverse order, as to why a data lake house should be a priority.

The Top 10 Reasons To Make a Lake House Central In Your Data Architecture

While many banks make a straight cost-benefit analysis on their data lake effort, there are also other, less apparent reasons to undertake this effort. Here are ten:

10. Proper Data Architecture is Cheap: To stand up a database on premises used to be an $80k+ effort. Now, with a cloud-native, on-demand architecture, any size bank can get going for around $5k and scale into it. Like an Uber, a bank is essentially only paying for the storage and processing power they are using, thus making the economics of a data lake an easy enterprise decision.

9. Attract Talent and Boost Your Career: No one wants to work at a 1980’s technical architecture company. To attract the best talent and to provide current employees another reason to stay, a data lake house teaches everyone how a modern organization functions. You may not need to know how to write a Mongo database query, but every banker should have a foundation in data literacy. Being able to speak the language of data, create reports, and generate/interpret business intelligence graphics are all now basic skills.

8. Reducing the Load on IT: Another reason for data literacy is through business intelligence tools such as Power BI or Tableau (the two most popular bank visualization applications). Anyone in the organization can create dashboards and reports. Giving line and management employees the ability to generate their reports reduces the load of IT having to create the output.

7. Clean Data Reduces Operational Cost Across the Bank: Creating a centralized place for your data allows you to solve data quality issues to produce a “single source of truth.” Once the data is cleaned and homogenized, it can be used throughout the organization, such as a CRM system, core system, in marketing, payments, lending, or any other product. Without a central place for data, multiple people in multiple departments will be spending time cleaning data.

6. Faster Time to Market: With all your important data in one place, integration into different systems becomes faster and cheaper. No longer do banks have to always rely on their core system. This architecture gives banks a speedier time to market their products. In addition, products are cheaper to build and test, speeding up the iteration cycle in product development.

5. A Record of History: Most source systems don’t keep a history of the data, and some don’t keep a history of changes. For example, suppose you want to see how many customers transferred from a low fee/low-interest account to a high interest/high fee transaction account during the last rate cycle. In that case, it’s either impossible or difficult to do. Old values often get replaced by new data hampering historical analysis.

4. Reduces Risk: The biggest risk in the bank is credit which is why banks need to spend more resources on understanding how their underwriting impacts risk. Having data intelligence allows banks to drill down to see what factors are contributing to delinquencies. Banks using data intelligence can cut their credit risk by an estimated 50%. When applied across all lending categories, this is no small number and is the difference between staying in business or needing more capital in the next downturn. In addition to credit risk, fraud is a rapidly growing area that data architecture is winning the day. Banks can leverage data for real-time analysis and fraud monitoring for account opening, and payments in addition to reducing general operating risk.

3. Marketing: While improving credit performance through data will significantly impact risk, using data in marketing is likely to give your bank the most prominent advantage in the marketplace. Being able to personalize marketing, understand a high-performing “look-alike audience,” know who your customers are NOT, be clear on “next-best-product” opportunities, and a host of other tactics can give your bank an average 12%+ lift in each of its marketing efforts with better intelligence. To this point, if you attend the ABA Bank Marking Conference (Sept. 11-13) in Denver, we will present how we purchase third-party data to enhance our small business marketing. This tactic alone can pay for any data lake house effort and can create untold growth opportunities for your bank.

2. Franchise Value: Next to the value of the customer, the value of data is the next most valuable asset a bank owns – more valuable than your loans AND deposits. Whatever multiple your bank trades at and whatever value you have on your loans and deposits, it is dwarfed by the future potential of your data. Data is the new oil, and banks are sitting on deep reserves. Use the data to fuel above-average growth and show the market that you can leverage that data to create new revenue streams and gain new customers, and your multiple will increase.

1. Understand Your Customer: A bank should be in the business of aggregating customers and making them happy with their financial lives. Since this effort goes beyond just making loans and deposits, winning banks will be the ones that understand their customer the best.

To learn more about how to get started in data architecture, build a lake house initiative into your strategic plan, and hear from a variety of banks about how they manage their data, come to our upcoming Webinar on August 23rd at 4:00 pm ET. Find out more information and register HERE.