Huntington Bancshares has been “well-served” by partnerships with grocery stores Meijer and Giant Eagle, Midwest chains that house hundreds of the Columbus, Ohio, company's branches, said Steve Steinour, its chairman and CEO.

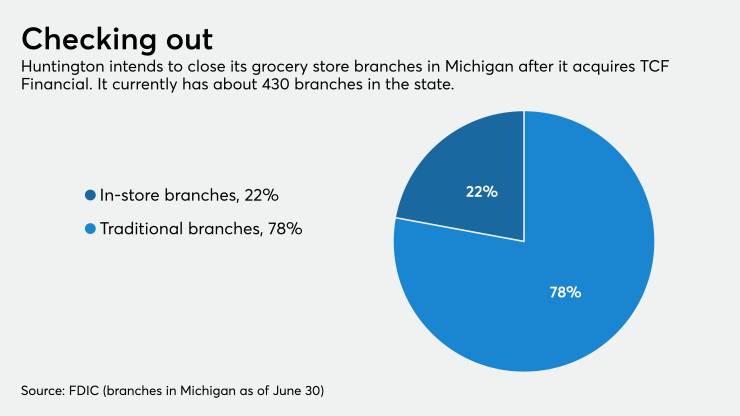

But consumers' shopping habits are changing, and that's prompting Huntington to re-evaluate its in-store strategy. The $123 billion-asset company addressed the issue in part Friday, announcing it expects to shutter all of its Meijer branches in Michigan — a total of 97 — as part of its

Steinour noted that foot traffic in grocery stores has declined, particularly during the pandemic, with more households choosing to order groceries online and have them delivered.

As a result, “their preference for doing banking in stores is changing,” Steinour said in an interview Friday after the company reported fourth-quarter earnings.

Huntington is the second bank in as many days to announce plans to shutter scores of grocery store branches. On Thursday, the $63 billion-asset People’s United Financial in Bridgeport, Conn., said it plans to

"Changing trends in retail shopping behavior has become apparent," People's United Chairman and CEO Jack Barnes said on the company's fourth-quarter earnings call Thursday. "The availability of delivery and curbside pickup options, which have become more prominent during the pandemic, have impacted foot traffic inside stores."

At the same time, Barnes added, "Customers are increasingly utilizing our online and mobile platforms for their banking needs."

Huntington has no immediate plans to close the dozens of branches within Giant Eagle stores in Ohio and Pennsylvania or the TCF Financial branches in Jewell-Osco stores in Illinois, though Steinour said Huntington may choose to revisit those arrangements as lease agreements expire.

Along with pruning its branch network, Huntington intends to invest heavily in technologies aimed at improving its digital capabilities. On an earnings conference call with analysts Friday, Chief Financial Officer Zach Wasserman said projected expense growth would likely outstrip revenue growth — a significant pivot for Huntington, which has repeatedly stressed the importance of generating positive operating leverage.

In 2021, however, Steinour wants the company to “lean into the [economic] recovery,” with new hires, more marketing and a major effort to bolster digital and online capabilities. About 60% of Huntington's added spending will be earmarked for technology, Wasserman said.

Steinour declined to discuss specific product enhancements, saying only that there will be a series of announcements in the coming months.

“We’ve laid out a digital road map for each of our business lines," he said.

Huntington's plans mirror those of its in-state rival, the $170.4 billion-asset KeyCorp in Cleveland, which

Huntington reported net income of $316 million for the quarter ending Dec. 31, in line with its results from a year earlier. Revenue of roughly $1.2 billion rose 7% from a year earlier.

At $81.1 billion, average loans and leases increased 8% from a year earlier, largely reflecting the $6.2 billion in Paycheck Protection Program loans Huntington made between April 3 and Aug. 8, when PPP’s initial authorization lapsed. With the program reauthorized as part of the Dec. 27 stimulus package, Wasserman said Huntington expects to make as much as $2 billion of new PPP loans.

For all of 2021, Huntington is projecting loan growth in the 2% to 4% range. The company is expecting continued strong liquidity, with deposits likely to increase by 5% to 7% in 2021. At Dec. 31, deposits totaled $99 billion, up 20% from a year earlier.

Nonperforming assets of $563 million were down slightly from Dec. 31, 2020 and more than 6.5% on a linked-quarter basis. At the same time, COVID-related loan deferrals, which peaked at $6.8 billion on June 30, had dropped to $217 million at yearend. Chargeoffs of $112 million equaled 0.55% of average loans.

Despite solid asset-quality metrics, Huntington reported a $130 million provision for loan losses in the fourth quarter. Chief Credit Officer Rich Pohle said the loan-loss allowance, which totaled $1.9 billion, or 2.29% of loans at Dec. 31, would remain elevated at least through the first half of 2021.

The decision to add to the loan-loss reserve had some analysts scratching their heads, as many banks have been releasing reserves, citing improving credit quality.

Huntington’s provision “is much higher than what we’re seeing as a trend around the banking industry this quarter,” Ken Zerbe, an analyst at Morgan Stanley, said during Friday’s conference call.

“It certainly seems clear credit concerns are melting away for the industry,” Piper Sandler analyst Scott Siefers added.

Pohle, however, insisted it is still too early to begin releasing reserves. “There are a number of assumptions that are still in doubt,” he said. “We didn’t feel there’s enough certainty.”

Huntington was "prudent on the way up" building the allowance, Pohle added. "We're going to be prudent on the way down."

Huntington’s acquisition of TCF remains on schedule to close in the second quarter, Steinour said.

“We’re collaborating extraordinarily well,” he said. “I’ve been part of more than 40 deals in my career. Our working relationship with TCF is the best one yet.”

Paul Davis contributed to this story.