Bank Impact of “Higher For Longer” Interest Rate Environment

On September 20, 2023, the Federal Open Market Committee (FOMC) left its benchmark rate unchanged, but it would be a mistake to conclude that the committee did not send a strong message about the projected path of future interest rates. The FOMC revised its view on future projected interest rates – rates will be “higher for longer” or perhaps higher for the foreseeable future. Given this new signal, community banks need to analyze what this interest rate environment means for their business model and how to maximize performance.

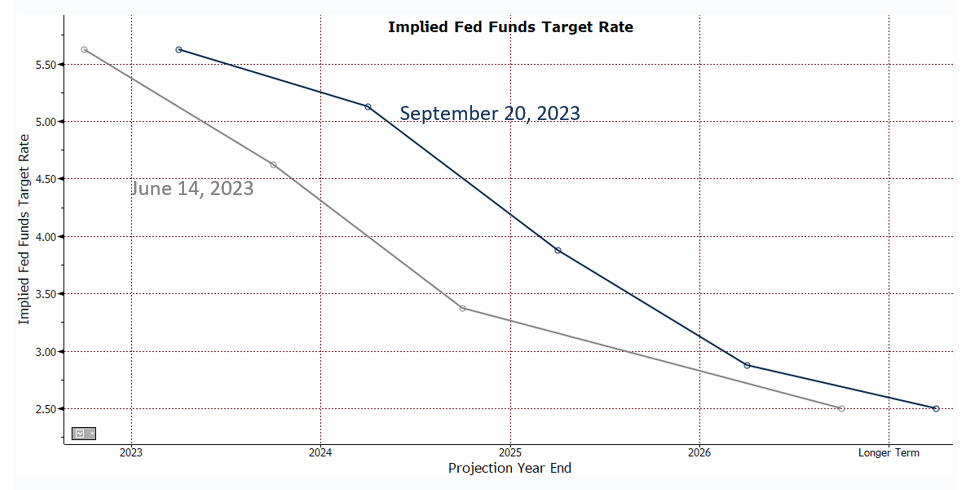

Implied Fed Funds Target Rate

The graph below compares the committee’s median projections for the Fed Funds rate from the June to the September meetings. The committee believes it will raise interest rates one more time in 2023 (an unlikely scenario, in our opinion, but dependent on economic data). Further, the Committee signals that the neutral rate (the rate that keeps inflation and unemployment stable) has risen.

The neutral rate cannot be measured directly but inferred by how the economy responds to a given level of interest rates. In the long run, the neutral rate is a function of long-term, slower-moving forces such as demographics, global demand for capital, debt levels, and investor’s prediction of inflation and risk. The convincing argument that the neutral rate has risen is the current economic and labor market resilience with 5.30% short-term rates. This interest rate environment is such that the majority of FOMC members now expect to keep interest rates near current levels through 2024, and the median of projections imply only one 25bps decrease in 2024.

The key argument for a higher neutral rate is that as federal debt continues to increase above 100% of GDP and federal deficits are projected to keep rising from the current 6% of GDP; it will take higher interest rates to convince investors to hold more debt. The question is how will this interest rate development affect community banks’ performance, and what must community banks do to remain profitable?

Community Bank Performance in This Interest Rate Environment

As the Federal Reserve pauses interest rate increases and keeps rates higher for longer, the following four pressure points will develop for community banks:

- Yield on earning assets will plateau, as already demonstrated in the latest community bank measures, as shown in the graph below. The industry beta on asset yield is high and demonstrates little lag.

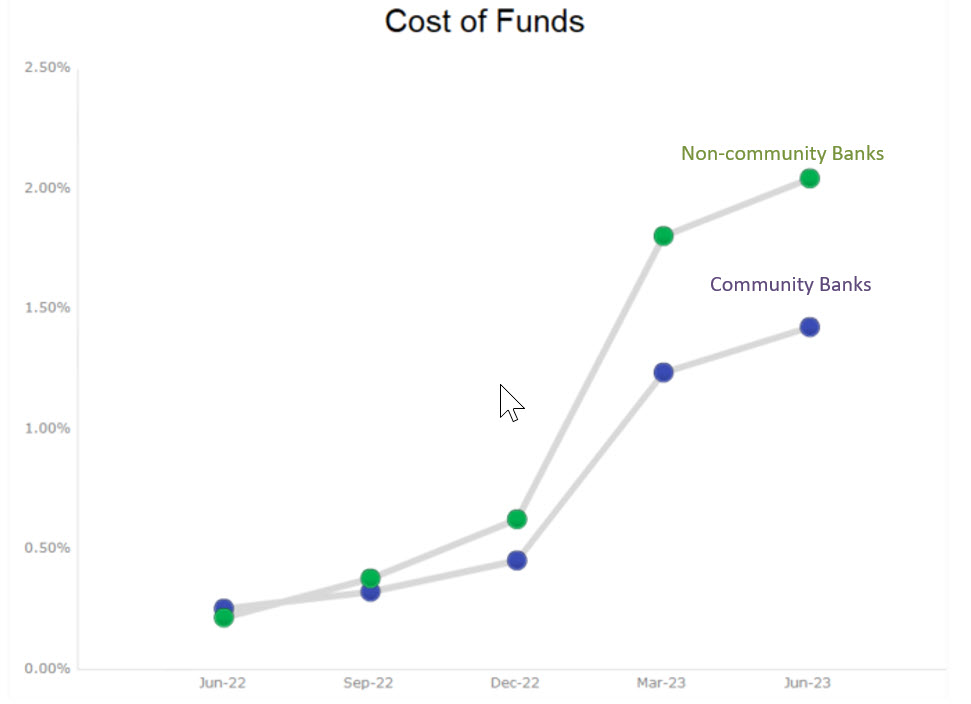

- The cost of funds will continue to rise for community banks and the industry, even as the Federal Reserve pauses rate hikes. S&P Global projects the deposit beta for the industry will hit 0.41 in 2023 and slightly higher in 2024. Three primary factors drive the continued pressure on the cost of funding: a) the lag between interest rate movements and banks’ cost of funding (9 to 12 months), b) the continued liquidity drain from the Federal Reserve’s balance sheet, and c) the large gap between Fed Funds and the industry aggregate cost of deposits. The cost of funds for community banks and non-community banks is shown in the graph below.

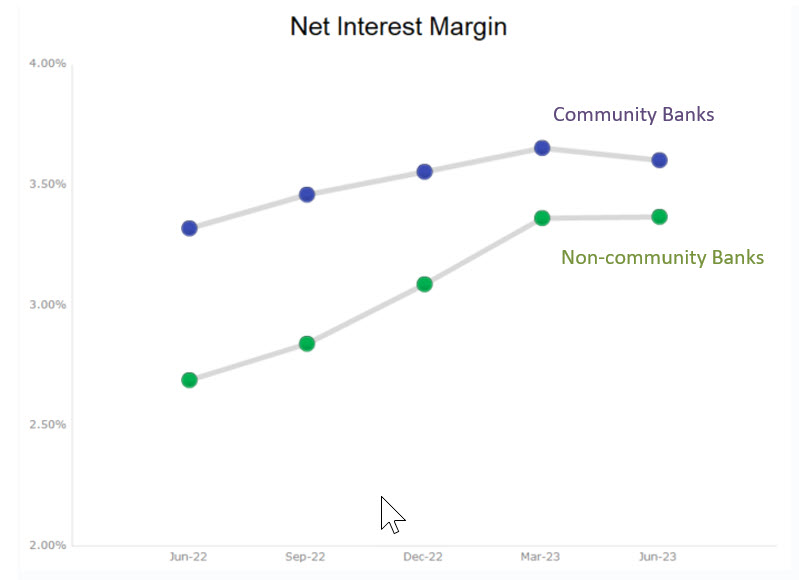

- The results of points two and three above are that community banks will experience net interest margin (NIM) contraction (the primary source of income for community banks). This has already occurred in Q2/23, as shown in the graph below.

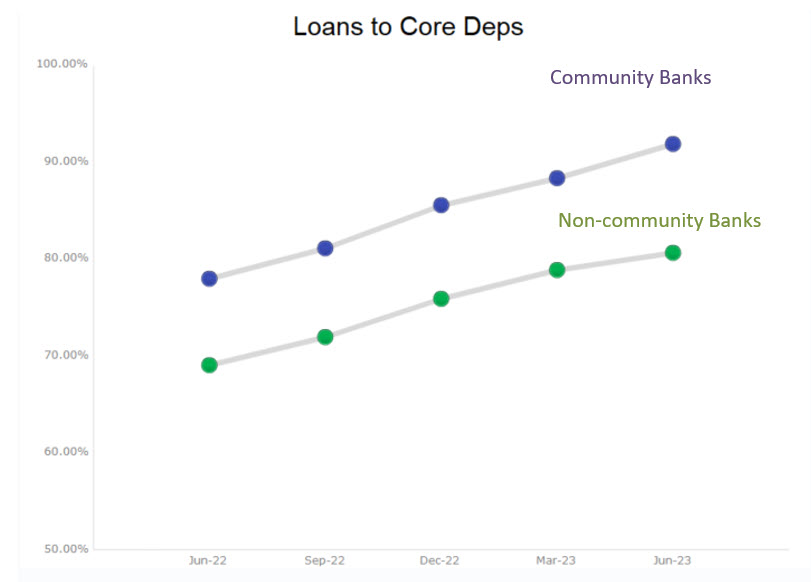

- Future below-industry trend loan growth will be a requirement for community banks as liquidity pressures continue and loan-to-deposit ratios reach their limits. The graph below shows loan-to-core-deposit ratios for community and non-community banks. As new loan volume decreases, banks will be further challenged in replacing lower-yielding loans from 2020 – 2022 with higher-yielding loans today.

Opportunities for Community Banks

Without loan growth, community banks must look for other avenues to bolster profitability. Fortunately, we believe there are ample opportunities for community banks to increase performance in this interest rate environment through the intelligent use of refinancing, extending existing relationships, and shedding unprofitable clients. Community banks have tremendous opportunities to improve efficiency ratios, cross-sell to existing top customers, and mitigate rollover risk on CRE credits, all through a focus on existing clients that can be renewed or restructured into more profitable relationships. We will discuss how this can be achieved in the following few weeks.