Copilot for Banks – What is It and 7 Steps Before Considering

By now your bank is likely convinced on the merits of generative AI. Microsoft’s Office 365 CoPilot, the integration of the Microsoft version of OpenAI’s Chat GPT into the Office suite, represents the fastest, and likely safest way, to integrate the latest technology within your bank. Earlier this year, Microsoft dropped the 300 licenses minimum (and other requirements) and now every bank should consider the technology. However, the technology is not without its risks. In this article, we provide seven practical steps to prepare executives, technologists, and business line leaders for Copilot for banks and mitigate much of the risk.

Generative AI, the likes of ChatGPT, Gemini, Anthropic and others, are now solidly permeating every business worldwide. The uptake of this sophisticated technology is setting records at every turn from the pace of innovation to adoption. While it is tempting to sign the contract for Copilot at a starting cost of $30 per person and distribute the technology bank wide, bank management should understand the greater context of the strategy and investment.

What is CoPilot for Banks?

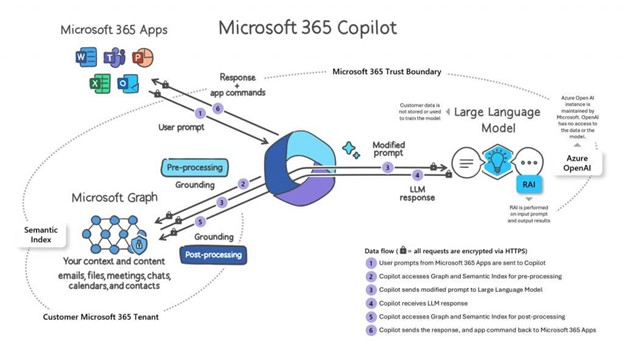

Copilot is a generative AI application which combines a bank’s internal data generated by the Microsoft 365 applications and Graph and combines the data with the ChatGPT-4 large language model and DALL-E 3 image models. Microsoft has two versions of Copilot, one for Microsoft 365 (the Office suite), which requires an enterprise subscription, and a more general version called Microsoft Copilot. The critical point here is the enterprise version of Copilot for Microsoft 365 (hereafter called “Copilot for Banks”) is different from the public, non-enterprise version of Copilot which individuals or small businesses can purchase. The Copilot for Banks is pretrained for an enterprise and includes the specific data of the Bank.

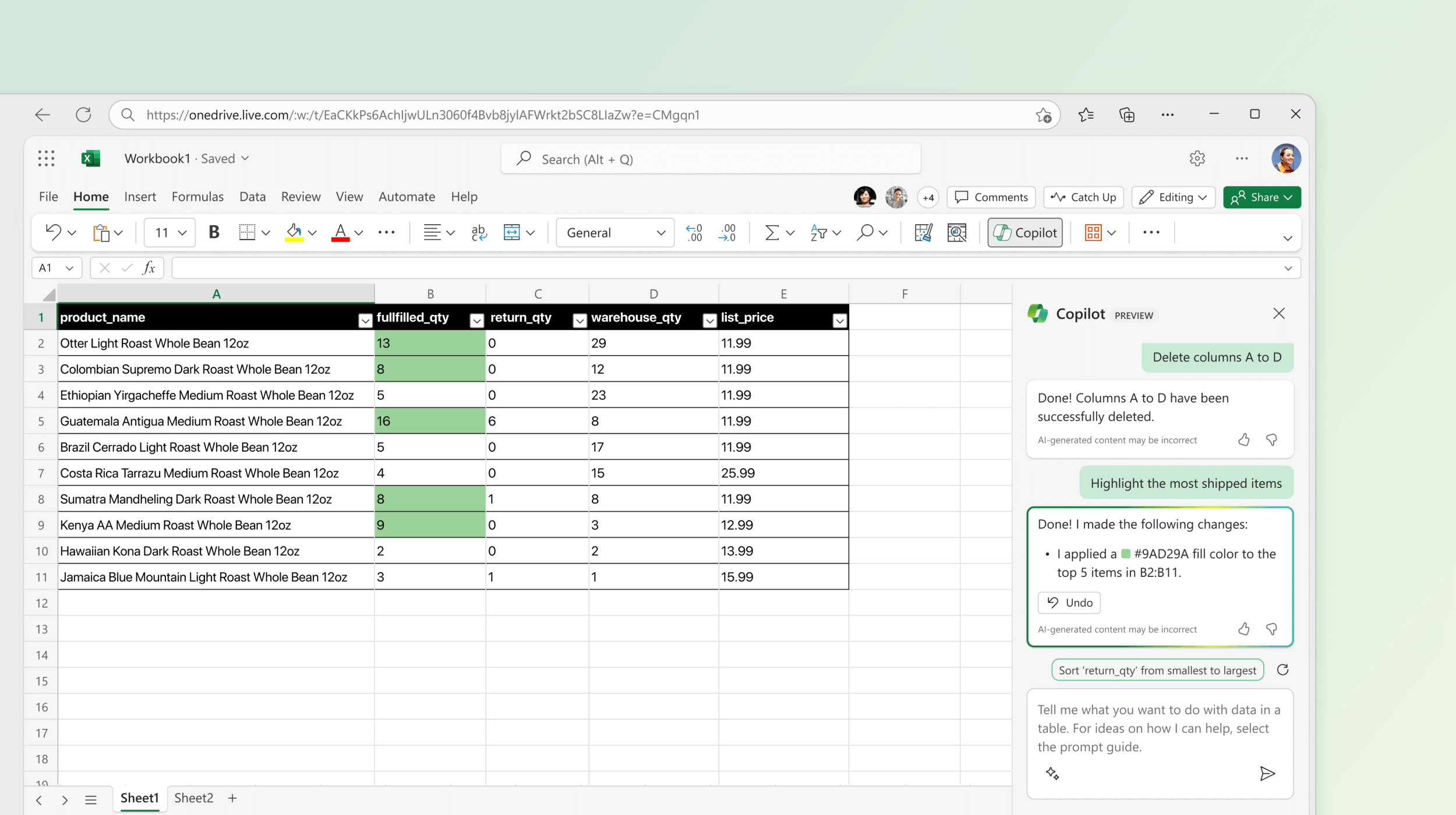

Copilot for Banks integrates into common Office applications such as Outlook, Word, Excel, PowerPoint, Teams, Microsoft 365 Chat, and GitHub. The application spans across a bank so data in multiple calendars, emails, Teams’ messages and documents can be accessed. This tight integration allows bankers to boost productivity, be more accurathave more creativity.

The Benefits of Using Copilot for Banks

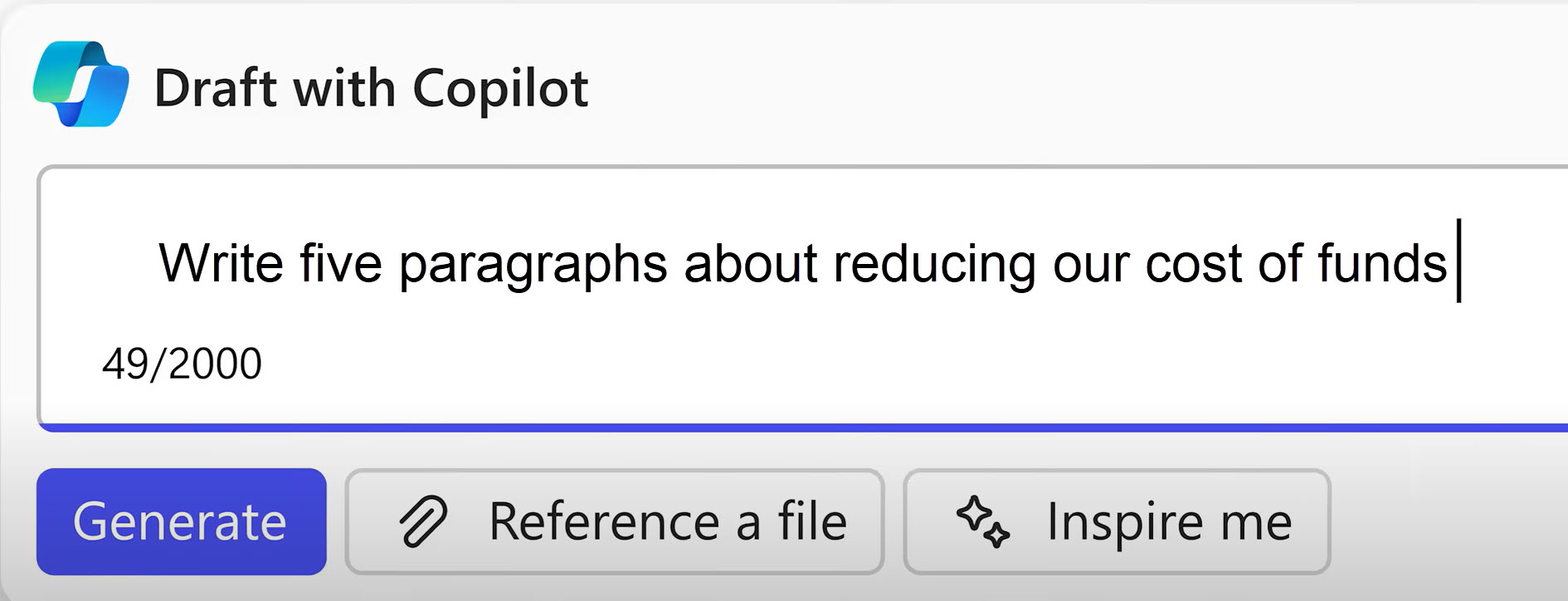

Getting a First Draft, Transformations & Proofing: As many bankers have already come to learn, generative AI is fantastic at solving the “blank page syndrome.” Jump starting a first draft of a policy, business plan, email to a client, spreadsheet or presentation are all examples of tasks that can save bankers multiple hours of work per day. The banker can then refine the document from there, modifying and customizing as necessary. Copilot is also excellent at creating and correcting to near flawless English, in addition to helping a banker tailor their writing to be more or less technical, more sales-oriented, more compelling, or more concise. Transformations can also include changing the text into various languages or personas. You can instantly create a five-slide PowerPoint presentation from email copy or an outline in a Word document.

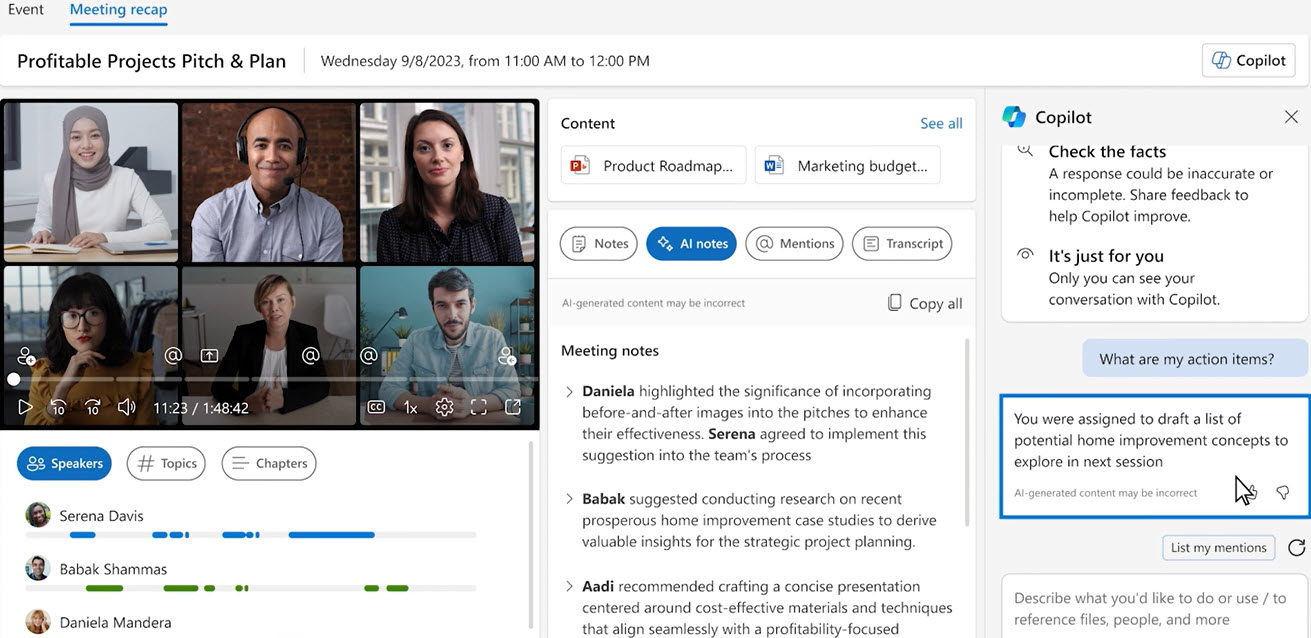

Bank Specific: Since CoPilot for Banks leverages enterprise data, one major advantage the application has over the public version is it can generate text and images specific to a bank’s products and brand. This further boosts productivity, as the application allows for instant creation of PowerPoint presentations using a bank’s templates, imagery, brand colors, and nomenclature. Spreadsheets can also become more standardized by starting them with specific version control, headers, assumption sections, layout, and standardized fields. In one test, for example, we transformed an older spreadsheet into a standardized format and made all the fields ISO 20022 compliant. Bankers can ask Copilot to grab all the new loan originations from its data site, graph them, and correlate them to the 10-year interest rate. If you have a meeting conflict, Outlook will flag the conflict, notify the host of the meeting you will miss, and notify you when a transcript is ready. You can then ask Copilot to summarize the meeting and ask if you have any action items (below).

Function Specific: Interestingly, last week Microsoft announced specific Copilots for Finance, Sales, and Service. These Copilots will not only be Bank-specific but will be function-specific, understanding a bank’s general ledger, accounts receivable, and customer relationship management (CRM) system. That is, Copilot will understand how to calculate net interest margin as well as have integrations into Salesforce, ServiceNow, and Zendesk. CoPilot for Banks can be used to browse and update CRM records in Outlook, then add contacts directly to a CRM.

Data Assimilation: Where CoPilot for Banks shines above ChatGPT and other public products is its ability to synthesize data and intelligence across the bank. Bankers can instruct Copilot to “Summarize all the unread emails I missed since 9am and flag any items requested of me.” Or, our favorite, “Send a Teams’ 30-minute calendar invite for an open spot next week with this title, this agenda and this Word doc.”

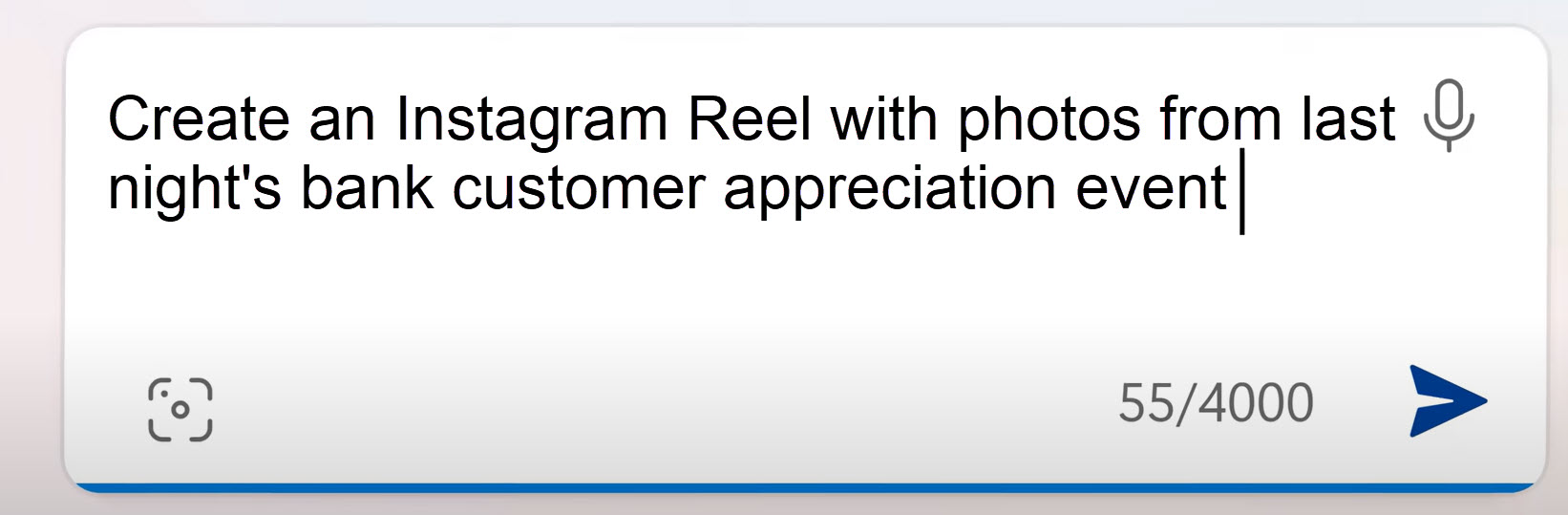

Task Automation: Copilot for Banks is excellent at automating tasks. Creating Instragram posts, removing background from images, summarizing meeting notes and then emailing them to a meeting group can all be automated as an example. Tasks that used to be done with Power Automate can now be driven off prompting so that any banker can save time without knowing the basics of robotics process automation.

Knowledge Enhancement & Generative AI Skills: One unintended consequence which many bank executives do not fully appreciate is the level of new skills and knowledge Copilot for Banks will train on. Using the application every day not only builds generative AI familiarity and skills but also allows the banker to delve more into specific domain expertise such as compliance, as well as various industries, business lines, or products.

7 Steps to CoPilot for Banking Success

Admittedly, Copilot for Banks is still brand new. We are learning here like the rest of the industry. However, after speaking extensively with Microsoft, various consultants, other banks and trying a limited version out on our own, we have the following current advice.

Step 1: Answer 10 Basic Questions Before Starting Copilot for Banks

To prepare for Copilot, banks should be prepared to discuss, and have consensus around, ten critical questions before proceeding with licensing the application. Answers to these questions will vary from bank to bank depending on budgets, sophistication of the workforce, risk tolerance and goals. Some banks may want to only embark on a pilot program to better understand the technology and learn about implementation, while others will want to start with a pilot program and then go “all-in” for every employee.

Below are 10 questions which very bank should answer before moving forward:

- What is our expectation of return given the additional cost?

- How will we calculate and measure this return and over what time horizon will it be done?

- What happens if the bank doesn’t achieve its return?

- Who in the organization should have access to Copilot?

- What training is required?

- Should the bank start with a pilot program and how big should it be?

- Will Copilot be the bank’s primary generative AI tool and how will Copilot change vendor strategies such as generative AI tools from Salesforce, Adobe, document intelligence systems, and other popular bank platforms which have or will have competing generative AI tools built in?

- What additional risks should the bank be monitoring?

- Is there proper AI governance in place to manage the new risks?

- Will you allow your business line “citizen developers” to use GitHub Copilot?

Step 2: Define What a Pilot Program Looks Like

A common approach for banks is to start with a pilot program utilizing a diverse, cross-functional cadre of employees totaling 1% of a bank’s workforce. Diversity is critical here as it is important to understand how Copilot impacts different age groups, experience levels, skill sets, business functions and backgrounds.

A pilot should be designed to achieve two goals: 1) Understand how Copilot impacts preliminary banker productivity; and 2) Learn best practices, including the mitigations of unintended risks, of introducing the technology. Best practices would include considering the ancillary cost of the technology, determining the required support level, assessing the maturity of Copilot before introducing it to staff, identifying the necessary training level, evaluating the policy changes that will be required, and establishing the governance needed to specifically address Copilot.

Pilot teams should establish clear criteria and key performance indicators (KPIs) for program success/failure based on improved value to the employee and the business line.

Step 3: Setting and Communicating Expectations

Given the hype around generative AI, few employees are indifferent as to the technology. While some will fear it, many will crave it. The impact of introducing, or not introducing, Copilot is likely to have a material impact on bank culture and, management should be prepared to have a position on the topic. More specifically, bank executives may want to include the following sample internal messaging points:

- Does the bank plan to introduce Copilot, what is its timing and what does the pilot program look like?

- The bank will adopt a “security and privacy first” approach and needs to test how the various Copilots will be used securely and in a controlled manner.

- A pilot will first focus on the following specific use cases: (e.g. email productivity, spreadsheet assistance, code development productivity, etc.). These use cases are designed to understand Copilot’s largest immediate impact on staff productivity and accuracy.

- Once the bank is confident that it can safely deploy the application, it will take the next step of …

- An acknowledgement that, while Copilot is likely to change job roles and responsibilities, it will likely make the bank more efficient to allow future growth.

- The bank is being thoughtful about its pilot group ensuring a high level of diversification so that the institution can understand how this new technology can influence all employees. The bank looks to actively seek feedback, communicate its findings and to be completely transparent in its plans.

Step 4: Mitigating Risk of Copilot for Banks

As mentioned, while CoPilot inherits Azure’s cloud controls, there are other issues. Banks must still implement controls for AI data protection, privacy, application security and filtering of CoPilot content internally. Banks need to train users to be aware of hallucinatory responses and how to better ground prompts in order to provide more context to improve accuracy. Here, if banks need extra protection, they will have to decide whether to also utilize Microsoft Purview for generative AI trust, risk, and security management (TRiSM) or use third-party applications that are likely not supported.

Another aspect of risk is if a bank wants to allow employees to send feedback to Microsoft on Copilot performance (utilizing the prefabricated thumbs up or thumbs down). If it does, know that prompts and completions can be shared with Microsoft employees. This introduces another risk vector.

Step 5: Centralize Management but with Input

Usually, a bank would place control of Microsoft 365 Copilot with their technology team that handles Microsoft 365 applications. This is still a best practice; however, it is important to realize that this current team may not have the perspective needed for such a paradigm shift in workforce tools. IT teams that manage Copilot for Banks may want to do some or all of the following:

- Form a cross-functional governance team that can advise on access, training, resource management and product development. This team should consider establishing a center of excellence (CoE) led by a product manager.

- Banks should decide how to deal with inactive users. Should banks issue warnings to inactive users, and if so, how many warnings should be given before access is reassigned to another employee? During the pilot, does a bank want a fixed set of testers or does it want to rotate testers every three weeks? Note that it takes about three weeks to become moderately proficient with Copilot.

- A CoE community should allow for employees to share usage tips, experiences, concerns, case studies and techniques. Because banks are at the very early stages of using the technology, new uses and new risks arrive daily. An IT-only team may become overwhelmed communicating all the new uses and risk for the technology, hampering innovation and the safe usage of Copilot.

- A formal collection and reporting procedure should be established to review usage statistics and to aid in increasing adoption and productivity. While a dashboard view is rumored to be in the works by Microsoft, banks should consider collecting and visualizing important data to help manage the platform. In this same vein, the CoE community should formally decide on how and how often it will collect user sentiment and feedback.

- The CoE community should create a path for input outside the governance team in order to collect feedback from areas not represented. Legal, finance, human resources, and branch staff often get left out of the conversation, yet can be some of the largest contributors to establishing best practices.

- Leverage Microsoft Copilot Lab, a centralized website which helps employees . Disseminate this information regularly as it is always evolving.

Step 6: Consider Multiple Pilots

While most banks will conduct a single pilot program for Copilot for Banks, some banks may want to consider multiple pilots, each focusing on different aspects of the product. For example, utilizing Copilot for shared inboxes, which some banks utilize, presents a particular usage and risk challenge. A separate pilot program may just want to focus on this aspect given the complicated needs of the users. Multiple pilots with different project leaders allows for more granularity. The larger the bank, the more they may want to consider multiple pilots.

Step 7: Test Data Integrations

Somewhere in a bank’s evolution with Copilot, the use of various data integrations will want to be tested. These will be in the form of the Semantic Index, various plug-ins, and graph connectors. This will allow Copilot for Banks to not only leverage data natively within a bank’s Office applications but be able to utilize data outside of Microsoft 365. The Semantic Index for Copilot allows for the structuring and context of data at both the bank and user level while Microsoft Graph allows for the connection of data. Here, banks may want to use these tools to leverage core data, retrieve SharePoint documents, use data stored in data warehouses/lakes, or to access other customer data in disparate systems.

There are a whole host of web plug-ins, Power Platform connectors, and Teams message extensions which banks may want to also consider using. For example, a plug-in could let the Copilot for Banks, book travel arrangements, pull market data on interest rates, query a site like Wolfram Alpha to solve an equation, or pull loan data from Klarna, Redfin, Zillow, or other integrations.

Other integrations can connect Copilot Studio which is a low-code development tool for creating custom bank chatbots.

Putting This Into Action

Copilot for banks represents a rare tool which can change the course for a bank. The power of generative AI is strong and cannot be ignored for too long. The fintech lending firm Klarna released a case study of how generative AI has changed the job responsibilities of 700 full-time customer service agents. AI handled 2.3 million customer conversations with 25% better accuracy. Customers’ time-on-task to solve problems dropped from 11 minutes to two minutes. Their generative AI tool speaks 35 languages and operates 24/7/365. Estimated net savings of this effort was calculated by Klarna at $40 million.

We are in the early innings and every bank should consider developing a plan on how and when it will use integrated generative AI technology. Copilot likely represents one of the easiest and safest methods to experiment and deploy.

Banks which don’t want to embark on a formal Copilot effort should consider other ways to test Microsoft generative AI capabilities. Individuals can utilize Microsoft Copilot outside of the Bank’s environment or banks can experiment with particular Copilots, such as Copilot for Teams.

Whatever the decision, banks should be proactive in their decision and not let the decision make itself by ignoring the technology. It is estimated bankers can increase productivity by 20% or more. If that is the case, a bank which utilizes Copilot could have a material efficiency and cost advantage against banks that doesn’t use the technology. If a 20% advantage is realized, that is enough to make a greater number of potential acquisitions currently accretive in less than two years. This is to say, this single technology is enough to drive the future path of banking.