Drive treasury and capitalize on fintech rise

Accenture

DECEMBER 19, 2022

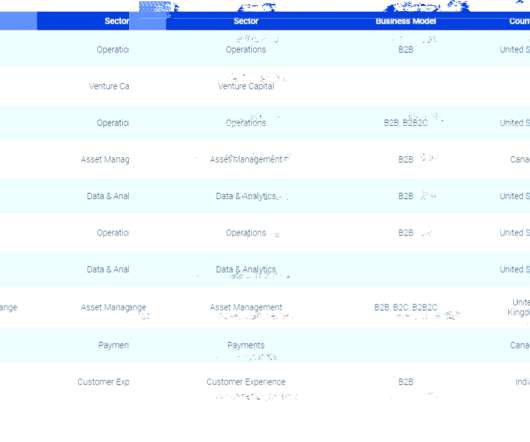

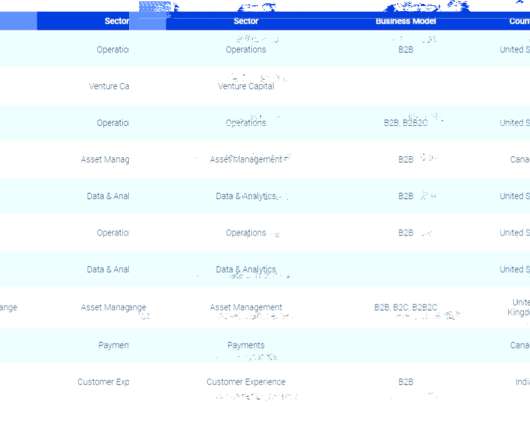

The post Drive treasury and capitalize on fintech rise appeared first on Accenture Banking Blog. Accenture conducted a survey of over 300 US businesses about their treasury functions, and the findings in our new report, “Unlock the treasury management treasure chest,” will be of particular….

Let's personalize your content