What Banks Can Learn from the Republic Bank Failure

On April 26, 2024, Republic First Bank (DBA Republic Bank) was seized by state regulators and the long running bank drama came to an end. With the assistance of the FDIC, Fulton Financial acquired certain assets, debt and deposits of Republic Bank. This first bank failure in 2024 is reported to cost the Deposit Insurance Fund $667mm. A slew of articles have been published explaining the reason for this bank’s failure. It is not unexpected that journalists and laypeople may not be able to identify the root cause of the bank’s failure. However, if our industry cannot properly analyze a bank’s root cause of failure in a post-mortem, then bankers may be bound to repeat the same mistakes over and over again.

Not The Root Causes

We think that the most disingenuous cause of the bank’s failure as cited in various articles is the “uncertain environment.” This includes “high interest rate environment”, and banks uncertainty around “interest rate cuts.” Every environment is uncertain – no period of time has been marked by certainty. Also, interest rates are not high by historical comparison (especially when eliminating the pandemic monetary response), and bank managers’ job is to manage uncertatiny (also called risk). Another retort to an elevated interest rate environment is that there are approximately 4,500 banks dealing with the same environment (who have not failed), and these institutions have been able to manage the market’s persistent expectation that interest rates continue to rise and fall.

A number of published articles discussed how commercial real estate has been under stress in the wake of the pandemic and 50% of Republic Bank’s loan portfolio is comprised of CRE. However, Republic Bank’s loan portfolio mix is not dissimilar to its peer group, and there was no credit stress in that loan portfolio. In the last reporting period, the bank’s NCL-to-loans and NPA-to-asset ratios compared better to peers.

Another spurious cause of the bank’s failure are explanations that the bank was challenged with low liquidity and wholesale funding. This is not the root cause of the bank’s failure. Yes, the bank liquidity ratio was below peers (10.25% vs. 15.76%), and net non-core funding dependence was well above peers (23.10% vs. 13.27%), but the bank was still liquid with sufficient cash on hand to meet depositors’ needs. The bank’s liquidity position did not directly cause this failure.

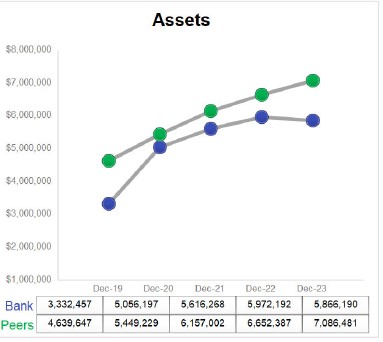

Another incorrectly proferred reason for the bank’s failure is a higher cost branch infrastructure and aggressive expansion. In the last five years the bank did grow somewhat faster than peers (defined as banks between $5B-$10B in assets – see graph below). However, that faster growth was not unusual and reflects the bank’s higher growth markets.

The bank had 32 branches and only five had deposits below $50mm (and only two below $40mm). The bank’s branch map appears below and does not demonstrate an uncontrolled or a dispersed branch banking model.

Another false cause of failure as stated by some was rising funding costs leading to contracting NIM. While true, it doesn’t explain why this occurred. In fact, until 2023, the bank’s interest expense to average assets was at par with peers. Therefore, saying that the bank was unprofitable because it could not generate sufficient net interest margin (NIM) does not explain the root cause of the bank’s failure.

The Root Causes

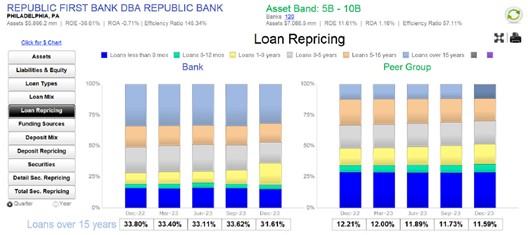

It appears to us that Republic Bank did not properly manage its duration and interest rate risk. The bank had unusually long duration loans compared to its peers (see graph below). Almost half of its loan portfolio had over 5Y fixed rate repricing (almost double its peer group).

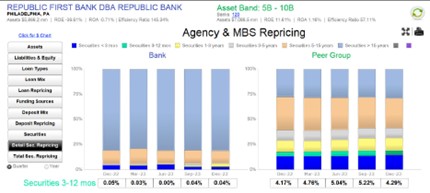

Even more stark was the bank’s securities repricing. Here the bank had duration that was again double its peer group’s average (see graph below). But because the bank’s securities portfolio was more than double its peer group’s average (41% of the balance sheet for the bank, vs. 19% for peers), the NIM generated by the securities portfolio was key to the bank’s NIM and profitability contraction.

The problem was that a large portion of both the bank’s securities and loan portfolios were generated when interest rates were low (securities yield of 2.19% (59bps below peer group) and loan yield of 4.77% (1.27% below peer group)). Those assets were funded by internal deposits (of which only 14.4% were non-interest bearing), and a large and growing amount of repricing and higher cost wholesale borrowings. Those higher interest rate wholesale borrowings ($1.4B, nearly 24% of all liabilities) were repricing at higher market rates as interest rates rose.

The bank’s failure is largely the result of a lapse in prudent management of interest rate and duration risks. Long-term assets were generated when interest rates were low, those assets were funded with shorter term liabilities that were rolled over into higher rates, resulting in contracting margin and creating unrealized losses on AFS securities, driving the bank’s adjusted tangible common equity ratio below zero before failure.

Conclusion

If we simply conclude that bankers must better manage interest rate and duration risks, then we will be doing a disservice to our industry, and we will continue to experience bank failures during periods of heightened interest rate, credit, and liquidity risks. Instead, our industry must insist that bank risk managers be held to a higher standard that includes using modern, simple, and inexpensive risk mitigation models and techniques. A simple start would be a requirement that for asset purchases and loan generation, a bank risk manager must analyze the impact of that purchase using fund transfer pricing (as we have discussed in the past here, here, here, and other publications) and risk-adjusted-return on capital calculation (as we have discussed in the past here, here, here, and other publications). This analysis does not require the ability to predict future interest rates or future cost of liabilities or cost of capital. We believe that such simple steps in risk management may help avoid the bank failures we have seen and may continue to see.