How to Manage Your Efficiency Ratio with Loan Size

South State Correspondent

SEPTEMBER 18, 2023

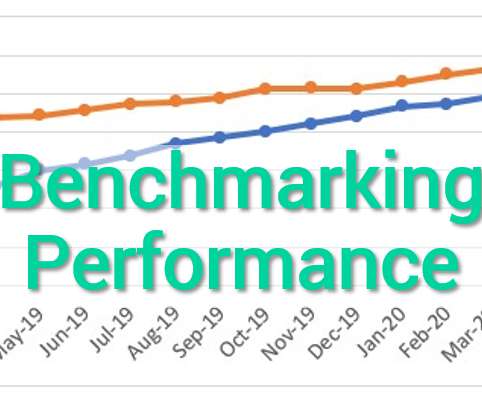

Industry Comparisons Many community bankers will argue that their business model differs from the national banks and that their customers are dictating a smaller average relationship. Further, banks could achieve much greater credit diversification by managing the industries and geography they lend to than by managing loan size.

Let's personalize your content