Fed courts nonbanks for FedNow growth

Payments Dive

APRIL 22, 2024

The Federal Reserve is stressing the importance of fintechs and core providers for the future expansion of its new instant payments system FedNow.

Payments Dive

APRIL 22, 2024

The Federal Reserve is stressing the importance of fintechs and core providers for the future expansion of its new instant payments system FedNow.

Perficient

APRIL 24, 2024

Uncovering the Challenge: Relying on Spreadsheets for Portfolio Analysis A leading wealth and asset management firm recently sought our financial services expertise for a critical challenge. Relying on complex spreadsheets for portfolio analysis, the firm faced operational hurdles due to immense computing demands. The Perficient Approach: Transforming Operations through Strategic Consulting Our team embraced the challenge, conducting a meticulous two-week analysis to uncover the root issue: a cu

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

South State Correspondent

APRIL 22, 2024

In a few short months, stronger economic data (higher GDP, stronger job market, and stubborn inflation) changed the market’s and the Fed’s view on the future path of interest rates. The market and the Fed are now aligning on only one rate cut in 2024 – obviously this will change over the course of the year as the economic data evolves. The market, and most economists, often get interest rate predictions wrong.

Jack Henry

APRIL 18, 2024

Diversity, equity, inclusion, and belonging (DEIB) are more than just buzzwords ; they are essential components of a successful and sustainable business. As we celebrate National Diversity Awareness Month, I want to talk about the positive impact leaders can have on DEIB within their organizations.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

ATM Marketplace

APRIL 19, 2024

Omnichannel experiences are driving behaviors that motivate, inspire, and stir emotions that prompt action in bank branches. Digital signage has emerged as an essential component of these experiences.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankBazaar

APRIL 23, 2024

Let’s face it, talking about money isn’t always sunshine and rainbows. We all dream of financial freedom, but the road there can be paved with some pretty epic stumbles. From the infamous “bottomless cocktail brunch” every Sunday that mysteriously drained your savings account to the “surely-I’ll-win-the-lottery” mentality, personal finance fails are a universal experience.

TheGuardian

APRIL 23, 2024

Bank of England executive says creeping sense of complacency and lack of data is putting lenders at risk UK banks are leaving themselves open to “severe, unexpected losses”, by failing to properly measure how exposed they are to the $8tn private equity industry, the Bank of England has warned. In a speech on Tuesday, Rebecca Jackson, a senior executive at the central bank, said there was a “creeping sense of complacency” among lenders, who – despite a boom in loans and financing to the sector –

Jack Henry

APRIL 22, 2024

The Magic 8 Ball might be the easiest fortune-telling device available. You simply ask it a question, shake it, then read its response through the little window.

American Banker

APRIL 19, 2024

For the better part of the past decade, the Federal Reserve Board in Washington has played a more active role in presidential searches by regional reserve banks. The shift seems to have made the system more diverse, but some argue it's at the expense of regional bank independence.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

Payments Dive

APRIL 24, 2024

The card network behemoth’s latest earnings report showed a contraction in card volume growth during the first three months of the year, and into April.

BankBazaar

APRIL 19, 2024

Confused by Credit Card jargon? Feeling lost in a sea of APRs, rewards points and interest charges? You’re not alone! This blog post is your saviour, translating complex Credit Card terminology into plain English. Dive in and learn to speak the language of Credit Cards – without getting lost in translation! Credit Cards – those handy rectangles that promise convenience, rewards and sometimes, a whole lot of confusion.

ABA Community Banking

APRIL 17, 2024

How organizations can support the advancement of women to the highest levels The post Making way for women leaders appeared first on ABA Banking Journal.

BankInovation

APRIL 24, 2024

Bank of America’s innovation is never complete since its team constantly updates offerings to meet ever-changing client needs. “At Bank of America, innovation is everybody’s job,” Jorge Camargo, managing director of mobile app, online banking and Erica AI at Bank of America, told Bank Automation News.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

American Banker

APRIL 21, 2024

As recently as a few months ago, many observers predicted a surge of bank mergers this year. But longtime obstacles to dealmaking are still there and have been joined by new ones.

Payments Dive

APRIL 19, 2024

Small and mid-sized businesses were fueling growth for American Express during the COVID-19 era, but not this year. That billed business grew 1% in the first quarter over last year.

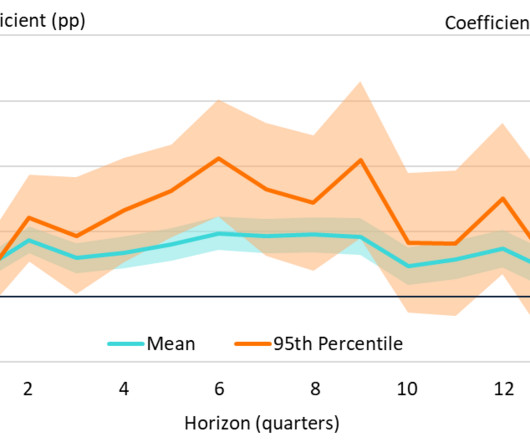

BankUnderground

APRIL 24, 2024

Julian Reynolds Policymakers and market participants consistently cite geopolitical developments as a key risk to the global economy and financial system. But how can one quantify the potential macroeconomic effects of these developments? Applying local projections to a popular metric of geopolitical risk, I show that geopolitical risk weighs on GDP in the central case and increases the severity of adverse outcomes.

The Paypers

APRIL 23, 2024

UAE-based du has announced the launch of du Pay to boost UAE’s transition toward a cashless economy and support the national digitalisation agenda.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

BankInovation

APRIL 23, 2024

Goldman Sachs Group Inc. is closing down its automated-investing business for the masses after clinching a deal with Betterment. The bank has struck an agreement to transfer clients and their assets from the unit known as Marcus Invest to Betterment, a $45 billion digital investment-advisory firm.

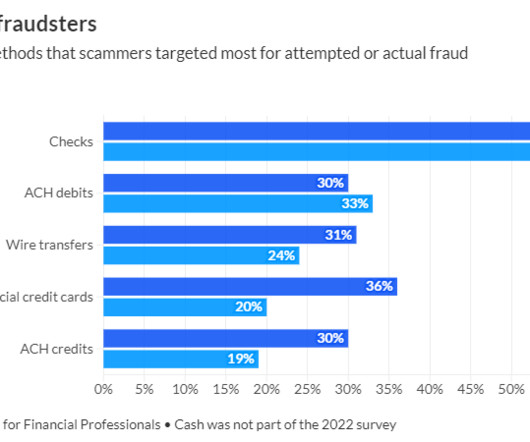

American Banker

APRIL 23, 2024

A new Citizens Bank survey suggests rising check-fraud incidents are driving middle-market companies to accelerate plans to fully adopt digital payments. But 70% of all businesses will continue to rely on checks for years to come, according to recent data from the Association for Financial Professionals.

Payments Dive

APRIL 23, 2024

The processing and payments technology giant is increasingly selling its services abroad, but also benefiting lately from sales to government entities at home.

ABA Community Banking

APRIL 24, 2024

The FDIC named four new bankers as members of the agency's Minority Depository Institutions Subcommittee. The post FDIC names four bankers to MDI subcommittee appeared first on ABA Banking Journal.

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

The Paypers

APRIL 22, 2024

Lithuania-based fintech Paysera has incorporated in its app the ability to directly invest in crowdfunded real estate rental projects on the InRento platform.

BankInovation

APRIL 22, 2024

Truist Bank expects to continue investing in technology to save money as it restructures. “We continue to see improvements in productivity due to investments in technology,” Chief Executive William Rogers said today during Truist’s first-quarter earnings call.

American Banker

APRIL 23, 2024

Many legal experts think the Supreme Court will rule in favor of the Consumer Financial Protection Bureau in a case challenging its funding. Such a ruling would unleash a flurry of litigation that has been on hold pending the outcome of the constitutional challenge.

Payments Dive

APRIL 24, 2024

The fintech One now offers buy now, pay later financing at the store chain, presenting competition for Affirm, which has partnered with the retail giant since 2019.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

Let's personalize your content