Loan Portfolio Asset Allocation Is About To Cause Problems For Banks

Ask most banks how they construct their lending portfolio, and they say that “it is what the market gives them.” That is not a great answer. That level of passivity will likely cause us to lose 75+ banks during the next downturn. Loan portfolio asset allocation should be active. Credit risks are increasing, and a brief window is available to solve problems on the margin. In this article, we analyze a typical bank loan portfolio to uncover its weaknesses and then point out some improvements that can be put into place over the next year to limit risk.

The Elevation of Loan Portfolio Risk

Sometimes, when rates are low after a recession, it’s a “risk on” strategy for banks. Banks generate “alpha” or excess returns by taking more risk, usually in the form of real estate and commercial lending. Now, it is likely the opposite time. It is time to take risk off.

In the near term, there are a variety of risks facing credit markets – the UAW strike, the potential for a government shutdown, the resumption of student loan payments stressing the young consumer, and higher energy prices. All those, however, pale in comparison to the capital at-risk banks have in their loan portfolios as a result of higher rates.

With interest rates up 5.25% from the start of the cycle and valuations for businesses and property coming down, a forthcoming credit shock will likely hit banking in the next 24 months and will leave many banks undercapitalized.

Many banks, unfortunately, made adjustable-rate loans that typically look like a five-year reset on a 10Y loan. Many of these loans were made in 2020 when rates plummeted during the pandemic. Many of these loans will be coming up for a reset, and the borrower will need more cash flow to meet the debt service coverage. Further, banks have a heavy number of balloon maturities coming due in the next two years. This combo presents a risk that banks should prepare for.

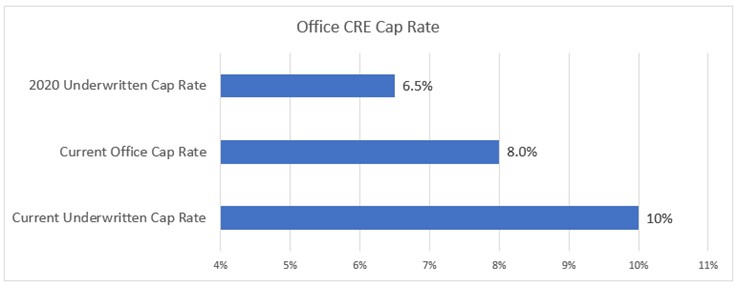

One only has to look at the current state of office commercial real estate (CRE) capitalization (cap) rates. This is the net operating income of a property divided by the current market value. Many of these office properties had a 4.5% cap rate back in 2019. When banks underwrote these properties back in 2020, they used a 6% or 6.5% cap rate to be conservative. Now, these cap rates are 8%, which means banks will likely underwrite these properties at a 10% rate.

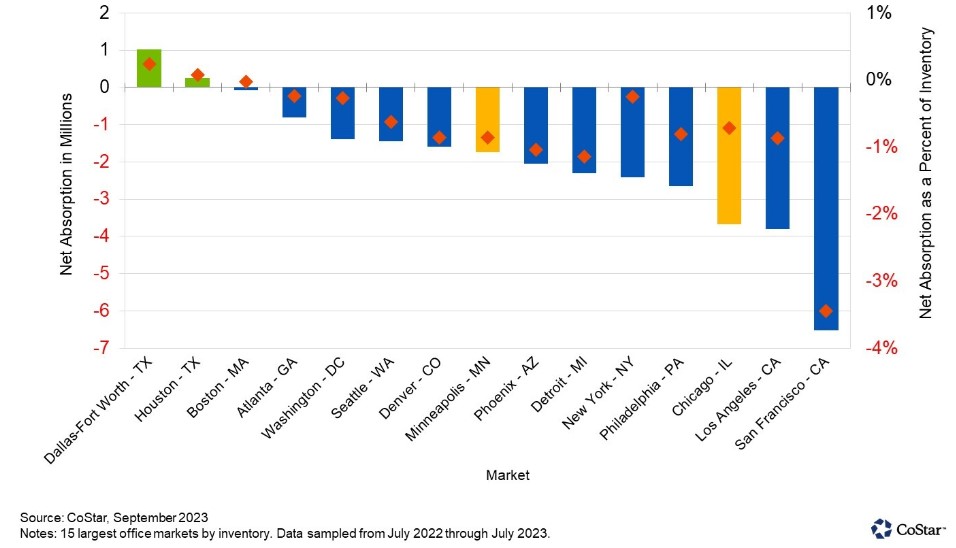

These properties will be challenging to manage, especially in light of negative net absorption in most major markets (below). That means that the market is getting worse. We track occupancy rates in the 40% range for most major markets, and appraised values are coming in at 50% of what they were back in 2020. Many of these loans coming up for reset or balloon maturity will not be able to sustain these higher rates.

Delinquency rates for bank loans will likely increase, similar to what we are experiencing in public markets, where office properties in collateralized loan obligations are approaching 7%, up from 1% last year.

Outside the office sector, rents continue falling in multifamily, retail, and specialty real estate. Conversely, we see hospitality and industrial rents stable but at their peak.

Given the growing credit risk, the question is, what should banks do about it?

Contact Borrowers Early – Refinance Early

Step 1 – Contact Borrowers Early: Step one to current cycle risk mitigation is to contact borrowers early. Any borrower with a balloon maturity or a rate reset occurring in the next two years should be contacted for a discussion. If nothing else, this contact will help the borrower understand the ramifications of higher rates and will provide their options. This gives the bank a chance to ascertain better the borrower’s ability to absorb higher rates or a refinance. For specific sectors, such as residential, it is essential to determine if the unit was a rental/Airbnb. Speculation, local ordinance changes, and slowing demand have put many of these properties in jeopardy of higher rates.

For borrowers who might struggle, now is an excellent time to work on a restructuring when more options are available.

Step 2 – Refinance Where Possible: To the extent you want the borrower, now might be the perfect time to refinance the borrower. Doing this early may secure the best possible deal and allow the borrower to take advantage of the current yield curve inversion. Banks can take the current rate and blend in the future higher rates. This allows better earnings for the current bank portfolio, decreasing risk while providing the borrower with more time to absorb future higher rates.

For borrowers you might not want because of risk, now is the time to gently push the borrower to another institution while credit is still available. This gets the borrower at least thinking about it. At some point, your bank might consider paying the borrower part of the difference in rate in order to incent them to move. A minor hit to earnings now is better than a big hit to capital later.

The Challenge in Loan Portfolio Asset Allocation

Step 3 – Lower Your Correlative Portfolio Risk: When deciding what new borrowers to take on, what borrowers to keep, and what borrowers to move out of the bank, you should consider your current portfolio construction. Most pundits are predicting a mild recession. If true, then having diversification in the portfolio is essential.

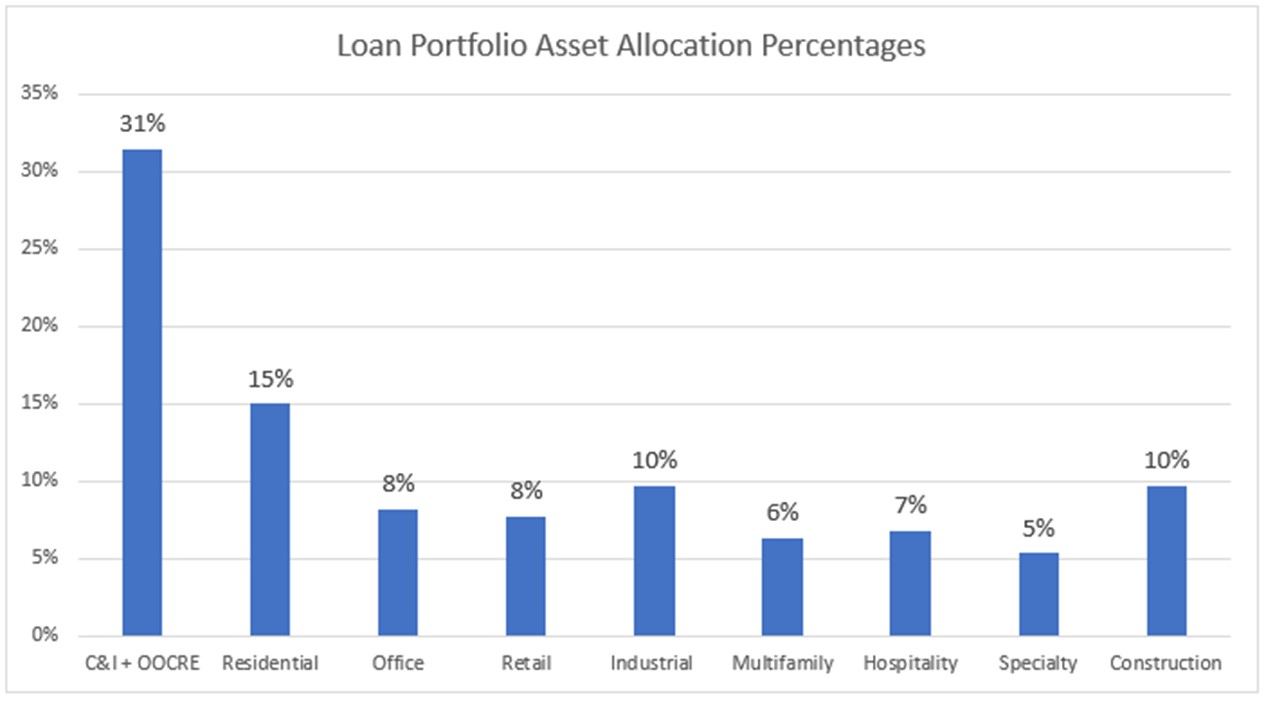

Below is a typical bank loan portfolio composition breakdown. We used it to model typical portfolio-level analytics. Your bank will be different given your geography, loan size, mix, and underwriting, but this data should be directionally indicative. For the sake of risk categorizations, we included owner-occupied commercial real estate in the commercial and industrial (C&I) loan category since the risk mainly depends on a particular business’s operations. Having real estate may help your loss given default, but it has little impact on the probability of default and portfolio performance.

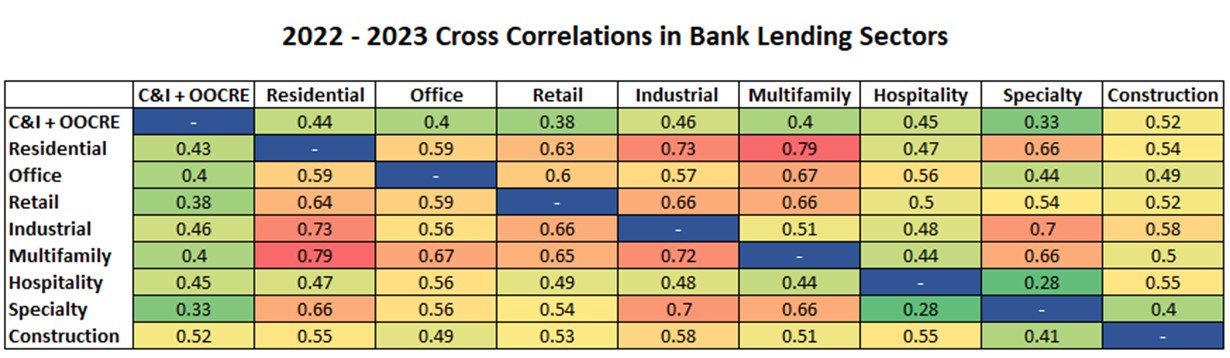

Cross-Correlations in Bank Lending Sectors and its Influence on Loan Portfolio Asset Allocation

We calculated the performance for each lending sector based on risk-adjusted total return for each sector at the end of each month. From the fluctuations of return, you can see which sectors move together and which have low correlations.

C&I has the nice attribution of not being correlated to any great extent to real estate. If we charted agriculture loans, you would see even less of a correlation. As your bank makes decisions on new and existing customers, keep in mind sector correlations to build a portfolio that thrives in a mild recession.

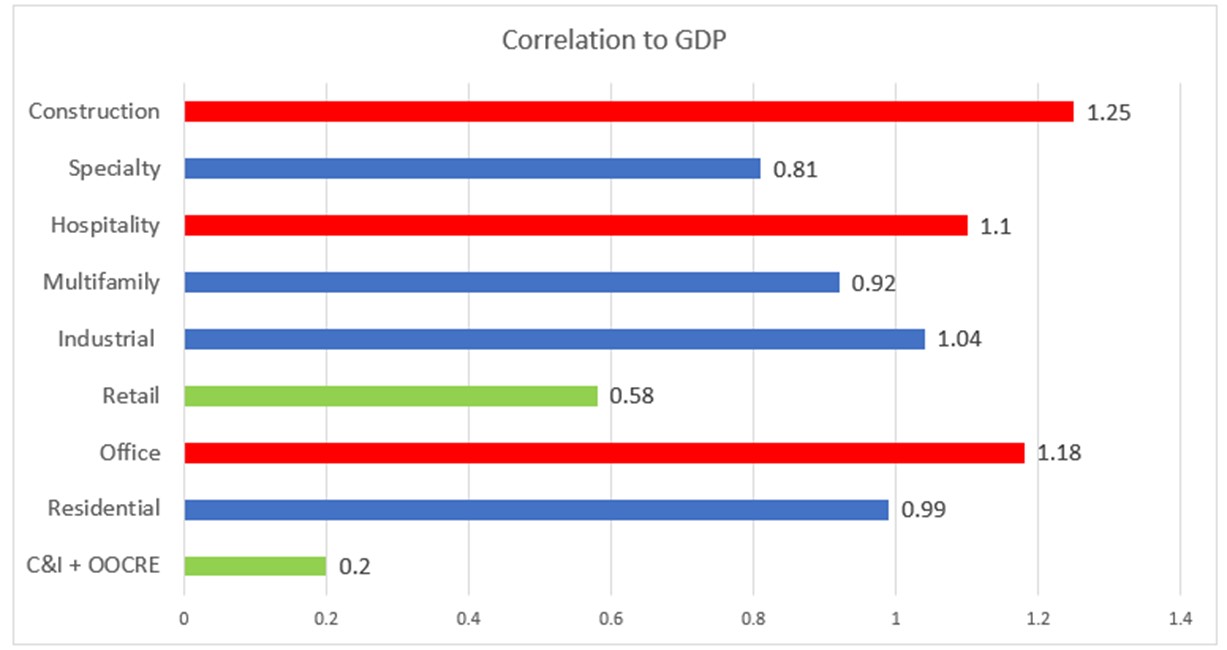

Loan Portfolio’s Correlation to the US Economy

Step 4 – Loan Portfolio to US Economy: The other consideration of risk is a loan portfolio’s correlation to the US economy. Here, you can see the risk-adjusted return performance correlated to the US economy. Generally, a bank’s loan portfolio is about 75% correlated to the US economy. Some sectors, such as construction, office, and hospitality, move in greater lockstep with the economy; that is, they have a beta of above 100%, or 1. Banks want exposure to these sectors in a risk-on environment to reap above-average yields. Banks want to reduce exposure to these sectors when the economy is slowing like it is now.

Use of Your Bond Portfolio

Step 5 – Use Your Bond Portfolio: Assuming you have enough liquidity on hand, your bond portfolio plays a vital role in managing bank balance sheet risk. The riskier your loan portfolio, the more liquid and conservative your bond portfolio should be. Bonds, particularly Treasuries and Bullet Agencies, are non-correlative to your loan portfolio, usually having a cross-correlation of 0.15 or less. Option-free bonds also often have a negative beta in that they increase in value as the economy weakens (and yields go down). Construct your bond portfolio considering the risk of your loan portfolio and not just bond yield.

Reallocate Credit To Increase Your Sharpe Ratio

Step 6 – Don’t overlook new customers: While many banks are not lending to new customers, this could be a mistake. To the extent a bank can shed risky or less profitable customers and take on a more profitable customer of higher credit quality, a bank would increase its risk-adjusted return on equity. More profitable customers can help protect the bank during a recession.

Consider the Sharpe Ratio. The average bank loan portfolio has a current Sharpe Ratio of about -0.07. The Sharp Ratio is the return of the portfolio less the risk-free Treasury rate divided by the standard deviation (variability) of the loan portfolio’s excess return. The higher the ratio, the more attractive the return and the more a bank should invest in the sector. As rates reset up, a bank’s Sharpe Ratio will move closer to “1,” and the goal is to be closer to a “2.” In addition to looking at lower correlative risk, a bank moving to more profitable customers that can handle the current rate environment will help lower the risk on the overall balance sheet. This also means a bank should consider rotating out of sectors with lower risk-adjusted returns and into sectors with higher risk-adjusted returns.

Optionality

Step 7 – Get Prepayment Provisions: Prepayment provisions in your loans are still important. If the economy is stressed and rates fall, you don’t want your borrowers refinancing to another bank. Now, more than ever is the time to ask for prepayment provisions to protect the bank’s balance sheet. If rates fall, it provides you with another tool to negotiate with. You can waive the provisions, keep them, or restructure the customer into another loan. Not having prepayment provisions gives away a free option worth approximately 60 basis points in this environment.

Putting Active Loan Portfolio Asset Allocation Into Action

The seven active loan portfolio asset allocation steps should help you make changes to your loan portfolio to increase balance sheet performance no matter where rates, credit, and liquidity trend. Proper balance sheet construction always matters, but it matters more in times of credit stress. While we might get a soft landing, the odds that some borrowers will have problems handling higher rates are higher than any banker has ever seen.

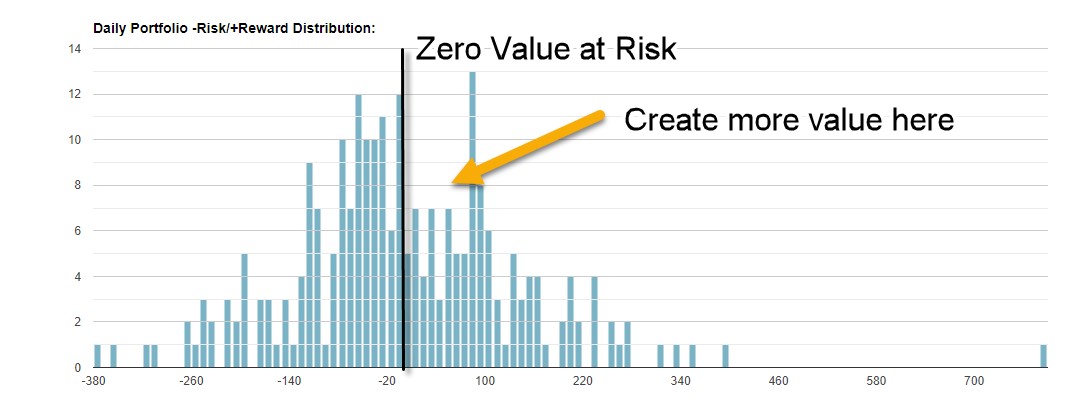

A bank can lose or gain value on its loan portfolio on any given day. We call this value-at-risk. Many banks (below) have constructed their loan portfolios where the probability of losing money is greater than making money. That is, the portfolio is negatively skewed when we look at loans on a total return basis. By shedding risky customers, adding quality customers, watching correlations, and ensuring you get prepayment provisions, banks can fill in the right side of the chart below and achieve a more even distribution of value creation.