Many community bankers aren't buying the narrative that the United States will avoid a recession, according to a new survey from IntraFi.

The survey, which included executives at 545 banks, suggests the industry is more pessimistic than many investors. Stock markets have shot up in recent weeks, driven by investors' easing fears over a recession.

Nearly 3 in 4 of the bankers surveyed said they don't think the Federal Reserve will achieve a "soft landing," where the Fed reduces inflation through interest rate hikes yet does so without causing a downturn.

The vast majority of banks that responded had less than $10 billion of assets. The survey was conducted from July 5 to July 16.

Inflation has receded significantly from its 2022 peak of roughly 9%, all without causing much damage to the U.S. job market. That has driven up hopes that the Jerome Powell-led central bank will achieve its mission.

Bankers may be less optimistic about that prospect because they tend to be more cautious in nature, said Paul Weinstein, senior policy adviser at IntraFi, a fintech that provides reciprocal deposit coverage and other services to financial institutions. Their conversations with clients may also make them a bit gloomier.

"They're experiencing challenges on the ground, at the micro level, that a lot of the other economists may not be picking up," Weinstein said.

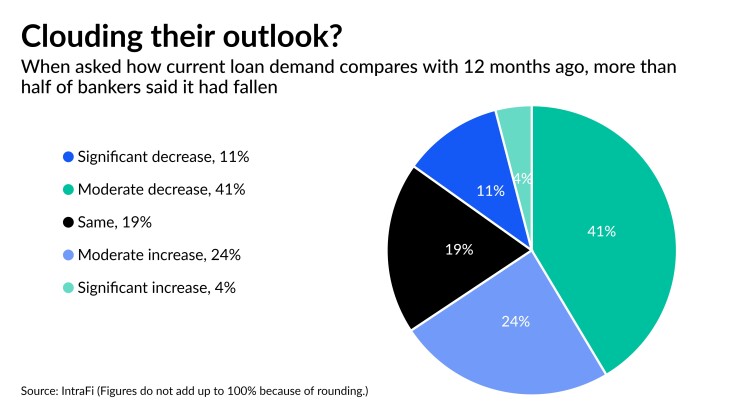

More than half of the bankers surveyed said they've seen a significant or moderate decrease in loan demand for clients over the past year. Nineteen percent haven't seen much of a shift, while 28% have seen a moderate or significant pickup.

Bankers don't expect a big increase in loan growth over the next year either, the survey revealed. Though some banks reported more demand than others, the survey's results line up with commentary from bank executives during second-quarter earnings calls.

"There's no question. Demand is muted," Timothy Meyers, CEO of Bank of Marin Bancorp in Novato, California, told analysts this week, according to an S&P Global Market Intelligence transcript.

To be sure, some lenders are more upbeat. BOK Financial's chief acknowedged Wednesday after reporting second-quarter results that funding costs had cut into profits but that he's bullish on the economy and loan demand in the Oklahoma company's six-state territory.

Still, earnings calls this month have been rife with questions over banks' commercial real estate exposures — and proactive presentations from bankers laying out the health of their CRE loans. The worries from investors have been particularly acute for office-related loans, as corporate return-to-office trends lag in some places and a large chunk of loans are up for refinancing next year.

While 36% of bankers in the IntraFi survey said they're somewhat concerned about their CRE exposures, 61% said they feel comfortable with them. Just 3% of bankers said they are very concerned.

Among those that expressed some level of concern, 71% said they've placed more scrutiny on their office CRE portfolios. More than half have tightened their underwriting standards for new CRE office loans, and 32% have shrunk their exposures. Bankers are also setting aside funds to cover potential losses, and they're restructuring loan terms with borrowers.

However, the vast majority of the bankers surveyed don't have massive exposures to the sector. Seventy-one percent said office CRE loans make up less than 10% of their Tier 1 capital, while another 18% said they make up10% to 30%.

The more pressing challenge for banks appears to be their funding costs. Banks' interest expenses have jumped as they're forced to pay depositors more to keep up with Fed rate hikes. (The Fed on Wednesday raised the federal funds rate a quarter point, bringing its target range to between 5.25% and 5.5% — a 22-year high.)

Some banks also had to borrow at more expensive rates during this spring's banking turmoil and are attempting to pay off those borrowings.

Nearly 75% of banks say funding cost increases have been significant, while 23% said they've been moderate. Only 3% of lenders were able to keep funding costs flat or down.

The competition "may not relent" until after year-end, said John Hairston, CEO of Hancock Whitney in Gulfport, Mississippi. The bank has been raising its certificate of deposit rates and doesn't envision repricing them until after the Fed is done hiking rates.

"The competition does not appear to be getting any easier as we look at the next six months or so," Hairston said, according to an S&P Global Market Intelligence transcript.

The bankers that IntraFi surveyed agree. Two in three say they expect moderate increases in funding costs over the next 12 months, while 19% expect significant ones. The rest believe funding costs will stay the same or fall.

The survey also asked banks about the FedNow real-time payments network, which the Fed

The Fed listed 57 organizations as early adopters of FedNow ahead of the launch, though a critical question remains whether the thousands of banks and credit unions will adopt it.

The IntraFi survey suggests the landscape is far from settled. Just 23% of banks surveyed said they "definitely plan to offer FedNow in the future," while 29% said they don't "currently plan to offer" it. The remaining 48% said they are considering FedNow.

Jim Dobbs contributed to this article.