Tommaso Aquilante, David Bholat, Andreas Joseph, Riccardo M Masolo, Tim Munday and David van Dijcke

Background

Covid-19 (Covid) has had heterogeneous effects on different groups of people. For example, it’s had larger negative impacts on contact-intense occupations (Leibovici, Santacreu and Famiglietti (2020)), low wage earners (Joyce and Xu (2020)) and low-income households (Surico, Känzig and Hacioglu (2020) and Chetty et al (2020)). In this blog, we show that UK listed firms have been heterogeneously impacted too (compare Hassan et al (2020); Griffith, Levell and Stroud (2020)). Surprisingly, small firms’ stock prices have been more resilient on average. Or, to put it differently, being bigger hasn’t been better for firms during the pandemic. However, being big with a modern tilt towards intangibles turned out to be beneficial too.

A striking observation

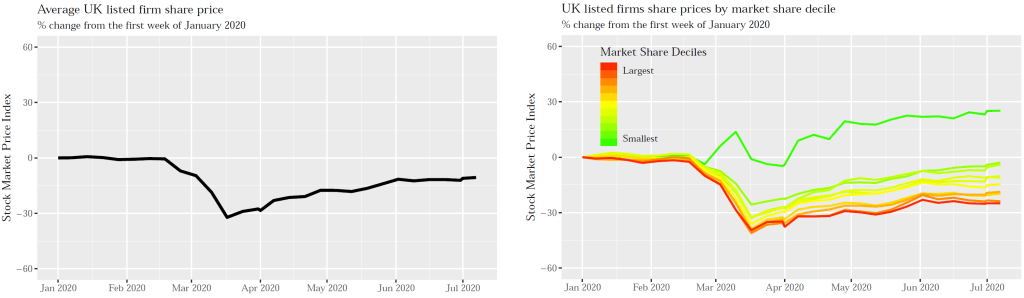

In the UK, the average stock price of listed firms experienced a sharp fall in response to Covid followed by a slow but steady recovery between March and July 2020 (Figure 1 left-hand panel). However, looking at average stock prices masks important heterogeneity; larger firms saw weaker recoveries than small ones (Figure 1 right-hand panel). Here we measure firm size primarily using a firm’s product market share, i.e. the sales of a given firm as a proportion of total sales in its industry. But we observe the same patterns when using stock market capitalisation or the number of employees as proxies of firm size. However defined, larger firms saw weaker recoveries than their smaller counterparts.

We also find this inverse relationship between the strength of the post-Covid equity price recovery and firm size across the economy. Figure 2 shows a stronger recovery for smaller firms in all sectors except agriculture, fishing and forestry.

Figure 1: UK listed firm stock prices during 2020

This is surprising. Firms with larger market share might be imagined to have had revenue streams and profit margins more resilient to the Covid crisis than smaller competitors. They might also have greater market power vis-à-vis suppliers to renegotiate input costs. And larger firms might find it easier to access credit from financial institutions (Cenni et al (2015)). Historically, firms with larger market share have also outperformed those with smaller market share on a range of book and market-based measures (Edeling and Himme (2018)).

Is small beautiful, and is there something else too?

To shed light on what might be driving the pattern observed in Figures 1 and 2, we looked at a series of models to better understand the relationship between firm size and equity prices. In particular, we investigated the relationship between the firm-specific equity price recovery, defined as the increase from its equity price trough after the initial ‘Covid shock’ in March 2020, to the subsequent peak until end of June 2020, on a series of firm characteristics.

Figure 2: Sectoral product market share quartiles and stock market performance

We included measures of balance sheet leverage and liquidity; the historical comovement of a firm’s stock price with the market; foreign sales as a proportion of total sales (to control for the possible impact of foreign exchange price movements); and the effect of intangibles like software, patents, brands and human capital, as a share of total assets (intangible intensity). We also account for sectoral effects.

The results are summarised in Figure 3, which shows the coefficients of our regression model for explaining a firm’s equity price recovery after the Covid shock. Effects which can be robustly differentiated from zero, i.e. where the whiskers on the bars do not overlap with the zero line, are highlighted in red. Strikingly, the strength of the price recovery was still weaker among large firms, even after controlling for these variables, as can be seen from the left most bar which represents the effect of firm size. More specifically, we find that a one standard deviation in log product market share is associated with a 0.1 standard deviation decline in the log equity price recovery. This means, for example, that the recovery in the equity price of a firm in the 95th percentile (by product market share) was, on average, 9% lower than the median firm.

We also find that firms had stronger recoveries if they had higher cash to total asset ratios; earn a greater proportion of their revenue abroad; and historically have had stock prices that move in line with the wider market, as measured by their equity beta. The first of these findings supports recent research by Joseph et al (2019), who find that firms who entered the crisis of 2007/08 with more cash performed better after the crisis than their cash poorer peers.

Moreover, even though previous studies have shown that UK smaller listed firms are more intangible-intensive than larger ones (Haskel (2020)), larger shares of intangible assets seem to play no role in explaining the behaviour of equity prices during the pandemic (second bar from the right in Figure 3). However, intangible-intensive firms with larger market shares fared much better than smaller ones, as can be seen in the right most bar, which shows the combined effect of the firm size and its intensity in intangible assets (labelled II below).

We can think of this as the ‘Netflix effect’. The demand for entertainment is unlikely to have changed during the pandemic and indeed may have increased. However, physical entertainment venues such as cinemas, theatres and museums have had to close. By contrast, large streaming platforms like Netflix can expand their operations serving more customers at minimal marginal costs due to the scalability of intangible assets; it costs Netflix little to provide a movie to one or thousands more customers. This may also explain why its share price grew by more than 50% during our study period (though not in our sample of firms). More generally, firms with higher shares of intangibles may be more agile than those with capital fixed in physical space.

Figure 3: Effect on equity price recovery (trough to peak) of firm characteristics

Discussion

Our analysis comes with several caveats. For example, equity prices are not always a true reflection of the state of a firm. Market microstructure, liquidity issues and other phenomena can push the equity price of firms away from fundamentals. Even so, our analysis helps us understand how the stock prices of UK firms responded differentially during the pandemic. The cross-sectional nature of the analysis and data limitations leave many questions unanswered and several mechanisms unexplored.

Possible venues for further investigation include a finer characterisation of firms’ exposure to foreign markets as well as the roles of intangibles in shaping corporate agility. In particular, smaller firms are more domestically focused than larger ones on average. Imports and the trading network in which firms are embedded crucially shape how they are affected by global disruptions such as Covid.

Finally, large firms are increasingly organised in highly complex (business) groups (Altomonte, Ottaviano and Rungi (2018)). The operational efficiency of these groups crucially hinges on the degree of decentralisation of managerial decisions, with more decentralised firms being more recession-proof (Aghion et al (2017)). To that extent that investors consider firms managerial practices as an intangible asset (see Damodaran (2012)), their degree of management decentralisation could help explain the differential effects in equity prices between small and large firms.

Despite the fact that our rather coarse-grained analysis only focuses on the tiny, but influential, group of listed firms in an advanced economy, our results may be indicative for deeper changes in the economy related to firm size and business models. For instance, our results point to the resilience of smaller, potentially more specialised, firms to large shocks, while larger firms concentrating on scalable ‘intangible activities’ fared well too. Understanding these differentiated reactions and to generalise them from the rather particular impact of a pandemic provides a rich set of questions for future research.

Tommaso Aquilante works in the Bank’s Structural Economics Division, David Bholat and Andreas Joseph work in the Bank’s Advanced Analytics Division, Riccardo M Masolo works in the Bank’s Monetary Policy Outlook Division, Tim Munday works at Oxford University and David van Dijcke works at the University of Michigan.

If you want to get in touch, please email us at bankunderground@bankofengland.co.uk or leave a comment below.

Comments will only appear once approved by a moderator, and are only published where a full name is supplied. Bank Underground is a blog for Bank of England staff to share views that challenge – or support – prevailing policy orthodoxies. The views expressed here are those of the authors, and are not necessarily those of the Bank of England, or its policy committees.