While the largest banks in the country

On Wednesday, executives at the Cleveland company defended the decision to set aside $482 million for credit losses, telling analysts on the second-quarter earnings call that the provision exceeds net charge-offs for the quarter by $386 million and reflects a June 30 economic outlook that’s largely unchanged more than halfway through July.

New Chairman and CEO Christopher Gorman, who took the helm on May 1 when

But whether those reserves are enough to cover loans that might sour in the future depends on how long the coronavirus pandemic lasts and how the economy performs in coming months. COVID-19 cases continue to surge in several states, and some parts of the country that reopened for business are shutting down again.

“What would drive an increase in reserves would be growing our loan book or a change in our forward view of the economy or a downward credit migration,” Gorman said in an interview after the earnings call.

“We are not seeing a continuation of a downward credit migration in the beginning of the third quarter,” he added.

Building up reserves to weather the possibility of more economic distress has been a central theme of second-quarter earnings reports this year. Two of the nation’s biggest banks — JPMorgan Chase and Wells Fargo —

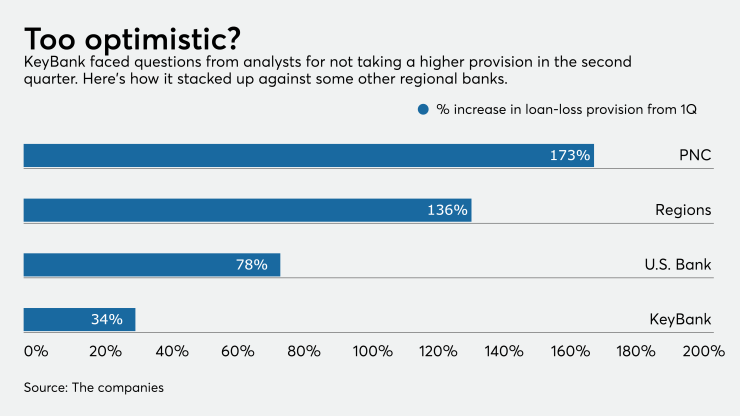

Piper Sandler analyst Scott Siefers said KeyCorp’s reserve was higher than he projected — about $94.4 million above his forecast — but lower than its peers, whose reserve-to-loan ratios are at or above 2%. KeyCorp’s ratio is 1.8%, he said.

“My best guess is they will have to ratchet up reserves incrementally,” Siefers said.

Net income for the quarter tumbled 60.5% to $159 million or 16 cents per share, reflecting an increase in payments- and COVID-19-related expenses and a decrease in service charges on deposit accounts.

A bright spot for the company during the second quarter was fee-based businesses. Noninterest income rose 11.3% from the year-earlier quarter, driven by upticks in capital markets, cards and payments and its consumer mortgage business, which continues to shine four years after KeyCorp bought First Niagara Financial Group in Buffalo, N.Y., and resumed making mortgages in-house.

Consumer mortgage originations of $2.2 million were up 100% year over year, with refinancing leading the way.

Gorman said the business is “really hitting its stride,” and the backlog remains strong, though the company does not expect the level of activity in the fee-income business to remain as high in the third quarter.

“Because of the pandemic, people are now investing heavily in their homes and buying new homes,” he said. “As such the purchase market has expanded, so it’s a great lineup for the mortgage business to really have the opportunity to capture that.”

Gorman, who is now more than two months into his tenure as top executive of the $171.2 billion-asset KeyCorp, said all branch lobbies are now open while 11,000 of the company’s 17,000 employees continue to work remotely. He said digital sales are up 100% year over year and customers are flocking to digital channels.

But the obvious downside to the pandemic is that “nobody knows the path or the duration” of the crisis.

“It’s an unusual time because there’s a lack of clarity as to what path the economy is going to take, and as you think strategically" as an organization, "that’s the No. 1 challenge we face,” he said.