Lenders set to flood SBA with new PPP applications

A backlog has formed since the first round of Paycheck Protection Program funding dried up, threatening to further strain a platform that struggled to handle the initial workload.

(Full story

LendingClub laying off 460 staffers, including president

(Full story

'Leave room for the little guys': Square's advice for PPP 2.0

(Full story

The new bankers' hours: Long nights and weekends

(Full story

Senate directs PPP aid to small banks in new funding measure

(Full story

Small banks could get big break in emergency loan program's next round

(Full story

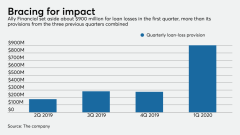

Ally girds for surge in auto loan defaults

(Full story

Banks' digital upgrade plans unshaken by coronavirus

(Full story

Fifth Third rethinks new-branch designs in light of coronavirus

(Full story

Can government do anything to stop mortgage market contraction?

(Full story