Loan Refinancing – Is Now The Time To Talk To Borrowers?

It is counterintuitive that you might want to advise borrowers to do a loan refinancing at this stage of the interest rate cycle. The FOMC has raised short-term interest rates by 3.75% in the eight months between March and November. The market is now forecasting an additional 1.25% in hikes by early next year. Borrowers and lenders continue to be surprised by the speed of these increases. As short-term rates have gone up, so has the cost of credit for all borrowers, especially those who want to borrow for shorter terms (up to five years). In this article, we consider if borrowers should refinance at this point in the business cycle, and if so, what are some of the better options for borrowers and lenders.

The Loan Refinancing Decision – Bankers As Trusted Advisors

Bankers are trusted advisors and must understand their client’s specific financial and personal situations and offer prudent and objective advice to help the customer reach their goals. Therefore, every borrower’s best course of action will vary based on specific circumstances. There are a few basic guidelines that every good banker must consider.

- Lenders must recognize that banks are in the business of keeping loans and not making loans. It costs the average community bank $6k to $14k to book a new commercial loan but only about $2k to $4k to modify or amend an existing commercial loan. The borrower ultimately bears that cost in the form of higher payments. But bankers must be motivated not to lose an existing earning asset, and losing good relationships is highly unprofitable for banks. It is almost always preferable to be proactive in discussing loan refinancing options with existing customers to retain an existing relationship rather than: a) lose the customer or b) play defensive and have to respond to an existing customer’s competing offer.

- Loans that mature within the next two years pose a repricing and, therefore, a credit risk to both the borrower and the bank. Historically, borrowers would not seriously consider refinancing until the debt became current (contractual maturity within 12 months). However, with credit spreads at all-time lows and interest rates expected to continue to rise, more sophisticated bankers and borrowers are refinancing two or even three before their debt matures to secure favorable terms today. Many borrowers realize the difficulty of refinancing debt in a recession.

- Borrowers should have loan structures that match their asset-liability position. Bankers must be able to provide the proper structure, payment terms, conditions, and maturities for the specific borrower and their personal situation and business needs. Many borrowers will not know or even ask if their loan matches their cash flows correctly and if the liability and assets are appropriately matched for their business. For example, real estate is a longer-term asset with net operating income (NOI) that is mostly insensitive to interest rate movement. Therefore, commercial real estate (CRE) loans are best structured with fixed-rate for longer terms.

- When interest rates or credit spreads are expected to be volatile during market inflection points, conservative borrowers tend to refinance. This key variable forces borrowers to abandon existing shorter-term debt and take advantage of longer-term stability. Today’s environment is that inflection point. Inflation remains at multi-decade highs, and the Fed has been aggressive with its interest rate hikes. This rate hiking cycle has been the most severe in 35 years and the sharpest of the last six hiking cycles. Given the option, this current business environment is the right time for borrowers to eliminate financing uncertainty.

- The current yield curve is inverted. Borrowers that typically finance projects on fixed-rate term debt for one to five years are paying a premium to do so. Currently, the cost of loan refinancing drops the longer the repricing term. The benefit to borrowers is that longer-term financing is cheaper and eliminates or reduces the repricing risk, affecting both the borrower and the lender.

Lenders’ Advice on Forecasts

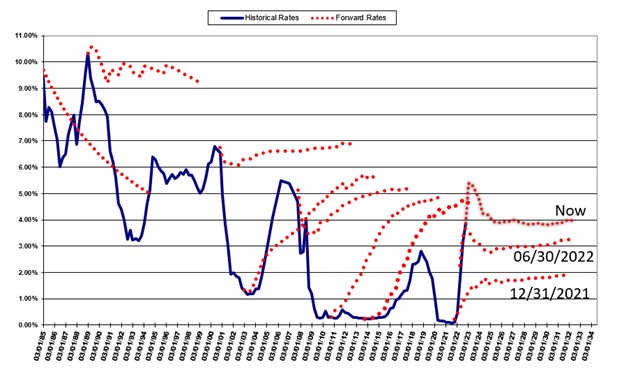

What advice should lenders provide about the future of interest rates and the business environment? The problem with the market’s expectation of the future is that it is generally wrong. Below is a graph showing in the blue line where short-term rates have been since 1985 to the present (Prime, LIBOR, or Fed Funds are 99% correlated). In the dotted red line are forward rates at specific periods (the last three dotted red lines are labeled and highlight how quickly the market changed its forecasts). The market is generally wrong but is wildly off during inflection points. We do not expect that the market is getting it right today, either.

But lenders don’t need to have a crystal ball to be valuable, trusted advisors to their customers. Instead, lenders need to analyze a customer’s balance sheet, cash flow, and business model to structure products that insulate customers from adverse outcomes, regardless of what interest rates may do in the future. Lenders do not know what the future holds, but they can analyze the cost and benefit of retaining existing debt versus refinancing today. Lenders should be able to provide borrowers with the calculations to compare interest rates, monthly P&I payments, and total interest paid among various refinancing options.

Lenders should also be able to calculate what-if analysis to show borrowers their cost of financing if rates are higher or lower – because either outcome is equally possible by definition. Being able to show DSCR or advance rates for LTV with various dispersion in interest rates allows borrowers to make more informed decisions. Almost all borrowers make more money when the cost of financing decreases, but many borrowers become unbankable if interest rates are substantially higher.

The best position for lenders is to offer different financing options that cater to the borrower’s balance sheet instead of the bank’s balance sheet. The loan refinancing option that reduces the borrower’s cash flow risk and increases profitability is probably best.

Conclusion

We run various models that compare the borrower’s cost of retaining existing debt, refinancing now on various terms, or refinancing in the future based on assumed market rates. We can run the same analysis for you and your specific customer so that you can see what the analysis looks like. If your borrower is not getting this loan refinancing analysis from you, they will likely get something similar from a competing institution. We urge lenders to become comfortable discussing these options with their clients.