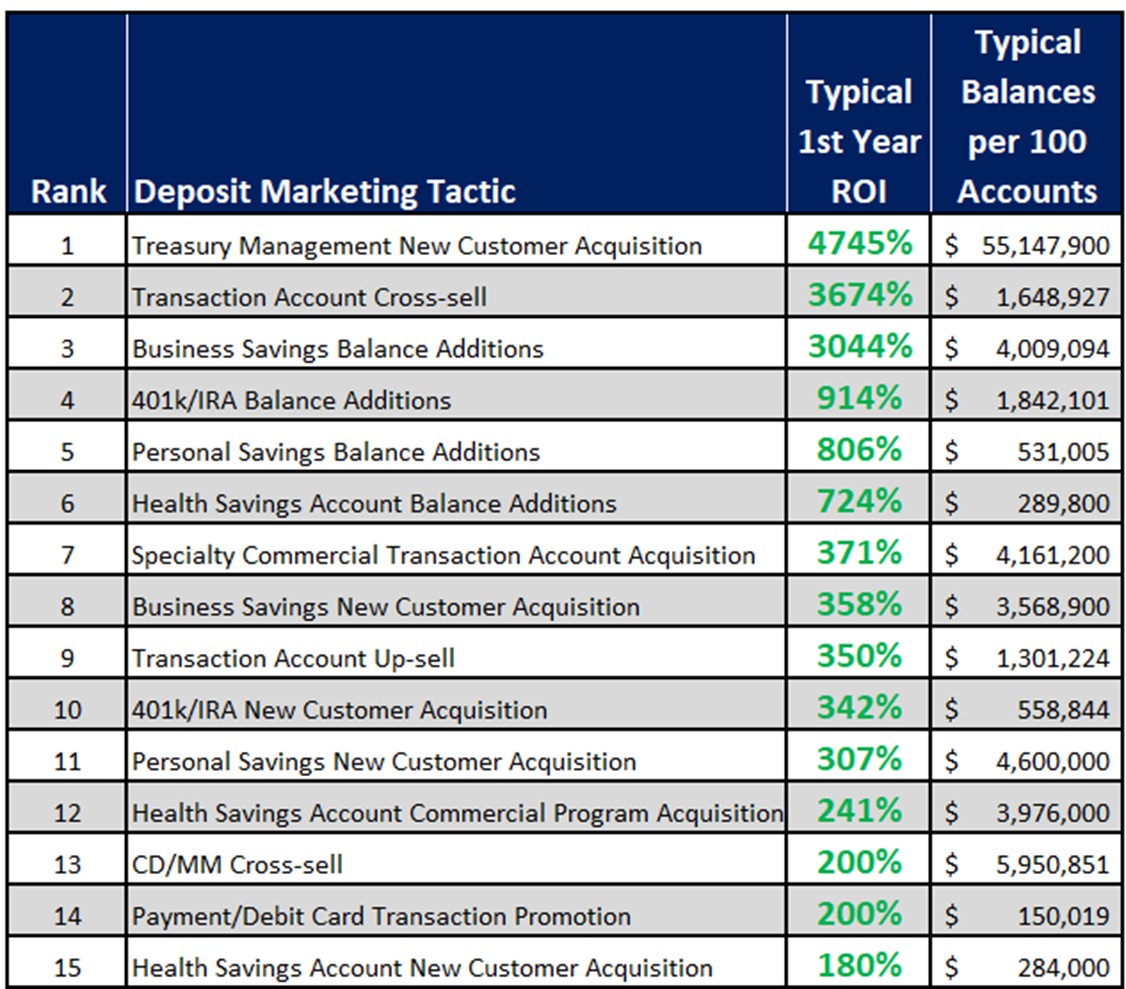

Here Are 15 of the Best Deposit Marketing Campaigns Ranked

If you want to grab a material amount of new deposit balance, offer a 5.05% money market rate, post it all over Instagram, and sit back and watch the money roll in. This approach has many problems, the first of which is a negative return on your investment (ROI). You will also end up cannibalizing existing balances, training customers/employees to be rate-sensitive, and you will be forced to spend more to keep those customers from walking out the door. The approach is a mess, yet it is done every day in banking. In this article, we will show you 15 proven deposit marketing campaigns that will rack up deposit-gathering wins while building a high-performing bank in the process.

Honing Your Banking Skills – Don’t Be Lazy

If you need large balances quickly, use brokered CDs, FHLB advances, or other wholesale channels to protect your customer base. There will be a tendency to say that you would rather pay your customers a high rate on their deposits through wholesale channels. While that might be true for SOFR minus 2% or less, it is not true for anything more expensive than SOFR minus 1% or more. Having to pay near SOFR rates will give you a false sense of security, cost you more in the long run, and slowly erode franchise value.

Proper deposit gathering is about doing a lot of little things right. It is about consistently creating products that engage customers and marketing existing deposit products using anything but rate.

Using the ten ideas below will hone your skills, give your bank valuable experience, and help educate the next generation of bankers within your bank. You will gather the data to help you make better deposit product and pricing decisions in the future, all while building franchise value the quickest way possible.

Don’t Cut Your Marketing Budget Next Year

There will also be a tendency to believe that because your margins will be less next year, you need to save operating expenses, which means budget cuts for marketing. Your margins are contracting this year because you are already NOT spending enough on marketing. Cutting the marketing budget will likely compound margin problems.

Marketing is one of the largest value drivers in banking. Where else can you get consistent triple-digit ROIs? You can’t get ten triple-digit project ROIs in a row in lending, credit, mortgage, wealth, insurance, or several other areas. Maybe technology and maybe fraud, but other than that, it is hard to duplicate that success rate. Marketing can.

Chances are you have already invested in digital account opening, which provides a channel to promote and acquire new customers quickly. Leverage payment capabilities to easily allow existing customers to consolidate more funds into your bank. Use creativity to boost engagement and drive ROI.

If you say you can’t measure the ROI in marketing, that is another problem. You likely can’t measure your ROI because you have not invested in marketing enough to manage it. Consider that many banks have one person in their marketing department, and then they task that person with managing events, merchandise, and brand building. While all of that might be important, what is more important is keeping and acquiring profitable customers. You can do this with small wins.

Proven Deposit Marketing Campaigns

Forget running an extensive marketing campaign to gather deposits. Instead, focus on a series of small wins. Building consistent balances across the organization is the path to more significant margins and better deposit performance in the future. The emphasis should be on cross-selling that will aid in retention, build customer satisfaction, and, in the process, build employee satisfaction as they support the customer.

Below are ten simple marketing campaigns that cost little, have ROIs over 100%, and are relatively easy to execute. Note that not one of these campaigns is primarily about rate. While all these campaigns can be automated, they should also be included in your bank’s most important customers’ annual, semi-annual, or quarterly personal customer checkups. That is, don’t underestimate a consistent face-to-face sales effort.

These ideas come from our experience, database, and the analytics of the Infusion Marketing Group, one of the few bank marketing firms that understands deposit building at its core. They only get paid for producing results, so this team is a very effective and motivated group.

Most of these campaigns revolve around an email drip campaign, digital advertising, retargeting, social media, podcasts/video, and print.

Before we explain each deposit marketing campaign above, it is critical to understand that for ease of computation, we only included the first full year of net operating profit in return, as the lifetime value return is 3x to 10x the first-year ROI. Further, we have also included “halo” or additional accounts/balances that come with the marketing campaign. That is, market a health savings account, and a certain number of targeted customers are also likely to open a savings account with you as well.

Treasury Management: This is our favorite campaign. We wrote about treasury management HERE and provided the best clients to target HERE. This effort includes both targeting existing customers to cross-sell treasury management and conducting a new customer campaign. There are few better customers to acquire and retain than treasury management. These are engaged customers with larger balances that generate an above-average level of fees. While acquisition through email, print, digital, and in-person calling is expensive compared to the rest of the marketing campaigns on this list, the return is enormous. It is shocking the relatively small number of banks that have a consistent digital marketing effort around treasury management.

Transaction Account Cross-sell: This tactic looks at all your single product customers and cross-sells a companion transaction account. If you are a typical bank, you likely have 30% of your accounts with a single product. This is banking 101, but it is not done enough and not done consistently. While bankers are good at trying to cross-sell at the start of the relationship, where many fall down is going back and asking for additional accounts and balances after the bank has “proven” itself. Start with loan customers to sell them a transaction account and then sell savings accounts to transaction account customers and keep going from there. Also, look at all your small business accounts and ensure you have the owners’ personal accounts. If you are going to use one deposit marketing campaign, make sure you are consistent with this tactic.

Business Savings: If you are looking for the least marketed product in the banking industry, we would submit for your consideration the business savings account. The business savings account is hardly ever marketed or even discussed. Few banks purchase the keyword, and fewer even produce organic content about the importance of businesses establishing an emergency reserve account funded by six months of operating expenses. With minimal effort, a community bank can rank at the top of the Google search page, where they would gain visibility from 100 to 1,000 searches per month per state. Build a campaign to acquire new customers or, at a minimum, remind your current customers to save for taxes, incentive compensation, emergencies, or any number of other items. Look for news events such as government shutdowns, tax law changes, or disaster preparedness to amplify your marketing.

401K/IRA Savings: This is another good start of the year campaign as well as for those customers that receive tax refunds in 2Q and 3Q. Remind existing customers via email about the magic of compounding and the importance of being consistent in savings. If you need to increase your deposit rates to attract new funds, this is the product to do it due to the long-term nature of the product and its high lifetime value.

Personal Savings: The customer in this product is a little more rate-sensitive and has a lower lifetime value than a 401k, HSA, or commercial account, but the reality is that most households do not save enough. You likely have a large number of accounts to target. Consumers see savings news monthly, and banks can jump on the media trends to amplify their marketing. The first of the year is a great time to market personal savings, as bank marketing campaigns for this product will see a jump in conversions. The same is true after getting a tax refund or estate windfall. Banks can also conduct promotions to lure bank switches and transfer their savings. Offering to add $600 to transfer an existing savings account of more than $30,000 (the average balance transfer) is a popular and tested campaign.

Health Savings Accounts (HSA): When it comes to deposit marketing campaigns, this has the highest consistent lift year after year. Execute this tactic at the very start of the year and again in the third quarter. Remind existing customers via email and text to add to their HSA account balance. Provide giveaways and education here, but never use rate to primarily market. These customers are driven by convenience and the tax advantage nature of this account. This is where you pay customers bonuses to open and fund accounts for new customer acquisition campaigns. Market programs to small business and commercial customers to provide to their employees.

Specialty Commercial Account: There is an array of specialty industries that rarely, if ever, has received any type of marketing from a bank that understands them – food manufacturers, bottle distributors, college athletic collectives, video game creators, utilities, ad agencies, youth sports leagues, political campaigns, and thousands of others. Each of these industries has needs that likely are not being fulfilled by their local banker. Contract some expertise, make some product tweaks, and create targeted marketing. With the growing popularity of instant payments, banks with those capabilities have an easy way in. Understanding cash flow cycles, tax reporting, international payments, or capital requirements is usually enough to have a standout product.

Payments: Get your customers to use more payment products, and you will see more bank engagement and more deposit balances. While the deposit balance lift is small on a per-account basis, it pertains to many accounts and helps build a lot of small balances. Being able to offer instant payments will be the key driver in the future. For now, you can cross-market ACH services for small business and commercial accounts and debit cards for retail accounts.

Other Deposit Marketing Campaign Tactics

High Balance Targeting: This is a favorite of the Infusion Marketing Group, and it rings true. There is a tendency to look at your best customers, see high deposit balances, and assume you are one of their primary banks. While that could be true, the chances are that if they have high balances with you, they also have high balances at another bank. You can lure those deposits over by asking, providing superior service, or having a superior product. Targeting customers at certain banks utilizing third-party data (either purchased or for banks using Plaid, Boss Insights, etc.), geotargeting mobile ads at competitors’ branches, or figuring out intent through webinars/financial education are just some tactics to execute around this strategy. Apply this tactic to any of the additional balance tactics above to turbocharge your effort.

Audience, Not Channel: While we have discussed channels, one reminder that the folks at Infusion consistently preach – while you are marketing to a channel, to be effective, you need to market to an audience. Taking time to understand the target customer’s persona, motivation, and intent is critical. Build each of your deposit marketing campaigns around the persona, not the product or channel.

Recency: Another favorite of the Infusion Marketing Group – Use quality customer service successes as an opportunity to cross-sell deposit products. For example, after a successful onboarding, loan origination, or problem solution, customers are more open to consolidating balances from other banks to your bank. Training employees to cross-sell at these “moments of success” can increase conversions and jump balances.

Putting This Into Action

When it comes to effective deposit gathering, a consistent marketing effort is the foundation of success. The programs outlined above, and others like it, should be running in the background throughout the year, from January through mid-November. Existing customers should be targeted to build balances, while prospects should be targeted for new customer acquisition.

Before you raise your money market rates, grant deposit pricing exceptions, or run that CD special, do the marketing basics first. These 15 deposit marketing campaigns will help generate lower-cost deposits. You may not gather large deposit balances as you would in a 5% CD offering, but you will slowly build a much more valuable customer base while honing your marketing skills and gathering data.