More than half (55%) of Americans own stock (Source: Gallup, June 2020) while just 7% own rental real estate (Source: Arrived Homes). This despite real estate being widely viewed as one of the most promising investment alternatives (Source: Gallup, May 2019). This gap is being filled by startups such Fundrise, CrowdStreet, YieldStreet and more. But those are all commercial real estate plays.

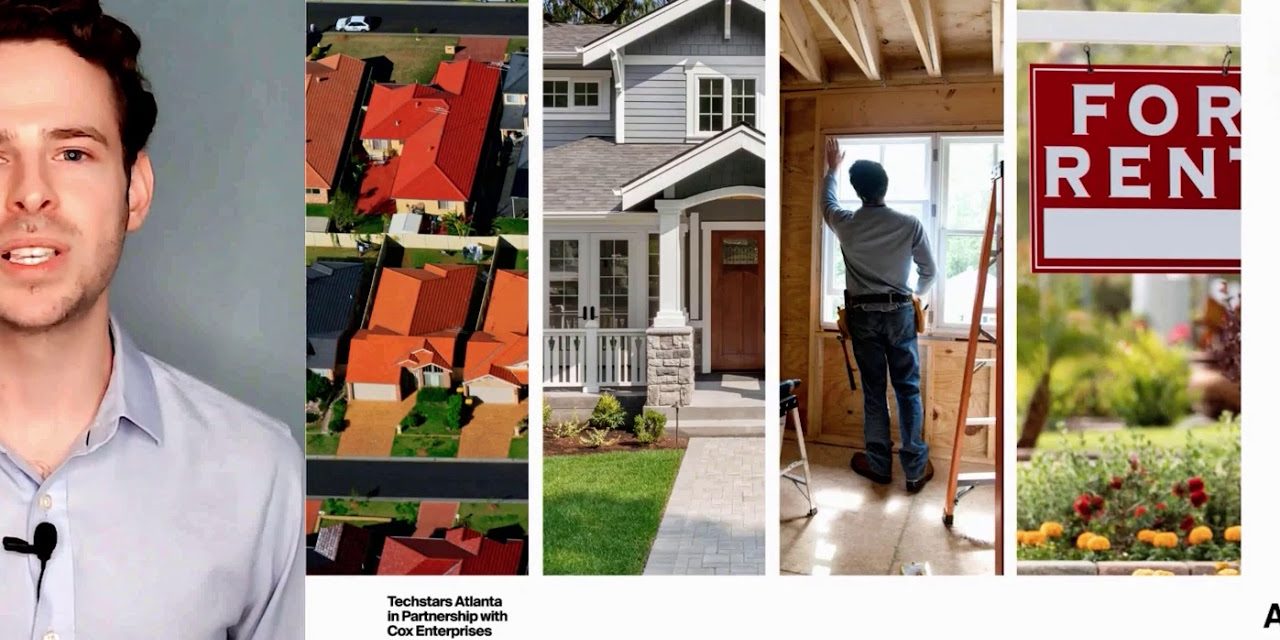

In the $70B single-family rental home market (annual purchase volume), Roofstock is the only major player currently. But that’s about to change with the launch of recent Techstar alum, Arrived Homes. The Seattle-based startup delivered a near-perfect pitch at the Atlanta demo day a few weeks ago (see above).

Product

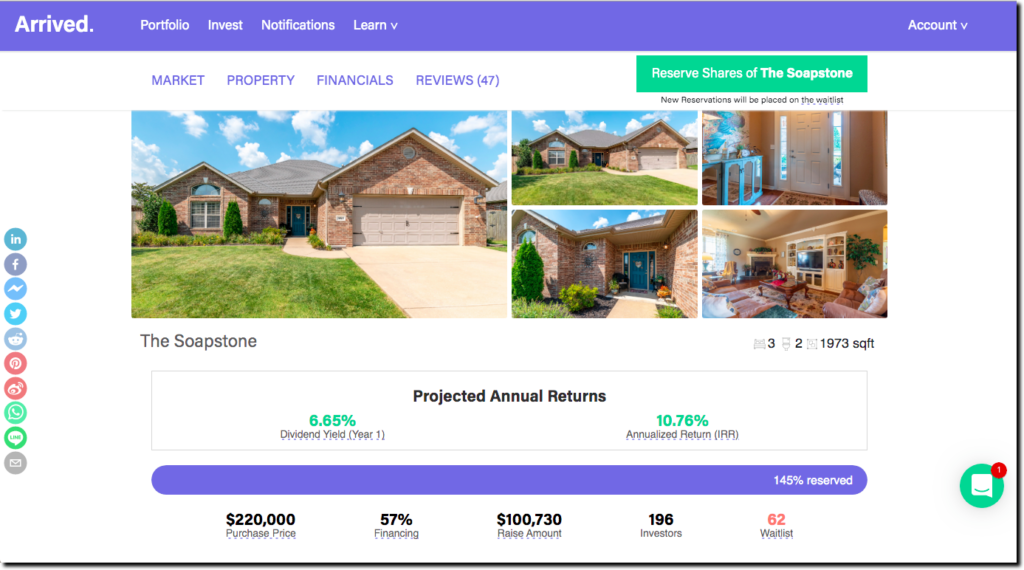

If you are familiar with P2P lending, you’ll instantly get the Arrived Homes platform. Investors fund an account at the startup, then choose individual rental properties to invest in. The minimum investment is $100 allowing consumers to build a diversified portfolio of rental properties around the country (though currently, the first 5 properties are all in Fayetteville, AK). Arrived buys the homes, fixes them up and rents them long-term.

Homes are financed through mortgages with LTVs of 57% on the first 5 homes. Sample mortgage terms listed were 4% APR with interest-only payments on a five-year term. The company projects annual dividends of 5.9% and 6.7% on the first two properties along with about 4% in annual asset appreciation for an expected IRR of 10.5% and 10.8%.

The startup makes money in several ways:

- Real estate commissions (paid by the seller) when buying the home (e.g. $6,250 for $250k house at 2.5%)

- Monthly rent before the home is syndicated on its platform (e.g., $4,500 if rented for 3 months at $1,500/mo)

- 1% management fee from investors ($1,000 annually on $250k house with 40% owned by investors, assumes 60% LTV mortgage)

- 8% of rent for property management ($1,400 annually on $1,500 monthly rent)

In the pitch, CEO Frazier said it needed just 28 homes to earn $7M GMV ($250k per home) and $1M in revenue ($35k per home). He did not specifically say this was lifetime revenue, but clearly it must be.

Traction

- 2,000 person waitlist

- The first 2 homes are live on the platform (with projected returns of about 10%) are oversubscribed by 50 investors

- 3 more coming-soon homes are also oversubscribed site unseen by 40 investors

Company Vitals

Description: Crowdfunding rental homes

Business model: Direct-to-consumer

HQ: Seattle, WA

Founders:

– Ryan Frazier, CEO

– Kenny Cason, CTO

– Alejandro Chouza, COO

Frazier and Cason were co-founders of DataRank, a YC-company (Spring 2013) acquired by Simply Measured in 2015. Chouza has 4+ year stints at both Uber and Microsoft as well as founding several smaller companies.

Raised:

– Techstars made an undisclosed investment at the start of its incubator in June (typically $100k)

– The company has secure a “sizable” credit line to purchase properties

Status: First 2 properties are live, with “large credit limit” secured to buy more properties

Press:

– Geekwire (22 Oct 2020)

Company links: Website | Twitter | Angel List | Crunchbase