Why You Need To Use Funds Transfer Pricing in Banking

Funds transfer pricing (FTP) has been an essential tool for financial institutions for several decades. FTP was introduced to banks in the early 1980s to help manage interest rate risk on a transactional basis. FTP gained further focus after the 2007 financial crisis when financial firms failed partly because of the lack of funds transfer pricing application and rigor.

FTP was initially adopted to enable front-line business units to lay off interest rate risk in their loans and deposits to a central treasury function. Over time FTP was further advanced to allow management to measure and manage credit, interest rate, liquidity, and operational risk across business units.

All domestic systemically important banking organizations and most large regional banks engage in some form of FTP practices and building blocks. However, over the years, there has been considerable debate at community banks on how to implement the principles of FTP to various balance sheet accounts like loans and deposits. We believe that with proper FTP data analysis and segmentation, community bank managers can realize considerable value in product pricing and incentive compensation programs. In this blog, we would like to explain the building blocks of FTP and how FTP can help community banks price loans and think about effective profit allocation. In a future blog, we will highlight specific examples and considerations for community banks in implementing an effective FTP model.

Simple Funds Transfer Pricing Example

Last month we worked with a lender at a $2Bn community bank who was competing for a $2.1mm owner-occupied commercial loan with strong credit quality. The lender was lamenting that his bank’s cost of funding (COF) was higher than the industry average, and he needed a higher rate loan rate to win business. The banker stated that his bank was much more competitive on smaller commercial deals or deals with some “hair.” In turn, the banker avoided competing on A credits and larger deal sizes. Ultimately, the banker lost the $2.1mm commercial loan to another community bank by almost 90 bps spread.

The above is an example of a misconception of economics resulting from a lack of funds transfer pricing implementation. This specific bank’s poor deposit gathering ability should be motivated to improve the bank’s deposit gathering function and not a reason for the bank to migrate to poor credit quality and smaller loan sizes that ultimately lead to lower long-term ROE.

Funds Transfer Pricing Framework

FTP is both a regulatory requirement and an essential tool for managing a bank’s balance sheet structure and measuring risk-adjusted profitability. FTP measures interest rate, credit, and liquidity risk and enables costs to be transferred from central treasury functions to the bank’s products and business lines. Fundamentally, FTP divides a bank’s overall NIM into two major sub-margins (one for deposits and one for asset origination). Banks can then measure the economic value obtained from each action taken separately.

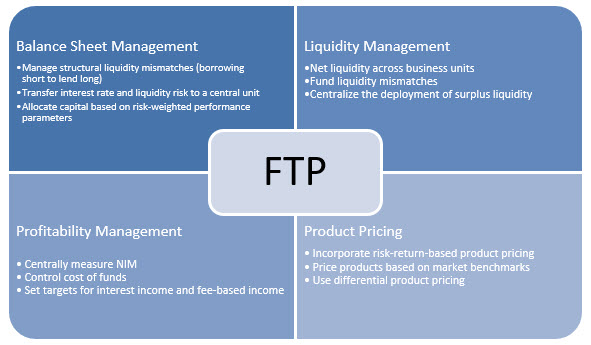

Further, FTP can be extended to provide other analytical tools, as shown in the graph below.

Regulatory Recommendations

The March 2016 Interagency Guidance on Funds Transfer Pricing outlines four principles related to Funding and Contingent Liquidity Risks as listed below:

- Principle 1: A firm should allocate FTP costs and benefits based on funding and contingent liquidity risks.

- Principle 2: A firm should have a consistent and transparent FTP framework for identifying and allocating FTP costs and benefits on a timely basis and at a sufficiently granular level, commensurate with the firm’s size, complexity, business activities, and overall risk profile.

- Principle 3: A firm should have a robust governance structure for FTP, including producing a report on FTP and oversight from a senior management group and central management function.

- Principle 4: A firm should align business incentives with risk management and strategic objectives by incorporating FTP costs and benefits into product pricing, business metrics, and new product approval.

Principles 2 and 4 above are especially important, and implementing an appropriate FTP framework will help community banks dissect net interest margin (NIM) in a manner the general ledger cannot. This allows community bank managers to do the following:

- Understand the profit contribution of its balance sheet products (loans versus deposits).

• Understand the profit contribution of a channel, an officer, an organization, or an individual customer.

• Create internal accountabilities and associated targets for funds users (credit risk takers) and funds providers (deposit gatherers).

• Price interest-earning products more knowledgeably based on a RAROC model.

• Reward loan officers, branch managers, and regional leaders based on margin contribution versus volume or revenue production.

Conclusion

We recommend that community banks incorporate a simple funds transfer pricing model for appropriate product pricing and incentive compensation. Incorporating an FTP framework can change the understanding of the makeup of net interest margin and how the bank’s activities have contributed to economic profitability. Too often, commercial lenders’ and management’s focus, and incentive plans, are not properly aligned with the institution’s processes for measuring economic contribution. In an upcoming blog, we will decompose NIM contribution based on deposit costs, IRR, and liquidity costs and show by specific examples how community banks may evaluate the profitability of deposits, loans, products, branches, and specific employees.