Another bank with fintech partners has been struck by an enforcement action, this time from the Federal Reserve. It follows recent actions by regulators including the Office of the Comptroller of Currency and the Federal Deposit Insurance Corp. against financial institutions such as

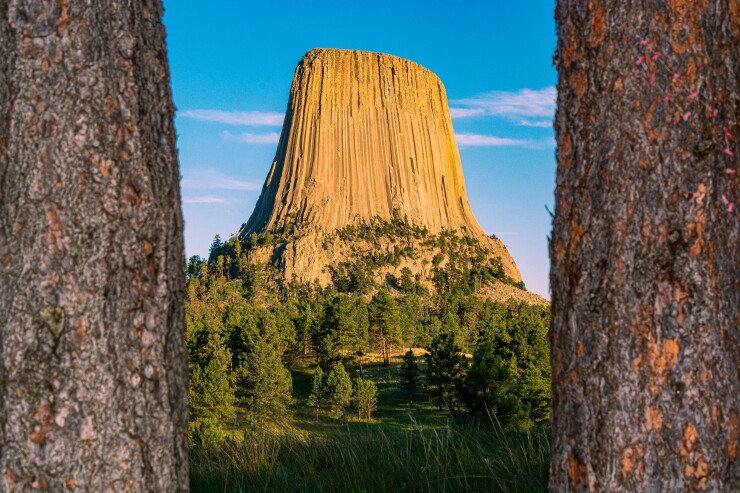

On Thursday, the Federal Reserve Bank of Kansas City issued a cease-and-desist order to Mode Eleven Bancorp, the holding company for Summit National Bank in Hulett, Wyoming. The order against Mode Eleven is partly related to the $110 million-asset Summit's banking-as-a-service activities.

The document states that the bank cannot engage in any "expansionary activities related to the fintech business strategy, including the establishment of any new subsidiaries, business lines, products, programs, services, customers, or program managers in connection with the fintech business strategy, without the prior written approval of the Reserve Bank."

Unlike some other banks hit by enforcement actions, Mode Eleven is voluntarily winding down its fintech program entirely, according to the order. Others have offboarded fintech partners or vowed to stay the course while complying with regulatory demands.

This action stemmed from the Federal Reserve Bank of Kansas City's most recent inspection, in September 2023, which uncovered issues relating to its fintech business strategy, board oversight, capital, liquidity, risk management and more. Beyond limitations on its fintech business, the bank must also form a plan to strengthen board oversight and risk management, including its ability to identify and monitor compliance and fraud risks; construct a proposal to improve earnings and the bank's overall condition; set up a program to enhance liquidity risk management, including diverse sources of funding; make a plan to maintain sufficient capital; and more.

These are issues that

A request for comment from Mode Eleven was not immediately returned.