Investing in America: 7 Strategies and 7 Tactics That Can Drive Business

The Biden Administration “Investing in America” agenda continues with many programs opening in June of this year. If your bank has not done so already, it should consider getting involved for the benefit of customers and shareholders. The various programs are wide ranging, complicated, and impactful which is why now is an excellent inflection point to provide financial advisory to both your retail and commercial customers. In this article, we breakdown the details and discuss seven strategies and seven tactics banks use to set themselves apart.

Background

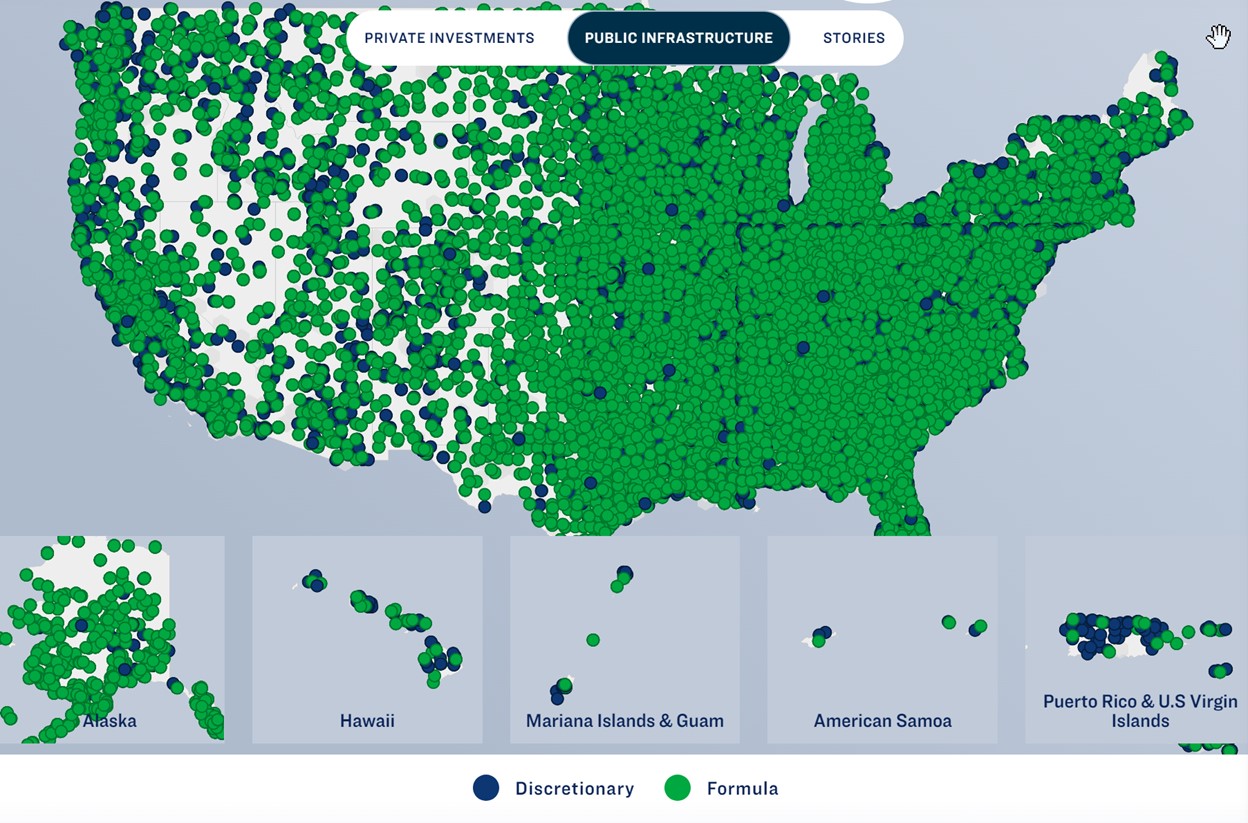

The Investing in America agenda comprises the American Rescue Plan, Bipartisan Infrastructure Law, CHIPS and Science Act, and Inflation Reduction Act. These programs aim, in part, to mobilize the private sector by pairing its capital with public investment to stimulate American manufacturing and infrastructure improvement, creating new jobs plus innovating in industries like clean energy and technology. These acts impact more than 55,000 locations throughout the U.S. (Projects and locations: Investing in America Program Details ).

By partnering with community leaders, state and federal agencies, local commissions, and commercial customers, banks can be an effective conduit to leverage this public capital better while making sure the funds are fully utilized effectively in the communities we serve. By taking a leadership role, banks can assist customers and their communities and generate loans, deposits, and fees in the process.

Below, we outline some considerations to help banks set strategies and tactics, including providing references to help educate your bankers and customers.

Rates and Inflation as It Relates to Investing in America

The first thing banks should assess is the overall impact of these programs on the macro and micro economic outlook. The breadth of these programs is massive and combines grants, tax credits, production incentives, tax relief, and private investment stimulus. Some of the stimulus is formula-based, while others are allocated to various agencies, states, and commissions to be dispersed as they see fit according to a predefined intent.

Most economic pundits and economists fail to appreciate how much stimulus has yet to be deployed fully. The Infrastructure Investment and Jobs Act (IIJA), enacted in 2021, still has approximately $451B to deploy. Last year’s Inflation Reduction Act still has almost $400B to deploy. The ancillary Investing in America program has roughly $171B to put to work. This is all on top of the tax benefits, such as the Employee Retention Credits businesses still claim have yet to be dispersed.

While some of this is offset by taxes or tax credit phaseouts, much of the stimulus will be inflationary. Each of the programs continues to place pressure on wages and labor costs. While these programs are somewhat evenly distributed, certain areas, such as the 13 Appalachian states, benefit more.

These programs are one reason we continue to see GDP growth and low unemployment in light of a historic 5% rate increase. As banks get involved in these programs and see first-hand the sheer amount of stimulus being put to work, banks will have a front-row seat to judge the macroeconomic impact of the funds in their region. This experience may lead many banks to conclude that while they plan on rate cuts in 2024 to help margins, they may want to start discussing an alternative plan with their board and management team.

Seven Basic Strategies

After considering the macroeconomic picture, banks should consider setting a strategy to utilize sales and marketing resources more effectively. There are lots of details and breadth in these programs. Banks likely need to focus on specific areas to be effective. Picking a strategy will depend on a bank’s goals, geography, and industry expertise. While there are many different approaches, our analysis shows that one or a combination of the following basic strategies are the most effective:

- Rural Support: Rural communities get a massive boost from the Investing in America agenda, and banks that serve these areas may just want to focus on the programs that provide support for lower-population areas that the bank serves.

- CRA-Focused: The bulk of the funding benefits disadvantaged communities and minority businesses. A bank may want to amplify these programs to gain CRA attribution and help the underserved. Specialty focus here can benefit banks catering to minority, women, or tribal-owned businesses.

- Manufacturing-centric: The program encourages, through production bonuses and tax credits, small businesses to invest in manufacturing. For banks that can focus on industries such as electric vehicles, batteries, solar, transportation safety, and semiconductors, this is likely the best strategy. Banks can assist their manufacturing customers to take advantage of these programs, distinguishing them from other banks while growing the coveted commercial and industrial section of their balance sheet.

- Clean Energy Support: Perhaps the largest recipients of credit are companies that support clean energy projects and manufacturing. Small businesses can benefit from tax credits for clean electricity through domestic content bonuses. By ensuring projects meet domestic content requirements for iron, steel, and manufactured products, businesses can access increased tax credit values, thus incentivizing the use of American-made components. Banks that are publicly traded and want to garner environmental, social, and governance (ESG) attribution while promoting sustainability may consider this strategy.

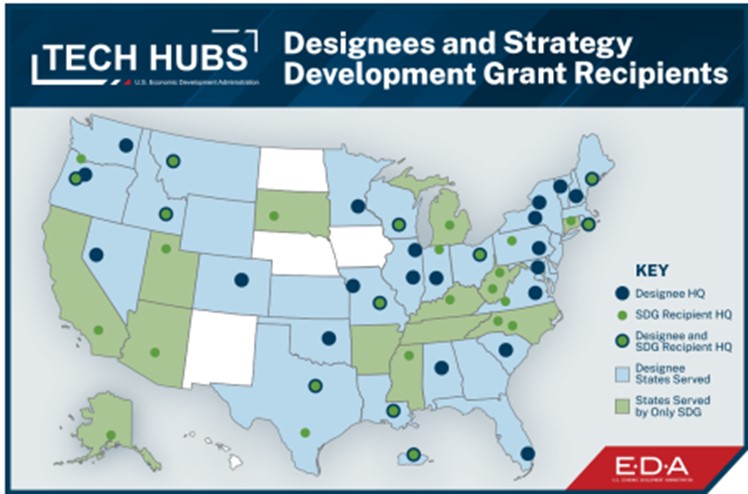

- Technology Targeted: A large part of the Investing in America agenda revolves around improving efficiencies by upgrading technology. Banks can target companies that are technology-driven in the areas of drinking water filtration, broadband internet delivery, transportation safety, energy efficiency, and clean energy technology. For example, under the Tech Hub initiative by the U.S. Economic Development Administration (EDA), 31 technology centers are being established throughout the United States. Five to ten of these Hubs will receive $40mm to $70mm in capital to invest in projects that meet established qualifications. The rest of the hubs will get approximately $450k strategy grants to help them further build out the hubs. These hubs will be focused on robotics, sensor systems, quantum computing, biomanufacturing, healthcare, clean energy, advanced materials, semiconductors, identity, 6G wireless, optics, and energy storage technology. Banks can partner with any of these consortiums to support the initiatives.

- Construction Industry: Small businesses in the construction and infrastructure sectors can find new opportunities in projects that rebuild roads, bridges, rail lines, drinking water delivery, wastewater processing, and other public infrastructures using “Made in America” materials. In addition, companies that demolish old infrastructure will also benefit. Banks that support infrastructure contractors can help these companies and their supporting suppliers gain these contracts by providing them credit and deposit services.

- Retail: Many of the Investing in America programs target households. Banks can focus on helping their retail customers obtain tax credits, rebates, and financial assistance.

Seven Tactics Banks Can Use to Leverage the Investing in America Programs

Once a strategy is outlined, banks can then go to work to focus on specific tactics. The number one tactic here is education. Taking advantage of these programs is confusing, and banks are in an ideal spot to impart value to their customers. Banks can leverage the Investing in America agenda to benefit both themselves and their customers in various ways, aligning with key priorities like infrastructure, clean energy, and small business support.

In many cases, project applications have been submitted and have yet to be awarded. In these cases, banks can wait to see who the winning organizations and companies are and then offer their support.

Here are seven tactics that banks can utilize to generate business and customer appreciation based around the various programs and initiatives under the Agenda:

- Banker Education: The size and complexity of these programs are massive. Before educating your customers and communities, you must start with your bankers. Once a bank narrows down its strategies and tactics, banks should invest resources in internal education. Relationship managers, lenders, and deposit marketers should clearly understand the basics of the Investing in America programs and be able to direct commercial or retail customers to the appropriate place. Banks can use this technical assistance guide (HERE) to create training materials. As bankers get educated, they should, in parallel, reach out to community leaders to join teams or collaborate on efforts to win funding to implement critical investments. Banks should consider partnering not only with civic leaders but also with appropriate non-profits and consultants who have expertise in the targeted fields.

- Customer Education: Perhaps the biggest way banks can assist their retail and business customers is by informing them of these various programs. Banks can provide resources, tools, and an overview of education on the most popular and impactful programs by leveraging landing pages, webinars, and workshops. Partnership with aligned community groups will be critical here.

- Loan Production with a Focus on Small Businesses: Banks can utilize programs like the State Small Business Credit Initiative (SSBCI) to provide loans and credit enhancements to small businesses. This initiative aims to catalyze private investment by leveraging public funds and supporting businesses in critical sectors like manufacturing and clean energy. By utilizing term loans and lines of credit, commercial customers can draw on this capital to complete their mission and then get reimbursed from these programs or from tax relief. Banks that have SBA lines will be at the forefront here, as the SBA has a mandate to support these programs.

- Deposit Gathering and Treasury Management Services: Many companies that look to take advantage of these programs will not only need loans and lines of credit to support their growth but will need help with cash flow planning and managing liquidity. Targeting customers that derive benefits from Investing in America programs will help drive bank deposit growth in the future. Having an education and assistance program is another way banks can acquire these targeted customers in addition to extending credit.

Banks can assist their small business clients by guiding them through the application process for these programs, offering advice on preparing the necessary documentation, and providing financial planning to ensure the effective use of any capital received. Banks can also help their customers tap into Advanced Manufacturing Tax Credits. Small businesses in manufacturing can utilize what is called the “45X Advanced Manufacturing Tax Credit” and the “48C Advanced Energy Project Credit” to invest in clean energy manufacturing (More information HERE).

- Grant Programs: Banks can help their small business clients leverage several grant programs under the Investing in America agenda, particularly through the State Small Business Credit Initiative (SSBCI). For example:

- General: For organizations that have never applied for a federal grant, they must register with three systems (see below). Banks can help their companies do this as soon as possible, as this process can take up to two months.

-

- SSBCI Technical Assistance Grant Program: This program offers more than $27 million in awards to states and territories. The funding is designed to provide legal, accounting, and financial advisory services to eligible small businesses applying for the SSBCI capital program and other government small business programs. Additionally, a significant award of over $57 million for American Samoa under the SSBCI Capital Program was announced.

- SSBCI Investing in America Small Business Opportunity Program (SBOP): This new initiative seeks applications for grant funding to deliver technical assistance in legal, accounting, and financial advisory services to very small businesses (VSBs) and businesses owned by socially and economically disadvantaged individuals (SEDI-owned businesses). The program is related to and supports the SSBCI Capital Program and the allocation formula-based SSBCI TA Grant (more information HERE).

6. Household Assistance: One of the challenges facing rural communities is an inefficient energy infrastructure. The Bipartisan Infrastructure Law provides $8.8 billion for two new Department of Energy programs to fund state and tribal rebate programs that encourage energy efficiency upgrades in low and middle-income households. For example, the law also allocates $3.5 billion towards the Weatherization Assistance Program, which helps low-income households increase the energy efficiency of their homes. In addition, the Inflation Reduction Act creates or extends more than 20 tax credits for individuals and businesses to move towards clean energy, including 30% of the costs of installing rooftop solar panels and up to $7,500 for qualified households to purchase an electric vehicle. Banks can help their customers educate and apply for these credits.

7. Community Investment: Participation in federal programs under the Investing in America agenda, such as the Emergency Capital Investment Program, allows banks to invest in community development financial institutions (CDFIs) and minority depository institutions (MDIs) that will directly benefit from the Investing in America agenda. These indirect investments can support loans, grants, and forbearance for small and minority-owned businesses and consumers in underserved communities.

Putting This into Action

This article presents an overview that pushes banks to consider leveraging the Investing in America programs to help their communities and be more relevant to their customers. There are many ways banks can get involved. These strategies and tactics showcase how banks can align with the Investing in America agenda to enhance their business operations and make significant contributions to the economic well-being of their customers and communities.