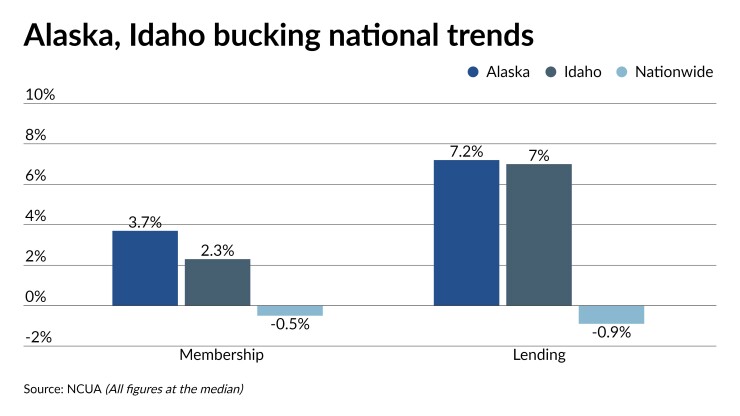

Recent data from the National Credit Union Administration shows membership and loan growth slipping slowing across the country, but two states are bucking those trends.

Alaska and Idaho both reported membership and loan growth well above the national median the end of 2020. Membership in the two states was up 3.7% and 2.3% at the median, respectively, compared with a decline of 0.5% nationally. When it comes to lending, the national median was -0.9% while Alaska saw loan growth of 7.2% and Idaho experienced 7% growth last year.

Some of that has been the result of strong mortgage markets in those states, particularly in Alaska. In Anchorage alone, more than 3,200 homes were sold in 2020, and ongoing low interest rates and pent-up demand could keep that trend going through much of 2021, said Bill Popp, president and CEO of the Anchorage Economic Development Corp.

Inventories were tight due to a lack of single-family home construction over the last several years, which led to a spike in prices in 2020. The average home sold for a record high of $393,579 in 2020, up over $23,000 compared to 2019.

"This surge in home buying benefited lending institutions and mortgage and title companies who also saw a significant surge in business in 2020 compared to 2019," Popp said.

The COVID-19 pandemic fell heavily on low-income Alaskans, with roughly 60% of the state's workers who filed for unemployment making $30,000 or less per year, noted Popp. Those residents were often looking for financial institutions with as few fees as they could find, which in many cases led them to credit unions.

With COVID restrictions on travel and gatherings and out-of-state vacations cancelled, Popp said, those workers who kept their jobs often found themselves looking for things to do in place of traveling.

That resulted in a spike in purchases of recreational vehicles people used to get out and enjoy Alaska, and a similar spike in sales of other “grown-up toys” such as snowmobiles, ATVs and other high-dollar purchases, all of which likely required financing, he said.

"The pursuit of low-interest credit to make those purchases has likely led many to establish an account with credit unions to facilitate access to credit," Popp said.

One institution that benefitted from some of that was Anchorage-based Credit Union 1, the state’s second-largest credit union, holding $1.3 billion of assets.

CU1 had nearly 90,000 members at the end of last year, representing 5.4% growth from 2019. President and CEO James Wileman attributed some of that growth to a focus on helping Main Street businesses during the coronavirus pandemic.

The credit union assisted in distributing $84.2 million in "AK CARES" grants from the state to more than 2,000 small businesses. "This meant staff who were traditionally lending were temporarily committed to getting dollars on the streets in the form of grants to help our members and businesses all over Alaska," said Wileman.

Along with bringing in new members, Credit Union 1 also lost fewer memberships than in previous years. Wileman said a decision to waive $707,000 in member fees at the onset of the pandemic contributed to the lack of attrition, along with allowing members to skip more than 4,600 loan payments, which helped keep as much as $1.9 million in members’ pockets.

CU 1’s saw 1.9% loan growth for the year, finishing 2020 with $845.4 million in loans and leases on the books. Mortgage volumes were up by about $30 million, though other lending lines stayed flat or even contracted. Wileman said that’s evidence that consumers used stimulus funds from the government to pay down existing debt.

Popp also suggested that spikes in personal income – driven in part by stimulus checks and expanded unemployment benefits from the federal government – are pushing many consumers to start new banking relationships.

“With this influx in cash to individuals in particular… workers and businesses that previously operated in a purely cash mode [with no banking relationships or checking accounts] are finding the need for more traditional banking services,” he said.

In Idaho, a heavy influx of new residents has contributed to strong membership growth for credit unions headquartered there. The state has beaten the national average for population growth for the

Idaho Central Credit Union in Chubbuck saw 11.7% membership growth last year, finishing 2020 with just over 432,000 members. Kent Oram, president and CEO of the $6.7 billion-asset credit union, said that while those new residents are helping drive membership growth, they’re also putting a strain on housing in the state.

"It has put demand on all services but particularly housing. As a result, mortgage volumes are strong," he said. Mortgage balances at Idaho Central were up 6.7% year-over-year to reach nearly $1.6 billion, and total loans and leases rose by 13.6% to reach nearly $5 billion.

"Consumer confidence is generally good leading to strong lending growth. Commercial lending including Paycheck Protection Program loans continues to be very good," said Oram. He added that Idaho’s businesses saw fewer restrictions than those in some other states, which helped it maintain a more robust economy during the pandemic than other parts of the country.

Despite those successes, much of the growth that credit unions across the country – including in Idaho and Alaska – saw in 2020 was attributable to the mortgage refinance boom and the Paycheck Protection Program, noted Vincent Hui, managing director at Cornerstone Advisors. And neither of those will last forever.

One other factor that may have given a boost to Alaska and Idaho’s performance is the relatively low number of credit unions in each state. Alaska is home to just 10 federally insured credit unions while only 33 are based in Idaho. By comparison, Illinois has 235 credit unions, Missouri has 108 and Pennsylvania has 350, according to third-quarter data from NCUA, the most recent figures available. Because those states have so few CUs, said Hui, they have more room to grow than some other states where the industry is better represented, but where the struggles of many small credit unions can pull down aggregate performance.

Hui said he does not anticipate a "hockey stick" growth trajectory, though, in which sudden and extremely rapid growth follows a long period of linear growth.

CEOs in the states also aren’t expecting this kind of growth to continue for the long haul.

“Last year was so atypical, it’s difficult to pinpoint one reason for the overall growth,” said Wileman. “However, I do know people have been evaluating their financial relationships to a degree. Sometimes it means folks whose lives have dramatically changed and they need a fresh start. We have seen this often throughout the pandemic, and we’ve found that for many Alaskans who have come upon difficult times, they thought of us first as a place that will help.”