What Relationship Pricing Means for Bank Performance

Many banks pride themselves on superior customer service, and approximately 90% of all community banks believe that they provide an above-average level of customer service (the math cannot work that way). The reason bankers should want to provide an above-average level of service is to increase profitability, which translates to charging customers more in the form of higher loan rates, lower deposit rates, and more charged fees. However, historically very few US banks have been able to consistently provide a level of service that translates to higher profitability. There are several ways for bank managers to address this issue and better align relationship pricing with bank profitability.

The Issue with Relationship Pricing and Profitability

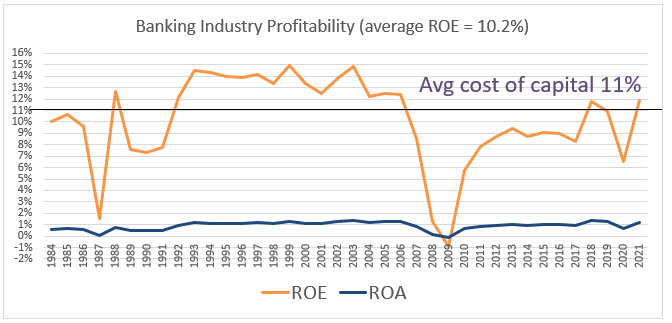

The US banking industry has been unable to consistently earn a return on capital equal to its average cost (approximately 11% over the last few decades). The graph below shows the industry ROE and ROA from 1984 to 2021. Further problematic for the banking industry is the volatility of returns, and in the last 37 years, every recession except one has caused very low or negative ROE.

The real issue for many banks is that managers cannot easily identify and measure the service level or correctly measure granular returns at the customer, product, branch, region, or supervisor level. Until this can be done, bankers cannot discern profitability or the connection between service and profitability.

In the big picture, providing superior service across the entire bank customer base is counterproductive. Service (a scarce resource) must be directed at its highest return. In most industries, 20% of customers account for 80% of profits. But banking is different – at most banks, only 10% of customers account for 120% of profits, and the remaining 90% of the customers subtract profitability from the bank. Therefore, rather than spread customer service resources uniformly, banks must be able to measure relationship profitability for their entire balance sheet, work to retain the most profitable customers, increase return on lower profitable relationships, or lose that business to competition that is better able to serve those relationships.

Banks cannot afford to deliver above-average service across their entire customer base. This is where understanding relationship pricing and profitability help allocate resources. Businesses perform better when they segment relationships based on customer lifetime value ranking and allocate limited services to customers that generate the most profit for the bank.

How to Measure Relationship Pricing and Profitability

In a future blog, we will discuss shareholder value added (SVA) in more detail and how it can be used to measure performance on deposits and loans. However, it is worthwhile giving a brief explanation. Using SVA, banks apply a risk-adjusted return on capital model (RAROC) to calculate the return on economic capital for each relationship, taking into account all products sold for the expected lifetime value of that customer. Banks can then calculate SVA by subtracting their cost of capital from net operating profit after tax for each client. For example, two customers may both show a 20% ROROC for the bank, but customer A has $1mm in loans and $1mm in deposits, while customer B has $10mm in loans and $10mm in deposits. While both customers have the same ROE, customer B has 10X the SVA compared to customer A. Using the SVA methodology, each customer is ranked from highest to lowest in profitability. Banks can then allocate service-based highest potential return for the bank – this is known as customer lifetime value relationship segmentation.

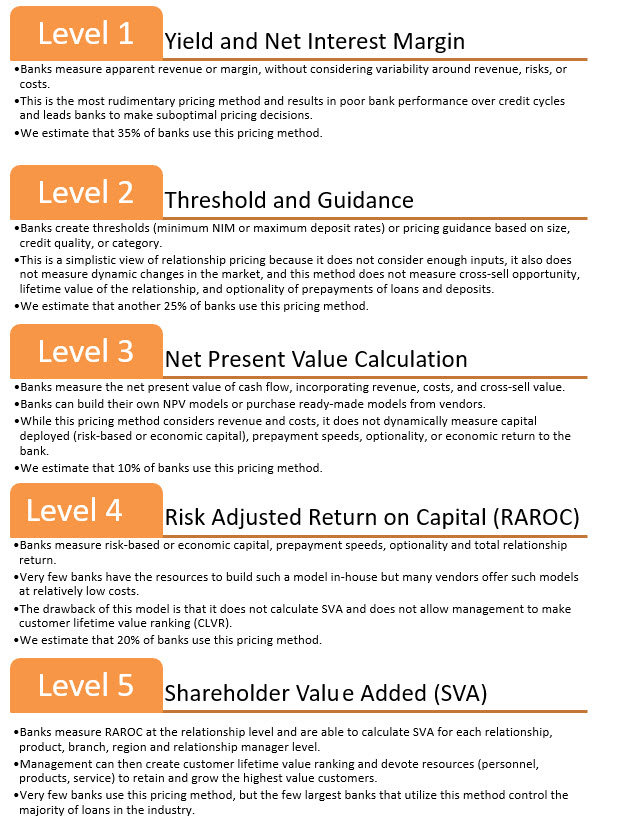

Some banks do not have a tool to accurately measure profitability at the relationship, product, branch, region, or supervisor level. However, banks can develop their tools or purchase pricing models from third-party vendors. Below is a ranking of pricing tools that community banks should consider when assessing their options.

Conclusion

In the current rising interest rate and credit environment, which is expected to last for the near future, banks that can correctly price loans and deposits, rank customer relationships based on profitability and then allocate service resources to harness such relationships will substantially outperform the industry. Larger banks already utilize RAROC and SVA models to address customer issues proactively and offer special client experiences. Understanding relationship pricing and profitability can help banks prioritize resources to allocate credit and capital to where it is most needed. Community banks can develop or purchase resources to price relationships and segment customers based on customer lifetime value ranking. They can also concentrate limited resources and direct services to their most profitable relationships. In a future article, we will address how community banks can use RAROC and SVA to maximize loan and deposit performance.