6 Reasons Financial Institutions Are Embracing Risk and Regulation Tactics

Perficient

DECEMBER 18, 2023

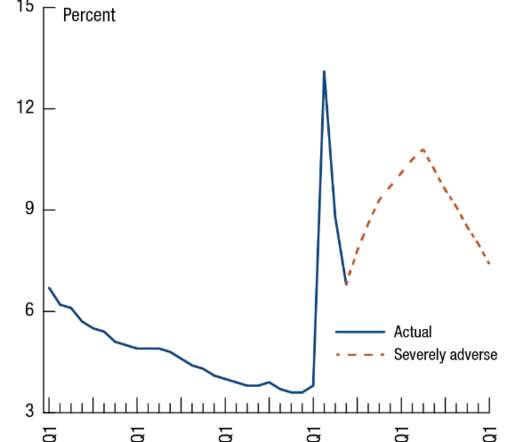

In the fast-paced realm of finance, the significance of regulatory risk and compliance management practices cannot be overstated. The Role of Regulatory Risk and Compliance 1. Compliance with these legal obligations is not only mandated by regulatory authorities but also necessary for maintaining an institution’s reputation.

Let's personalize your content