Strategic Loan Refinancing for Profitability

In an article last week (Here), we discussed how the higher-for-longer interest rate environment will affect the community bank sector. Stable short-term rates for the next year or longer will increase cost of funds (COF), hold yields on loans steady, decrease net interest margin (NIM), and pressure return on equity (ROE) for new credit assets. We argued that community banks must learn to improve performance in a low-growth environment for the foreseeable future. We believe that community banks should focus on the strategic loan refinancing of their most profitable customers to avoid the perils of commercial real estate (CRE) rollover risk coinciding with possible market credit stress.

We believe that there is a powerful strategy that can bolster almost any community bank’s profitability. Community banks can substantially increase ROE by intelligently using internal refinancing, extending existing relationships, and shedding unprofitable current clients. Community banks have tremendous opportunities to improve efficiency ratios, cross-sell to existing top customers, and mitigate rollover risk on CRE credits by focusing on existing relationships.

Profitability Reality at Community Banks

In a recent article (Here), we used CAPM (capital asset pricing model) to calculate community banks’ cost of capital – which we conclude is now 12.50%. Since 1984, the average community bank’s ROE has been 8.55%, and it was 11.13% in the last quarter. Banks that generate new assets that earn less than their cost of capital are diminishing returns for their shareholders and will struggle to remain independent. This is especially important when liquidity is scarce, as it is now. Community banks’ loan-to-core deposit ratio is currently 91.87% – approaching the pre-pandemic level. Most community banks that want to grow loans will need to attribute incremental COF for new sources of liquidity, and that, unfortunately, will pressure core deposit costs since non-core funding dependence (Federal Home Loan Advances and brokered CDs) is reaching its limit for many banks. Using incremental COF methodology results in a much lower ROE, diminishing shareholder value further.

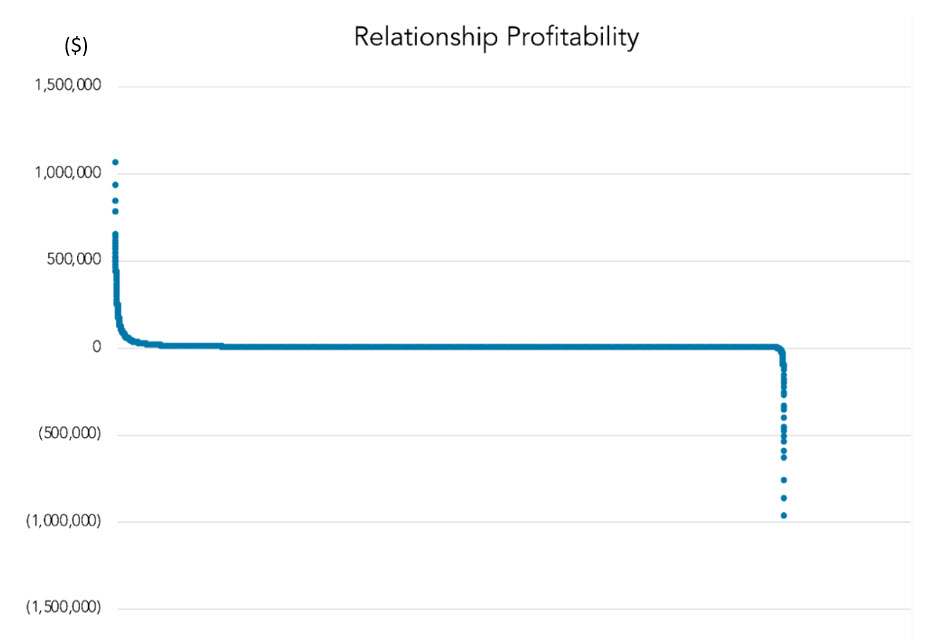

However, viewing a community bank’s balance sheet as a homogenous collection of similar assets and liabilities is a mistake. The average community bank generates all of its profits with just 10% to 20% of its top customers, and the remaining customers generate negative profitability for the bank. PrecisionLender published a working paper, including the graph below, that shows a standard relationship profitability distribution for a bank. The graph shows each relationship at a bank from most profitable (on the left) to least profitable (on the right).

On average, most relationships generate little profit for a bank, a few relationships generate most of the profits, and a few relationships subtract from the bank’s profits. PrecisionLender concludes that the top quartile of profitable customers makes up over 100% of the bank’s profits, and the bottom 75% are unprofitable. This conclusion is not a surprise to us. In a hypothetical scenario, a bank can double or triple its ROE by eliminating its bottom quartile of customers if that action does not affect any other bank parameter. In a low-growth business environment, community banks must focus on retaining, extending, and protecting their most profitable relationships, augmenting profitability on the average relationships, and actively shedding those relationships that cannot be converted to profitability.

How To Retain, Extend, and Protect Top Relationships

This task requires a collective effort coordinated by lenders, underwriters, and executive management. The first step is accepting the premise that borrowers should not allow their contractual debt maturity to become the current portion of long-term debt (12 months to maturity). Further, credit facilities with 12 to 36 months to maturity may make sense for some borrowers to refinance or extend. Some borrowers believe that interest rates will fall because a recession is approaching. However, most market participants (borrowers, lenders, and economists included) cannot predict a recession’s onset, cause, or duration.

Below are the reasons for borrowers to not wait for a recession to refinance their debt:

- No one can predict whether Interest rates may fall in the future. However, the market is already pricing in the probability of a recession, thereby lowering long-term financing costs.

- If interest rates do fall in the future because of a recession, refinancing in a downturn is risky, with unknown project cash flows, uncertain credit availability from banks, and wider credit spreads from most creditors.

- Even if the Fed lowers short-term interest rates in a recession, longer-term credit costs for borrowers do not necessarily decline and, in many instances, go up.

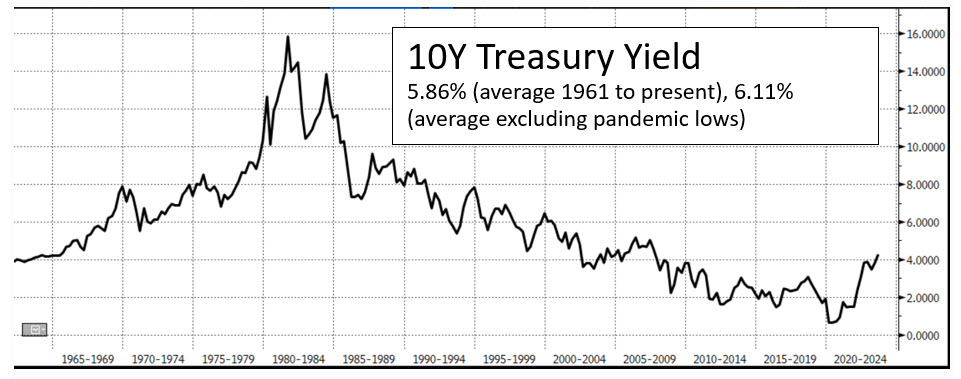

The actual (stated or unstated) reason many borrowers resist refinancing today is the belief that interest rates are too high by historical standards, making current refinancing unattractive. This is an anchoring problem. Interest rates are indeed higher than during the pandemic but are still low by historical averages. The graph below shows the 10-year Treasury yield, a proxy for the base cost of commercial funding. Unless another pandemic is around the corner and monetary policy again pushes interest rates to zero, today’s financing costs are low by historical comparison.

The average community bank’s loan portfolio attrition rate is about 25% to 30% annually. By identifying profitable relationships with up to 36 months to maturity, lenders can enhance the ROE for up to 75% of a community bank’s total relationships. This creates an opportunity to remake the bank’s loan portfolio by cementing profitable relationships, augmenting profits for the average customer, and shedding those relationships that cannot be made profitable.

Lenders must be trusted financial advisors to their customers. Not every borrower will be a suitable candidate for refinancing. To be compelling for a borrower, the internal refinancing or extension may need to accomplish some or all of the following:

- Retain existing favorable market pricing for the remaining maturity on debt but lock in an attractive future starting rate for extended maturity. Or somehow blend the existing and new rates to make the borrower indifferent to pricing.

- Possibly lower existing debt costs or lower debt costs anticipated at the next repricing date.

- Negotiate attractive advance rates, pricing, amortization, and terms before any possible economic downturn.

- Reduce the risk of repricing at a higher rate that diminishes cash flow cushion or requires equity infusion to right-size the loan.

How To Implement Strategic Loan Refinancing

We believe there are ample opportunities for community banks to increase performance through intelligent internal strategic loan refinancing, extending existing relationships, and shedding unprofitable clients. The steps lenders can take to identify these opportunities can be confusing. Most lenders have honed their skills to acquire new business, not mine existing portfolios. At SouthState Bank, we have developed and used a set of procedures, data mining techniques, and template borrower correspondences that we would like to share with our readers in a future article.