Visa’s next CEO sees a world of growth

Payments Dive

NOVEMBER 21, 2022

Ryan McInerney, who will become CEO of the card network juggernaut next year, recently detailed the areas where he sees opportunities for the company.

Payments Dive

NOVEMBER 21, 2022

Ryan McInerney, who will become CEO of the card network juggernaut next year, recently detailed the areas where he sees opportunities for the company.

CFPB Monitor

NOVEMBER 21, 2022

The CFPB has released the Fall 2022 edition of its Supervisory Highlights. The report discusses the Bureau’s examinations in the areas of auto servicing, consumer reporting, credit card account management, debt collection, deposits, mortgage origination, mortgage servicing, and payday lending that were completed between January 1, 2022 and June 31, 2022.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

NOVEMBER 21, 2022

Families of all income levels plan to increase holiday spending this year, and they expect to rely more heavily on credit cards for their purchases.

CFPB Monitor

NOVEMBER 21, 2022

I am delighted to share with our blog readers a new initiative to feature more women as guests on weekly episodes of our Consumer Finance Monitor Podcast. We are launching the initiative with an episode this week featuring special guest Abby Hogan, a regulatory attorney and former analyst in the Office of Fair Lending and Equal Opportunity of the Consumer Financial Protection Bureau.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

NOVEMBER 21, 2022

While one card network giant has grabbed center stage at the World Cup event in Qatar, other payments companies have landed bit roles too.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

NOVEMBER 21, 2022

The fintech aims to extend buy now-pay later financing options to consumers for healthcare payments.

Banking Exchange

NOVEMBER 21, 2022

The deal will add approximately $500 million in assets to the Virginia-based company Management Feature M&A Feature3 Community Banking.

ABA Community Banking

NOVEMBER 21, 2022

As the end of the year draws near, banking journalist and analyst Paul Davis joins the ABA Banking Journal Podcast to discuss the bank mergers and acquisitions outlook for 2023. The post Podcast: The community bank M&A outlook for 2023 appeared first on ABA Banking Journal.

Ublocal

NOVEMBER 21, 2022

During times of market volatility, like those we’re experiencing today , many individuals interested in building their nest egg, or saving for a specific goal, look for alternatives that offer less risk and more stable returns than traditional stocks and stock-based accounts. While CDs have often been written off in the recent past for their low-yields, today’s high interest rates , coupled with the low-returns of the stock market, have once again made them a popular savings tool.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

FICO

NOVEMBER 21, 2022

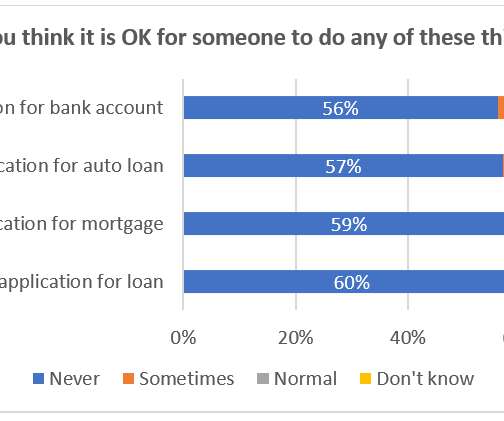

Home. Blog. FICO. First-Party Fraud Must Be Stopped Across the Customer Lifecycle. Financial institutions face first-party risks “inside the wire” - 14% of customers worldwide think it is normal to exaggerate income on a mortgage application. FICO Admin. Tue, 07/02/2019 - 02:45. by Sarah Rutherford. expand_less Back To Top. Mon, 11/21/2022 - 15:15. FICO’s 2022 global consumer survey on financial services and fraud produced some surprising results, but none more alarming than the 25% to 30% of fi

BankInovation

NOVEMBER 21, 2022

Financial institutions (FIs) looking to securely store data amid rising cybersecurity threats and open banking regulations can look to confidential computing, a technology that encrypts sensitive cloud-based data while it’s being processed. Confidential computing is a fairly new technology that performs computations in a hardware-based, trusted execution environment (TEE), according to tech giant Intel Corporation. […].

FICO

NOVEMBER 21, 2022

Home. Blog. FICO. FICO Ranks Top 5 in the 2023 Chartis RiskTech100® Report. FICO awarded first place in six categories on risk and compliance technology in the 2023 Chartis RiskTech100 ® Report, including Innovation for the sixth year in a row. asokolowski. Fri, 06/03/2022 - 12:24. by Darryl Knopp. expand_less Back To Top. Mon, 11/21/2022 - 20:30. I am thrilled to announce that the annual 2023 Chartis RiskTech100® Report ranking risk and compliance technology companies is live!

BankInovation

NOVEMBER 21, 2022

Truist Financial has launched Truist Trade, a self-directed investing solution that allows clients to open investment accounts and conduct online trading. The $534 billion bank unveiled the offering last week as an addition to its Truist Wealth portfolio, according to a Truist release. There are no minimum account requirements, along with commission-free trades for stocks, […].

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Financial Brand

NOVEMBER 21, 2022

This article Top 5 Customer Experience Trends for 2023 and Beyond appeared first on The Financial Brand. The experience banking provides must catch up to consumers' increasing expectations around digital delivery and service. This article Top 5 Customer Experience Trends for 2023 and Beyond appeared first on The Financial Brand.

The Financial Brand

NOVEMBER 21, 2022

This article Community Bank BaaS Provider Creates Private ‘Metaverse’ for Fintechs appeared first on The Financial Brand. Building its own interactive 3D ecosystem gives a tech-savvy community bank potential entrée to over 5 million potential customers. This article Community Bank BaaS Provider Creates Private ‘Metaverse’ for Fintechs appeared first on The Financial Brand.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Financial Brand

NOVEMBER 21, 2022

This article A Bank Marketer’s Guide to Hacking the Human Brain appeared first on The Financial Brand. To craft more effective marketing messages, banks and credit unions should tap into the ‘default decisions’ that all humans make. This article A Bank Marketer’s Guide to Hacking the Human Brain appeared first on The Financial Brand.

Banking Exchange

NOVEMBER 21, 2022

Republican Patrick McHenry is expected to lead the House Financial Services Committee as chair Compliance Lines of Business Duties Financial Trends The Economy Feature Management Feature3.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

American Banker

NOVEMBER 21, 2022

American Banker

NOVEMBER 21, 2022

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content