Cross-Selling and Upselling – 2 Drivers of Relationship Profitability

In two previous articles (here and here) we discussed how loan size and loan term affect the profitability of commercial loans. We continue this theme of major drivers of loan and bank profitability and discuss the importance of cross-selling and upselling, and its impact on bank performance. In this article, we consider the common features of upselling and cross-selling. In a future article we will discuss how community bankers may structure their commercial loan products to maximize cross-selling and upsell opportunities.

The Importance of Cross-selling and Upselling

Studies conducted on banking relationships find that the most profitable commercial clients at banks buy more than one product at those banks, and there is a strong positive correlation between profitability and number of products sold and the bank’s size of customer wallet. The banking industry is unlike many other industries when analyzing how cross-sell drives profitability. For the banking industry upselling and cross-selling have a high and disproportional impact on profitability. With proper tools and strategies, community bankers can upsell and cross-sell their products to maximize profitability.

Upsell versus Cross-sell

Upselling is defined as selling the client more of the same product in quantity, volume, or time. In the banking industry, the time factor is extremely important. The upsell may occur at the initial purchase or subsequent purchases. Again, unique to banking, the subsequent purchases are crucially important to profitability.

Cross-selling, on the other hand, is defined as selling the client additional complementary products or services. Again, we believe that banking is a special industry where some products may appear profitable and are not, or vice versa. Being able to quantify profitability and identify profitable customers is key to using upsell and cross-selling techniques in banking.

Cross-sell Drives Profitability

For the average industry, upselling and cross-selling can increase revenue anywhere between 10% to 50% and add a few percentage points to return on equity (ROE). That means that the primary product can be sold for $100, and the sales team can add another $10 to $50 in revenue with well-developed upselling and cross-selling strategies. In banking, those numbers are markedly different. The average community bank has thousands of customers, and the vast majority (close to 90%) earn zero or negative ROE. At an average bank, the top 10% of customers generate the entire profit for the bank. There is one common element to those top 10% of customers: they have been effectively upsold and cross-sold. Upselling and cross-selling can increase revenue by more than 100% and add ten or more percentage points to ROE

Consider the entire array of products that a community bank may offer in the list below:

Business checking, savings or money market accounts

Merchant processing

Wire transfer services

Automated clearing house services (ACH)

Overdraft protection

Business debit card or business check card

Business credit cards

Electronic payments (Bill Payment)

Money market mutual funds

Remote deposit capture

Credit lines secured by receivables, or inventory

Certificates of deposit

Unsecured short-term loans or working capital lines

Payroll processing

Company sponsored 401(k), SEP, pension

Commercial real estate mortgage

Account reconciliation processing

Commercial real estate mortgage

Equipment leasing

Term loans or equipment financing

Overnight investment or sweep accounts

International (foreign exchange, import/export letters of credit)

Accounts receivable collection (lockbox)

SBA loans

Private placement of long-term debt

Interest rate risk management (SWAPS)

Electronic data interchange

Merger & acquisition advisory services

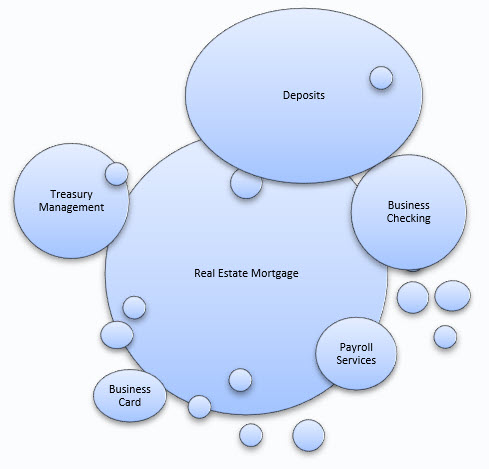

Not all community banks will offer all the above services, and no bank can offer all the above services equally well. However, there is one product that is specially designed for upselling and cross-selling and defines which customer can be profitable for the bank – it is the commercial real estate mortgage. If we mind map how community bank products are upsold and cross-sold, it may look something like this:

Of the many commercial products that community banks sell, the long-term credit facility (commercial mortgage) is the platform that creates the greatest cross-sell opportunities for many other bank products. While bankers can sell customers cash management or deposit products and later cross-sell credit, in the vast majority of cases the real estate mortgage acts as the entrée to a new relationship. The real estate mortgage is a platform that drives cross-sell and upsell capabilities. The real estate mortgage holds this important role for a bank for the following reasons:

- The commercial mortgage has high entry costs (fees, appraisals, and underwriting), and, therefore, switching is expensive.

- Commercial mortgages are long-term commitments and typically contain prepayment provisions.

- Credit products are one of the very few products where the customer takes the bank’s capital with the possibility of non-payment – this arrangement requires substantial scrutiny and underwriting by the bank. This builds a relationship and trust between lender and borrower, and further increases switching costs.

Once a bank sells a commercial mortgage to a customer, cross-sell opportunities open for every other product at the bank. Many community bankers complain that their bank excels at loans and deposits, and the other products are not best-of-class. However, these two products can produce tremendous value for the bank, and the biggest opportunity for the commercial mortgage is the upsell, not the cross-sell.

Commercial loans are often overlooked for upsell opportunities. At the inception of the loan, after the bank has expanded time and resources to source, originate, underwrite and book the credit, the profitability for the loan is negative. Only over time when coupon revenue is realized does the loan become profitable. Profitability continues to grow over time. Community banks can increase the expected life of the loan by using any of these features:

- Choose the right client (with growth opportunities)

- Commit to longer terms

- Include prepayment provisions

- Eliminate balloon features

- Make loans assignable and assumable (more on that in a separate article)

Conclusion

Most community banks can be profitable with just two best-of-class products – loans and deposits. Being able to upsell and cross-sell commercial mortgages can be highly profitable for community banks and does not require the purchase of new systems, no substantial change in processes and only modest product redesign; but it does require being able to measure relationship ROE. In a future article we will discuss how community banks may structure and position their commercial loans to maximize cross-sell and upsell opportunities.