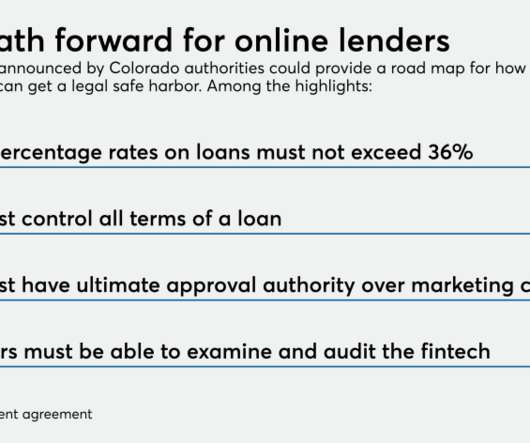

Colorado's new law on high-cost lending may be a model for other states

American Banker

JUNE 7, 2023

The measure will prevent banks chartered elsewhere from charging interest rates above Colorado's 36% rate cap. If additional states take the same approach, it could hamper the business model for high-cost consumer lenders that partner with banks.

Let's personalize your content