Community Bank Performance – 2Q Lessons

South State Correspondent

SEPTEMBER 11, 2023

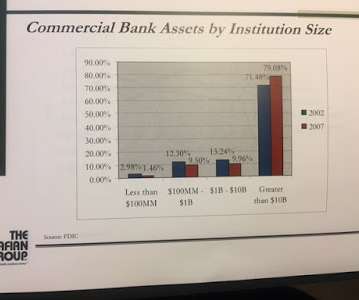

Therefore, the quarterly profile and Chairman Martin Gurenberg’s commentary on the industry are skewed by the performance of larger banks. In this article, we analyze the underlying data for community banks and focus on the Chairman’s view of the future of bank performance.

Let's personalize your content