Solve This Problem with Your Strategic Horizon

When it comes to bank planning, your strategic horizon has a huge influence on your success. Recently, we published a piece urging banks to set their strategic planning horizon out longer (HERE). We were inundated with questions and opinions. Our overarching point was that banks underperform, in part, because their strategic planning time horizon is too short. In this article, we want to go deeper to show how by increasing your planning horizon, you can increase your long-term performance.

Focusing on the Right Aspects of Strategy

If you look at the sensitivity in a bank’s budget, $1 of investment in a new line of business usually doesn’t break even for two to three years. $1 invested in finding a new customer usually returns about 9% for a consumer customer. That same $1 investment can return 16% for a commercial customer. That $1 invested in a new product to an existing customer base is usually above 20%. This all compares to about a 40%+ return invested in improving processes (loan, branch, cash management, etc.) and about an 80%+ return spent on reducing customer churn, increasing lifetime value and/or helping cross-sell. In comparison, investments in new technology or new business lines pale in comparison to other strategic investments due to the time and effort it takes to get a business line off the ground. If you are a typical banker and you agree with the above, then your conclusion will likely be that 2025 should be spent focusing on your core business. This, however, could be a mistake.

Strategic Horizon and Capital

As mentioned, the problem that bank’s often run into when it comes to strategic planning is their time horizon is too short. Many CEOs will argue that there is no way for them to see past a year or three years, so why forecast? It is a rare CEO that insists his or her team go five years and very few of our fellow banks go out ten years. Under a short time, horizon, all the above return estimates hold. However, if you look at a longer horizon, the picture changes.

Switch out your core, moving to real-time payments, creating a developer portal, building a data warehouse, creating an orchestration/workflow layer for products, and consolidating your multiple commercial banking applications are just some of the projects that will likely return less than 0% over the next one to three years but if you don’t do them will likely result in forcing your bank to sell to a bank that has done the hard work. Bank management should, of course, strive to increase cash flow as soon as possible. After all, a dollar today is worth more than a dollar tomorrow. If you don’t make money this quarter, you may not have the luxury of pursuing tomorrow’s dream. However, this, of course, is a balancing act, and not making a long-term investment is likely to be the riskiest move a bank can make.

Matching The Implied Duration of Capital to Your Strategic Horizon

Whether you want to admit it or not, your bank has a finite life – a life that seems to be getting shorter considering the current environment. Demographics shift, products change and technology drives channel preferences. Despite what each of us says about service, the reality is that our people and our location has been our only sustainable competitive advantage. Now, with customers, and relationship managers switching banks at one of the highest rates, banks need to adapt to remain relevant. The bank that will be around in the next 50 years will be one that develops the ability to build infrastructure now that allows for efficient innovation in the future. New products, new business lines and new ideas will drive long-term value and many banks are hindered by their technology and reliance on their core systems. As a result, the strategy and strategic planning horizon of many banks is the same as their core system providers.

Making a strategic investment in culture is one of the best things a bank can do to ingrain innovation in their team’s DNA, ensuring that “Research & Development” is a budgetary line item and a discipline that gets a board-level view. Risk management also needs to change. If your duration is too long or your BSA compliance is weak, those aren’t good things, but that is not how the bank is going to fail. Finding your bank tied to a rural area that is decreasing in size and profitable demographics is your bigger risk. Having commoditized products remains one of the largest threats in banking. These big risks are what banks need to organize around.

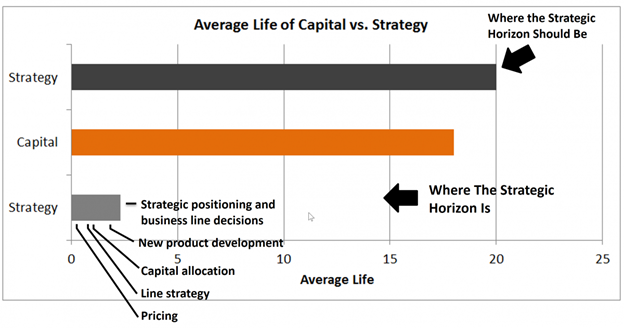

The fundamental problem is a bank’s implied average life of capital is long, some 18+ years, but their strategic horizon is too short – likely under three years. Your capital is likely in it for the long why shouldn’t your strategy match?

Banks need to evaluate new technology, new lending areas, and new cash management levels to name a few with a longer time horizon and with some process rigor. Today’s R&D investments are tomorrow’s businesses. Bank management must start to focus what initiatives they want to start in 2025. Just as you have a portfolio of credits, you need a diversified set of business lines, business models, R&D investments, and an average life of strategic initiatives to ensure a profitable future.

Strategy Is About Choices – Blockbuster

If your strategic plan operates under the common theory “more but better,” then you likely have more strategic risk than you know. Your strategic planning process is flawed. Increasing loans by 7%, providing a better customer experience or growing deposits is far from strategic. This type of exercise is planning, not strategic planning.

While Blockbuster was investing in marketing and cost-cutting, Netflix agreed to have lower earnings and made an investment in video streaming. Blockbuster produced near-record traffic at 3.5mm customers and revenue of around $5B in 2008 only to see both drop to near-zero by 2010 when it had to declare bankruptcy. The management of Blockbuster was looking one year out while the management of Netflix was looking 20 years out.

Innovation Is More Than Technology

Another great lesson in setting your strategic horizon comes from Polaroid. They had the right innovation process but the wrong strategic process.

Few companies were more innovative. Polaroid held over 500 patents and dominated the shift from chemical film development to instant picture development. In 1989, they correctly predicted the shift to digital imaging and was one of the first companies to develop a sensor that could render a one-million-pixel digital image. While their innovation labs were cutting edge, their management was not. Polaroid made all their money on selling instant film and in 1990 had a strategic planning session where they agreed to conduct more market research. Polaroid brought in a consultant and surveyed their customers in focus groups. Their customers, not understanding digital imaging, told Polaroid they wanted cheaper cameras and cameras that “were more fun.” The consultant, also recommended they go after a younger demographic as Polaroid’s current average age was getting older. The company decided to keep its business model and incrementally amend its product line up.

Polaroid produced a series of disposable cameras and cameras that appealed to a younger demographic (below). Sales for these efforts increased. Not wanting to further dilute earnings, management sold its digital imaging group to MIT in 1993. By 2001, Polaroid was out of business.

In other words, Polaroid went out of business focusing on the short-term, listening to their customer and focusing on their core competency. The next time you work on your strengths, weaknesses, opportunities and threats (SWOT) analysis, think about Polaroid.

Then consider the fact that in the late 1800s there were 40 major buggy whip manufacturers. The U.S. Whip Company had the largest market share with the most efficient operations. Do you remember them? Doubtful. Despite the introduction of the Model T in 1908, U.S. Whip still focused on grabbing market share and did so until failure was eminent in 1925. Meanwhile, Westfield Whip Manufacturing took the same technology but saw change coming in 1910. They adapted and focused on equestrian sports in early 1915 where it still survives today.

Putting This Into Action

The pace of disruptive change in banking is going to be greater than ever and will pick up speed. Ensure that you are building a culture of innovation (at some level), have a formalized innovation process and allocate the proper level of resources to the strategic effort. Make sure your planning horizon is out long enough, at least for some investments, in order to accomplish what is hard. Understand that innovation is not about technology, but about adapting to market conditions.

Finally, make sure your strategic decisions are formed around trade-offs and that you have intent behind your decisions. Looking out longer and adopting the tools for innovation will prevent future disruptive change from having a cataclysmic impact on your bank.