Fed courts nonbanks for FedNow growth

Payments Dive

APRIL 22, 2024

The Federal Reserve is stressing the importance of fintechs and core providers for the future expansion of its new instant payments system FedNow.

Payments Dive

APRIL 22, 2024

The Federal Reserve is stressing the importance of fintechs and core providers for the future expansion of its new instant payments system FedNow.

South State Correspondent

APRIL 22, 2024

In a few short months, stronger economic data (higher GDP, stronger job market, and stubborn inflation) changed the market’s and the Fed’s view on the future path of interest rates. The market and the Fed are now aligning on only one rate cut in 2024 – obviously this will change over the course of the year as the economic data evolves. The market, and most economists, often get interest rate predictions wrong.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

APRIL 17, 2024

Despite an industry-backed lawsuit seeking to stop the Consumer Financial Protection Bureau’s new $8 late fee rule, bank card issuers are bracing for potential implementation.

Jack Henry

APRIL 18, 2024

Diversity, equity, inclusion, and belonging (DEIB) are more than just buzzwords ; they are essential components of a successful and sustainable business. As we celebrate National Diversity Awareness Month, I want to talk about the positive impact leaders can have on DEIB within their organizations.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

ATM Marketplace

APRIL 19, 2024

Omnichannel experiences are driving behaviors that motivate, inspire, and stir emotions that prompt action in bank branches. Digital signage has emerged as an essential component of these experiences.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

APRIL 16, 2024

As crucial as it is to focus on your core business, today’s merchants demand a broader range of services from their providers. Can embedded finance help solve this core competency problem?

American Banker

APRIL 19, 2024

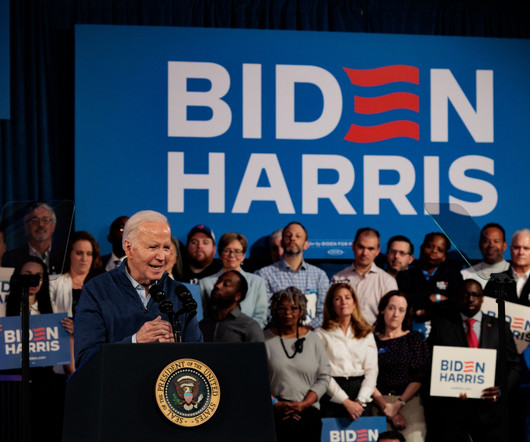

For the better part of the past decade, the Federal Reserve Board in Washington has played a more active role in presidential searches by regional reserve banks. The shift seems to have made the system more diverse, but some argue it's at the expense of regional bank independence.

Jack Henry

APRIL 22, 2024

The Magic 8 Ball might be the easiest fortune-telling device available. You simply ask it a question, shake it, then read its response through the little window.

ABA Community Banking

APRIL 17, 2024

How organizations can support the advancement of women to the highest levels The post Making way for women leaders appeared first on ABA Banking Journal.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

APRIL 22, 2024

Truist Bank expects to continue investing in technology to save money as it restructures. “We continue to see improvements in productivity due to investments in technology,” Chief Executive William Rogers said today during Truist’s first-quarter earnings call.

Payments Dive

APRIL 16, 2024

The chain first tested the technology that lets customers pay using their face in October, and began deploying it in January.

American Banker

APRIL 21, 2024

As recently as a few months ago, many observers predicted a surge of bank mergers this year. But longtime obstacles to dealmaking are still there and have been joined by new ones.

TheGuardian

APRIL 18, 2024

Tentative offer follows four months of talks and could create new banking group with almost 5m customers Coventry Building Society has tentatively offered £780m to buy the Co-operative Bank from its hedge fund owners, in what could be the latest in a string of takeovers among UK lenders. The offer follows nearly four months of exclusive talks between the two lenders, which began in December.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

Bussman Advisory

APRIL 20, 2024

The latest edition of the FinTech Ecosystem Newsletter is here: Image Credits: shutterstock.com The post Microsoft invests $1.5 billion in AI firm G42 | Software giant Salesforce in advanced talks to buy Informatica | Revolut valuation raised 45% by investor appeared first on Bussmann Advisory AG.

BankInovation

APRIL 19, 2024

Fifth Third Bank saved $15 million in the first quarter, partly driven by deploying automation throughout its operations. “Expenses are well controlled … driven by savings realized through process automation and our focus on value streams,” Chief Executive Tim Spence said during the bank’s first-quarter earnings today.

American Banker

APRIL 18, 2024

The first-quarter increase stemmed from higher interest rates, partial charge-offs and certain problem loans, many involving commercial real estate, executives at the Dallas bank say. Further CRE deterioration is anticipated.

PopularBank

APRIL 18, 2024

Defrauding others of their financial assets remains a common thread throughout history, from snake oil salespeople to modern-day digital fraudsters. Yet, despite advances in bank fraud protection, scammers continue to develop and deploy sophisticated—and successful—methods. Earlier this year, the Federal Trade Commission announced over $10 million in fraud losses in 2023, up 14% from the previous year.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

ABA Community Banking

APRIL 18, 2024

According to newly released Gallup figures, just 30 percent of American workers are engaged in their work. The rest are described as disengaged, with 17 percent actively disengaged, "which means they are literally trying to sabotage the organization," notes Neil Stevens. The post Podcast: How a Georgia community bank engaged employees at 3X the national rate appeared first on ABA Banking Journal.

BankInovation

APRIL 18, 2024

KeyBank is using robotic process automation to boost efficiency without hiring more people. The $189 billion bank has about 300 processes automated through (RPA), Michael Reynolds, business technology executive for service digitization, said last month at Bank Automation Summit 2024 in Nashville, Tenn. “Translate that into people.

Payments Dive

APRIL 19, 2024

Small and mid-sized businesses were fueling growth for American Express during the COVID-19 era, but not this year. That billed business grew 1% in the first quarter over last year.

American Banker

APRIL 22, 2024

With financial crime surging worldwide, it is critical that the public and private sectors align on a shared vision to collectively focus on combating bad actors and to eliminate their ability to launder the proceeds of criminal activity.

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

TheGuardian

APRIL 20, 2024

Growing social media interest in method of tracking spending and saving prompts banks to get in on the act Each month 20,000 people tune in to watch 27-year-old Beth Fuller work out how to spend her salary. For a year and a half she has, on payday, opened a spreadsheet and written out in granular detail what she will owe in bills, exactly what she wants to do in the weeks ahead, how much it will cost and how much she intends to save.

The Paypers

APRIL 22, 2024

The UK’s Metropolitan Police has announced that it infiltrated LabHost, a fraud website leveraged by criminals to scam individuals into handing over their personal data.

BankInovation

APRIL 19, 2024

Huntington Bancshares joined mega-banks in growing digital adoption during the first quarter, citing increases in digital and mobile usership and in digital logins. During the quarter, Bank of America, Citizens Financial Group, JPMorgan Chase and Wells Fargo all reported digital usership growth.

Payments Dive

APRIL 22, 2024

The CFPB report put gaming companies on notice that the long-expected regulatory scrutiny has arrived, according to professionals involved in the industry.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

Let's personalize your content