In my last blog I discussed the consolidations required for success with the FR 2052a Complex Institution Liquidity Monitoring Report. My next blog will outline the data that can be reported.

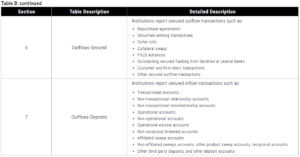

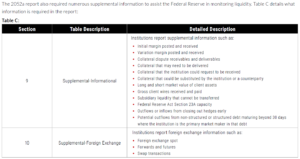

The FR 2052a report collects data for 10 distinct tables covering 115 product types, 14 counterparty types, 72 asset classes, and 75 maturity buckets out to five-plus years, which are related to the assets, liabilities, funding activities, and contingent liabilities on a consolidated basis and by material reporting entity.

Reporting Burden

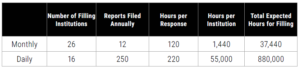

The reporting burdens are not to be taken lightly. The Federal Reserve estimates that daily responders, who must file 250 reports each year, will spend an average of 220 person-hours per submission. That equates to a total of 55,000 person-hours per year for this one report.

One advantage of the changes enacted in 2020 is that the reports themselves did not change; therefore, financial institutions that did not have their reporting frequency changes will not be impacted by the changes announced and implemented by the Federal Reserve.

Download our guide to learn more about the FR 2052a report, including; history and recent changes, consolidation of subsidiary institutions requirement, data to be reported, reporting burdens and tools needed for reporting.