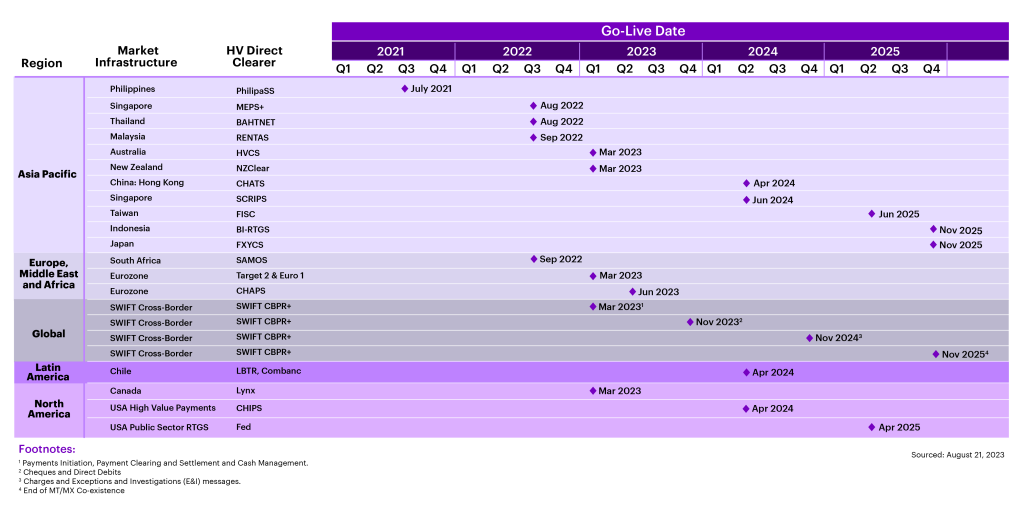

The years-long ISO 20022 journey has achieved a major milestone this year: it is now being used for cross-border payments. The new standard successfully launched globally in March 2023 with SWIFT CBPR+, and on the European Market Infrastructures of T2 (March 2023), Euro 1 (March 2023) and CHAPS RTGS (June 2023). Early data reveal a healthy level of payment traffic in the new MX format flowing through these market infrastructures.

For instance, in the three months following the SWIFT CBPR+ implementation, a daily average of 600,000 ISO 20022 messages were sent between more than 1,000 senders and 5,600 receivers across 200 countries. CHAPS, one of the largest high-value payment systems in the world, processes an average daily value of £344bn (USD434bn) across 192,000 transactions using ISO 20022. For T2 we see a daily average of 373,468 payments representing €1,877bn (USD2,028bn) in value, while Euro1 reports a daily average volume of 176,418 representing €190bn (USD205bn) in value.

For cross-border payments, the March 2023 implementation marks the beginning of a period of legacy and new format co-existence.

“We wanted to be an early adopter for cross–border payments and made the bold choice to migrate all of our payment systems and all of our outbound CBPR+ traffic to ISO 20022. As of August 2023, J.P. Morgan represents ~50% of the total ISO 20022 cross–border payment message traffic on SWIFT.”

Colin Williams, Global Clearing Transformation Lead at J.P. Morgan

Together, these launches are a collective step for financial services towards a common language across all financial messages, both domestic and global. But the new standard’s true impact on the industry and the world is still to come.

This is true both in a general sense and within the scope of cross-border payments. Right now, SWIFT CBPR+ uses ISO 20022-derived message formats for payments initiation, payments clearing, settlement and cash management. In November of this year, the use cases will expand to include checks and direct debit. In November 2024, new charges and E&I (enquires and investigations) will be added.

The global financial services industry’s journey to ISO 20022 adoption is well under way, with multiple market infrastructures already live in APAC and more following, and North America preparing for migration in H1 2024.

From compliance to value

Most banks right now are more focused on achieving regulatory compliance with the standard than deriving value from it. Recent Accenture research on commercial payments reveals that 60% of banks agree that keeping up with changes like ISO 20022 boosts their commercial payments innovation, while 29% said it limits their abilities in this regard.

When viewed in the context of initial ISO20022 message format adoption, this makes sense as a significant portion of the value of ISO 20022 compliance will only be unlocked when key categories of rich data are exchanged across players in the payments ecosystem.

We expect the purpose code, legal entity identifier, remittance data, structured address and extended character set categories to make the biggest difference, and their use will be mandated over the next few months and years. Taking the example of recent CHAPS migration, purpose codes will not be mandated until November 2024. Structured addresses, which are expected to significantly improve anti-fraud efforts, financial crime management and straight-through processing, will be optional until late 2025.

The true value of ISO 20022 for most banks and payments players has yet to be realized. But there is good reason to think that proactive institutions will enjoy a first-mover advantage as the use and impact of the new standard spread in the next few years.

View the ISO 20022 Enhanced Data Adoption Regulatory Timeline [PDF]

A client pain-point and an opportunity

To see how a proactive attitude to the standard can create opportunities, consider the situation from the perspective of a commercial payments client. Accenture research found that 96% of commercial clients use ISO support services today (e.g., client testing, MT/MX message comparison, truncation advice). But only 61% of banks globally provide those services, and client satisfaction for those services sits at 48%.

The research also found a strong appetite among commercial payments clients for value-added services that could be built on the enhanced data required by ISO 20022.

In other words, demand for services is high. Supply is limited and satisfaction mediocre at best. Depending on a bank’s perspective, this situation is either a risk to client retention or an opportunity to win new business through superior service.

And the stakes will only rise as more corporate clients embark on their ISO 20022 migration journeys.

The availability of rich data, governed by regulatory requirements, will create new markets for new and improved banking products and services. Examples here include automated receivables matching powered by remittance information; improved personalization of products and services by analyzing transaction purpose codes in real time; and reduction in payment failures due to the use of structured addresses.

Key takeaways on the future of ISO 20022 and global payments

While ISO 20022 did not launch in 2023, it has still broken new ground this year. It is now widely used for cross-border payments as well as in key domestic payment infrastructures in Asia and Europe. As an example, J.P. Morgan is now live in 11 market infrastructures with ISO 20022, with several more in progress across APAC, North America and LATAM.

ISO 20022 has already had a significant impact, but its true value is linked with the still-pending adoption of enhanced payments data. A bank’s ability to capture, process and exchange this data will help it not only achieve compliance but also seize opportunities.

In this regard, notable opportunities are connected to commercial clients, who need assistance migrating to and using ISO 20022. Many of them are not thrilled with the service they are receiving today, which represents potential growth for any bank with a proactive attitude and robust ISO 20022 support.

Which is also the case for other areas of ISO 20022’s impact on payments. It is easy to focus on compliance right now, but the real advantage and excitement connected with ISO 20022, in our view, is its potential to unlock value for banks, their clients, and markets as a whole.

We’d love to hear about your own experience with ISO 20022. Please reach out to Sulabh or Colin.

Thank you to Ather Rizvi and Ciáran Byrne for their generous contributions to this post.

For insights from J.P. Morgan’s recent experience of ISO 20022 migrations globally, please visit ISO 20022: First 120 days live

Download the full report, Commercial payments, reinvented: Your blueprint for accelerating payments revenue growth to learn how your payments organization can compete to win in the future.