If You Are Tired of Being Transactional, You Need A Hedge Program

An inverted yield curve, continued bank failures, and the desire to manage risk and offer clients higher service are all factors that are driving more community banks to adopt a loan hedge program. Community banks’ main goals are to diligently support their local communities and make an acceptable return on capital in these challenging times. Community banks do this profitably by turning transactional accounts into relationships. Loan-level hedging has become an important tool that many community banks have started to adopt in 2024. There are several benefits to community banks in using a loan-level hedge program, but how does a community bank choose a safe solution? We will share what we believe are the important parameters when considering a hedging partner for a community bank.

The Benefits of a Loan-Level Hedge Program

First, let us consider the benefits of a loan hedging program for community banks. In talking to community bankers, here are the main reasons provided:

- Improved Credit Quality: Banks can stabilize the borrower’s debt service coverage ratio (DSCR).

- Eliminate Interest Rate Risk: Eliminate margin compression when interest rates rise.

- Meet Competitive Pressures: National and larger regional banks are specifically targeting better borrowers for five, seven, ten-year fixed-rate loans.

- Protect Existing Loans: Average commercial loan prepayment rate is 25% per annum without a hedge but only 5% with a hedge. Banks are in the business of keeping loans, not making loans.

- Cross-sell: Locking borrowers into longer-term loans creates a stickier relationship.

- Lending Discipline: Sensible pricing methodology is part of a loan hedging program, and some hedge providers also offer a loan pricing model.

- Generate Fee Income: Hedge fee income for commercial loans can range between 25 to 200bps of the loan amount, and the fee is commonly recognized immediately in the period received. This added income can make loans much more profitable for community banks.

Community Bank Criteria for Hedge Partners

We believe that there are five top criteria for community banks to apply when choosing a hedge vendor.

First, the hedge provider must be a trusted advisor and help the community bank manage its balance sheet to create a neutral position and not take on speculative derivatives. Good hedging partners will pass on taking trades that generate revenue for the vendor but create more unforeseen risk. We witness over and over how some banks get themselves in deeper trouble booking derivatives on their books that are bets on market interest rate movements. A hedge should have a neutral outcome regardless of how the market moves (within defined bands).

Second, the hedge provider must be an FDIC insured institution and structure its hedges as a qualified financial contract (QFC). FDIC regulations afford QFCs certain rights and protections that will accrue to the hedge end-user (a community bank or a community bank borrower) if the hedge provider were to fail and the FDIC becomes the receiver. We see substantial risk to community banks in dealing with non-FDIC hedge providers or those that do not offer QFC protection – think Lehman Brothers.

Third, we believe that community banks should be suspect of vendors that require service exclusivity. There are certain services and products that require substantial setup costs, integration costs, and upfront resources, but providing a hedging solution is not that type of product. We believe that community banks should choose a path that offers the most operational flexibility. While the vendor’s services may be optimal today, business or economic changes may require a different path in the future. We believe that there is no reason to sign an exclusivity agreement with any hedge provider.

Fourth, community banks should be able to easily assess the health and safety of the hedge provider by considering the vendor’s credit quality, liquidity position, and capital position. One simple ratio to consider is derivative leverage ratio. Hedge providers will not typically disclose a full assessment of their derivative portfolio; however, every bank is required to disclose information that can be used to calculate the derivative leverage ratio, which is the ratio of total notional volume divided by tangible equity. This capital ratio is used to assess the possible riskiness of a hedge provider. More sophisticated entities can handle a higher ratio because they possess system and managerial sophistication to manage the risk. A simple rule of thumb is that any derivative leverage ratio over 20 requires an expert understanding of derivatives and risk management (for example, JPMorgan or Bank of America).

Fifth, community banks should work with vendors that understand the type of business conducted by the bank. The national banks may offer excellent products and services, but the hedge employees at a national bank may have little exposure to the community bank’s desired service, client, and product. Working with a vendor that understands community bank pricing, strategy, and customers creates better results for the bank. Working with a vendor that has a similar business model is often the key differentiator for success.

Conclusion

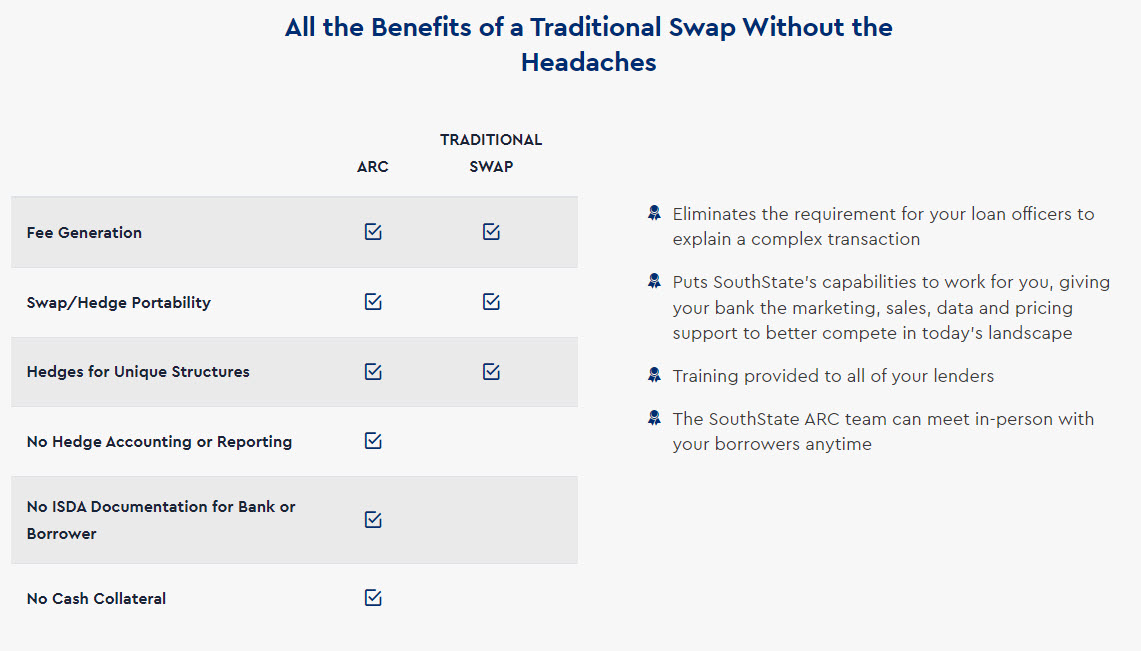

There are some substantial benefits to community banks in using loan-level hedging, and like every vendor analysis, community banks must understand how to assess the vendor’s capabilities and risks. Our ARC Program is one of many out there in the market but few other programs come with the array of support, analytics and resources that ARC banks enjoy. Don’t take our word for it – contact us and we will put you in touch with banks that can tell you the “before” and “after” of what a loan-level hedge program can do for a bank.