How to Set Your Strategic Planning Time Horizon

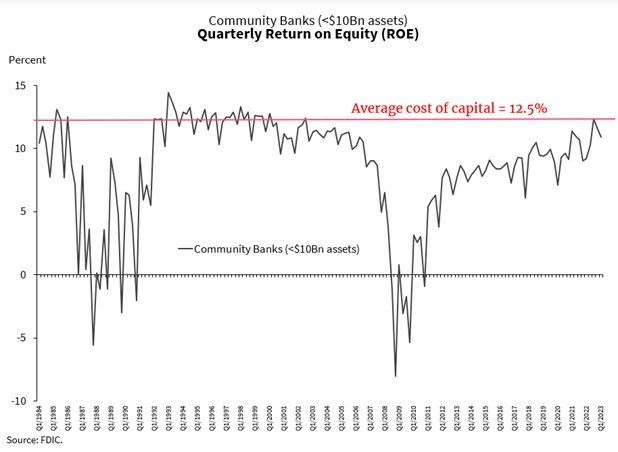

Banks consistently produce under their cost of capital. For example, at present, return on equity performance is about 12% for the average community bank. However, for the average bank, their cost of capital is between 9% and 14% depending on the bank’s equity liquidity with an average of 12.5%. Why is that? One answer is that banks have the wrong strategic planning time horizon.

One Of the Biggest Flaws In Our Industry

From an organizational standpoint, the answer is clear. As an industry, we misallocate capital. We do this in a few ways, but the most egregious and costly way is this:

We make short-term strategic decisions to employ long-term capital.

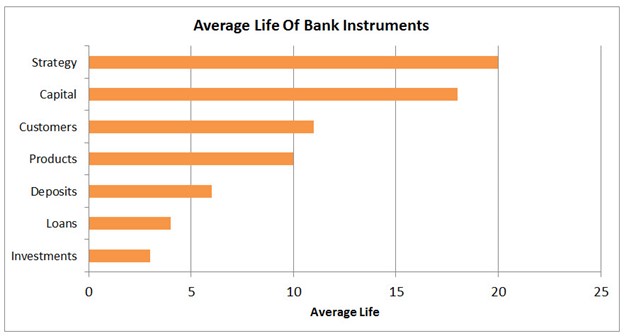

Like every asset or liability, a bank’s capital, which is largely equity, has a duration, a convexity, and an average life. Compared to investments, loans, deposits, and fees, capital is magical when it comes to these properties. The implied effective duration for the average bank equity position is between 10 and 25. The most amazing aspect is that the faster and more efficiently a bank grows, the higher the duration is and the longer the average life is. Yet, we squander this magic.

The Strategic Planning Time Horizon Mismatch

Consider that about 70% of banks only do a three-year strategic plan to include a three-year budget. That is a problem. It is also an organizational issue. We allocate capital and risk just thinking about the life of our next investment, deposit, or loan. You can’t develop lending expertise overnight. It may take years to build the right team and to develop the right customers. A three-year time horizon isn’t long enough if say you want to take your lending platform nationally such as specializing in lending on robotics.

Of course, the situation gets worse as most banks, other than real estate, don’t invest with a ten-year or longer horizon. Research & development, product design, human capital and brand building is usually a next year item when it should be a next decade exercise.

Many banks say they have generational ambitions, but measure performance quarterly.

The Current Environment and Reversion To The Mean

The current era is only exacerbating this problem. Bank management is hyper-focused on net interest margin. Expense control, loan growth targets, managing cost of funds and customer acquisition dominate executives’ time. Think about how much time your bank spends on trying to forecast the economy, discussing what loans to make or how much liquidity to keep.

The reality is that very few of those activities drive value. It is not that these decisions are not important, it is that there are more important decisions to make first.

After adjusting for risk and cost, individual securities and loans perform approximately the same. Securities add no long-term value while loans contribute about 10% (HERE) to value. Deposits generate the bulk of a bank’s value yet most banks spend little on deposit marketing and product design.

Take an intermediate term view, and most major asset classes such as multifamily, hospitality loans or construction lending perform the same. Over a ten or twenty-year horizon, very few of those decisions matter. What does matter is strategy.

A Better Way: The Waterfall of Strategy

Almost every bank that is in the top decile of top performing bank has a clear strategic intent. They are either creating value in a product line such as credit cards, a customer segment like technology companies or have developed a very clear brand/culture proposition. These banks have all taken a longer view.

In an ideal world, a bank should set its strategy first and then find the duration of capital to match. If your value proposition is to fix and sell broken banks, then you need capital with a five to seven-year time horizon. However, if you want to build a legacy institution, then your capital should be longer.

Most investors fall into this category. As such, the duration of capital will be long.

Then you choose your customer segments. Yes, customers are an asset, and they too have durations and average lives. Next to strategy, your customer segments are going to drive the greatest franchise value.

Once you have the customer segments you want to go after, then you can reverse engineer what products they need. Professional athletes need a different product mix than homebuilders.

After that, you set your deposit tactics. Deposits are the hardest to manufacture and thus should be given top consideration. You can buy loans, but you can’t buy bulk deposits for below market rates.

Once you have your deposits set, then that will dictate what type of loans you can make. If your deposit structure is certificates of deposit and money market account heavy, then you need to specialize in shorter duration assets to drive value. If not, you will have to develop capabilities to hedge either your loans or your deposits to shift duration.

Finally, you can set your investment duration. Securities are the most liquid and are the easiest to shift. The duration and investment horizon are usually the shortest and securities rarely create franchise value.

This means that your duration map looks something like this:

Putting This Into Action

If you notice, this is probably the opposite of how banks operate now. Banks often are active on the investment side and set those targets first, then focus on loans and then take any deposits that come their way. Instead of being proactive in product design, most banks just play defense only rolling out a new product in an effort to “keep up with the market.” These banks are often agnostic as to the type of customer they bank, and their strategy lacks any differentiating initiatives that put them ahead of their competition. As a result, they produce under their cost of capital.

The best move when it comes creating franchise value is to set your process first.

The process is everything, so figuring out how you are going to decide on strategy, customers, deposits, etc. is step one. Once you have a process, then strategy should come next. Since you already have capital, banks need to rethink how to extend their strategic planning time horizon to match their capital. For example, every bank should have a plan to go to an open-architecture, real-time core processing platform. This can’t happen overnight as planning takes five or more years. However, if your strategic plan is only three years long, you will miss long-term value drivers of policy, infrastructure, capital allocation, talent management, and strategy. There are very few strategies that can be executed in a three-year time frame so banks that limit themselves to that horizon are missing out on a majority of the universe that can set them apart for the future.

To drive value, the magical qualities of long-term capital should be paired with even more magical long-term decisions.