PacWest in Los Angeles accelerates CEO succession

American Banker

NOVEMBER 22, 2022

(..)

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

American Banker

NOVEMBER 22, 2022

(..)

American Banker

OCTOBER 2, 2023

The $23 million deal, signed in 2021 and initially projected to close in the second quarter of 2022, was delayed multiple times amid leadership turnover at the Los Angeles-based RBB.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

American Banker

JANUARY 30, 2024

billion-asset lender with a footprint spanning San Diego, Greater Los Angeles and the San Francisco Bay Area. The deal involving Southern California Bancorp and California BanCorp, expected to close in the third quarter, would form a $4.6

American Banker

NOVEMBER 9, 2023

Los Angeles-based Lendistry — in less than two years — became the largest Black-run 7(a) lender. Its CEO credits a concerted effort by the Small Business Administration to reach out to minority lenders and businesses, whose participation in the lending program is growing.

PYMNTS

MAY 1, 2020

Less than 30,000 loan applications from both banks combined have been approved by Small Business Administration (SBA). The government shut big lenders out of the program on Wednesday (April 29) so more community banks could participate.

American Banker

MARCH 11, 2016

MidFirst Bank in Oklahoma City has agreed to buy 1st Century Bancshares in Los Angeles.

American Banker

JANUARY 4, 2021

Brian Argrett, whose City First Bank is being sold to Los Angeles-based Broadway Financial, would take the helm of the combined company at a time of increased national interest in reinvigorating minority-owned financial institutions.

American Banker

MAY 17, 2022

(..)

American Banker

FEBRUARY 7, 2020

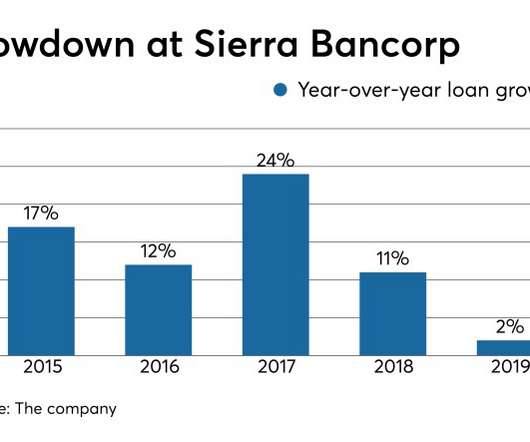

Sierra Bancorp in Porterville has formed dedicated lending teams in Sacramento and Greater Los Angeles in its bid to accelerate loan growth following a sluggish 2019.

American Banker

JANUARY 29, 2020

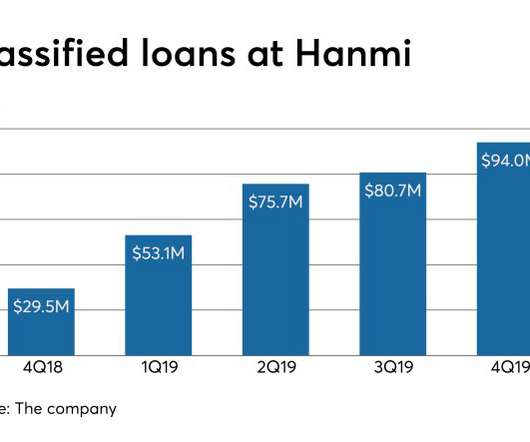

The Los Angeles company set aside more money to cover a problem loan after an updated appraisal of the credit's collateral.

American Banker

MAY 27, 2020

The company will incur an upfront fee but will save $7 million a year by walking away from a deal with the Los Angeles Football Club.

CFPB Monitor

SEPTEMBER 21, 2015

The CFPB announced the appointment of new members to its Consumer Advisory Board, Community Bank Advisory Council, and Credit Union Advisory Council. New members to the Consumer Advisory Board will serve three-year terms and new members to the Community Bank and Credit Union Advisory Councils will serve two-year terms.

American Banker

JULY 17, 2020

The Los Angeles company said Chang Liu, who runs its bank, will succeed Pin Tai, who is retiring.

Abrigo

APRIL 28, 2016

SBA Administrator Maria Contreras-Sweet started three businesses in Los Angeles, including a community bank, before joining President Obama’s cabinet in April 2014. So dream big, take that next small step today, because the next great American success story could be staring back at you in the mirror.

American Banker

JULY 8, 2016

Cathay General Bancorp in Los Angeles has agreed to buy SinoPac Bancorp from Bank SinoPac in Taiwan.

CFPB Monitor

AUGUST 22, 2016

The CFPB has announced the appointment of new members to its Consumer Advisory Board, Community Bank Advisory Council, Credit Union Advisory Council, and Academic Research Council. Arjan Schutte, Founder and Managing Partner, Core Innovation Capital, Los Angeles, CA. Community Bank Advisory Council Members.

American Banker

MAY 16, 2016

PacWest Bancorp in Los Angeles is the latest bank to exit its loss-share agreements with the Federal Deposit Insurance Corp.

American Banker

NOVEMBER 1, 2016

Cathay General Bancorp in Los Angeles has agreed to a community reinvestment plan tied to its deal to buy SinoPac Bancorp from Bank SinoPac in Taiwan.

American Banker

DECEMBER 29, 2016

Hope Bancorp in Los Angeles will close an additional nine branches next year as part of a second round of cost cutting.

American Banker

SEPTEMBER 28, 2016

CU Bancorp in Los Angeles has agreed to a consent order to address deficiencies in its Bank Secrecy Act and anti-money laundering compliance program.

American Banker

JULY 19, 2016

Profit improved at both BBCN Bancorp and Wilshire Bancorp in the second quarter, about two weeks ahead of the closing date for the Los Angeles companies' merger.

American Banker

JULY 22, 2016

Second-quarter earnings at Cathay General Bancorp in Los Angeles fell 22.9% million from a year earlier on a triple-digit spike in chargeoffs.

American Banker

MAY 9, 2016

Boston Private Financial Holdings is expanding its footprint in California, opening a new office in Los Angeles on June 1. The company will have 35 offices nationwide, including 14 on the West Coast.

American Banker

SEPTEMBER 29, 2016

City National Bank in Los Angeles has launched a national business to focus on the food and beverage industries.

American Banker

JULY 15, 2016

PacWest Bancorp in Los Angeles reported lower quarterly profit as higher expenses offset gains from fees and loan growth.

American Banker

DECEMBER 23, 2016

The Treasury Department has significantly reduced its stake in Broadway Financial in Los Angeles.

American Banker

MAY 13, 2016

BBCN Bancorp in Los Angeles will rebrand itself as Hope Bancorp after buying Wilshire Bancorp. billion-asset BBCN also plans to change the name of its banking subsidiary to Bank of Hope after the deal closes.

American Banker

NOVEMBER 16, 2016

PacWest Bancorp in Los Angeles has agreed to sell four properties in California to a real estate firm.

American Banker

APRIL 14, 2016

PacWest Bancorp in Los Angeles reported higher quarterly profit led by its acquisition of Square 1 Financial in Durham, N.C.

American Banker

JUNE 8, 2016

A longtime California bank regulator and executive has joined the board at Hanmi Financial in Los Angeles.

American Banker

JULY 14, 2016

That’s the message that two funds have for directors of Commonwealth Business Bank in Los Angeles.

American Banker

AUGUST 8, 2016

Pacific City Financial in Los Angeles has raised $15.3 million in a secondary stock offering.

Jeff For Banks

MARCH 27, 2019

“Our money is the same as the bank’s down the street.” And so were the Uber cars in my recent trips to Los Angeles and Nashville. Because as Tim said in our podcast, a great brand will mobilize a community bank's greatest asset, its people. But something was different. Get all employees on the same page.

American Banker

JUNE 6, 2016

Open Bank in Los Angeles has formed a holding company.

Jeff For Banks

JANUARY 20, 2017

I also noted in my most recent and in all of my past Top 5 total return posts that community banks deliver superior returns to their larger brethren. One example is German American Bank, highlighted in American Banker's Community Banker of the Year issue, and on this blog. It is a $3B bank with a 55% efficiency ratio.

Jeff For Banks

APRIL 24, 2010

My guess is to the holy grail of banking, the “General Bank”. Don’t laugh, there once was a bank named General Bank in Los Angeles. Should your bank’s name be General Bank? We don’t identify our destination, yet we set about a strategy to get somewhere. Where, I’m not sure.

South State Correspondent

APRIL 10, 2023

CRE Risk Background While ten years ago, community and regional banks use to make up some 55% of the CRE market, in 2023, these banks now compose approximately 72% (below). The risk here is that community banks continue to take on an above-average amount of CRE credit exposure. touched off a wave of bankruptcies.

Jeff For Banks

DECEMBER 18, 2014

A summary of the banks, their strategies, and links to their website are below. #1. Open Bank (OTCQB: OPBK) Open Bank commenced operations in 2005 as First Standard Bank in the Koreatown section of Los Angeles. They are built as a relationship bank serving the Korean community in LA and surrounding areas.

Fintech Labs Insights

SEPTEMBER 12, 2016

CU Wallet, a Los Angeles-based provider of white-label digital wallet solutions for regional and community FIs, has picked Finovate Best of Show winner AnchorID to provide multi-factor authentication. The technology integrates readily with Microsoft Active Directory and Azure, Linux, LDAP, and SAML.

Gonzobanker

DECEMBER 22, 2015

Community bank marketing resources. With market opportunity heating up and big bank and big credit union competitors hitting hard, too many community banks lack marketing resources … or they have 2X more spending in sponsorships than the campaigns, analytics and digital sales improvements that actually bring in new business.

Gonzobanker

DECEMBER 22, 2014

It’s been a busy year integrating recent acquisitions, purchasing $1 billion+ in Banco Popular deposits, hiring former Los Angeles Mayor Antonio Villaraigosa to advise on community relations, and having former President Bill Clinton speak at a major financial literacy event. Bank Acquisition of the Year - BB&T Corp.

Abrigo

APRIL 23, 2020

All of the [lenders] are in a holding pattern, but it will be like rush hour in New York or Los Angeles. Sound Community Bank AVP and Loan Systems Analyst Christian Fobian said his financial institution has been working since the first round of PPP funding ran out to get applications ready in case more money came through.

Gonzobanker

DECEMBER 19, 2016

The Millenials as Funding Award – Goes to Dime Community Bank for attracting press attention when it appealed to hipsters in Brooklyn as a means of funding its powerful commercial real estate niche. The FinTech Partner Best Practice Award – Goes to Cambridge Savings Bank and SigFig for their digital investment platform partnership.

Gonzobanker

DECEMBER 19, 2016

The Millenials as Funding Award – Goes to Dime Community Bank for attracting press attention when it appealed to hipsters in Brooklyn as a means of funding its powerful commercial real estate niche. A Gonzo community bank being a leader and not a fast follower – that’s pretty cool! Check it out on YouTube. Well done.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content