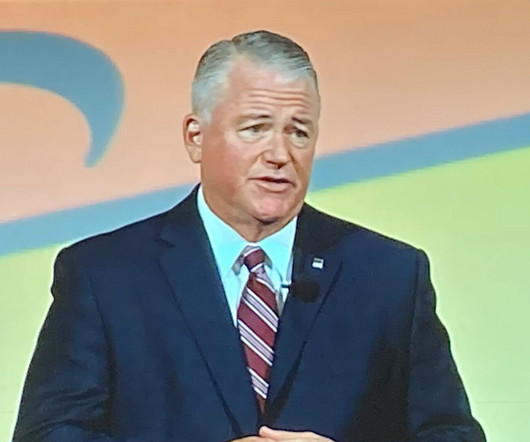

Survey: Community bankers remain concerned about economy, regulation

ABA Community Banking

APRIL 9, 2024

Community bankers are showing slightly more confidence in the future economic conditions but still have concerns, particularly about regulatory burden, according to the latest Community Bank Sentiment Index/ The post Survey: Community bankers remain concerned about economy, regulation appeared first on ABA Banking Journal.

Let's personalize your content