DevSecOps Best Practices ? Automated Compliance

Perficient

JUNE 5, 2020

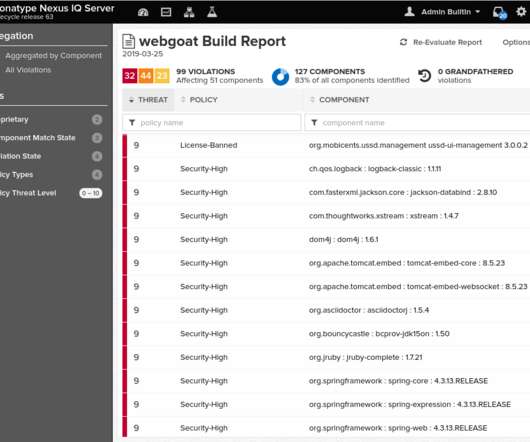

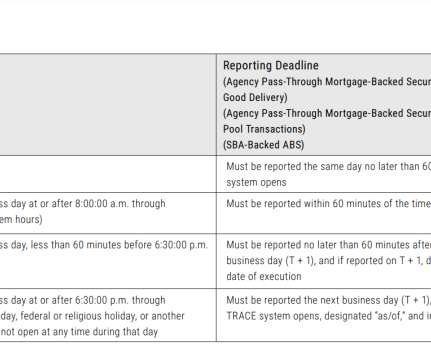

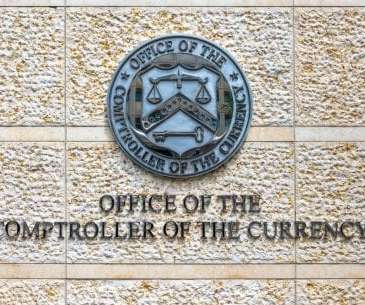

Secure software practices are at the heart of all system development; doubly so for highly regulated industries such as health-care providers. As a best-practice it is recommended to adopt automation of certain security audits, integration of compliance oversight into key development process areas (e.g.

Let's personalize your content