Cloud Takes Center Stage at 2023 Bank Automation Summit

Perficient

MARCH 30, 2023

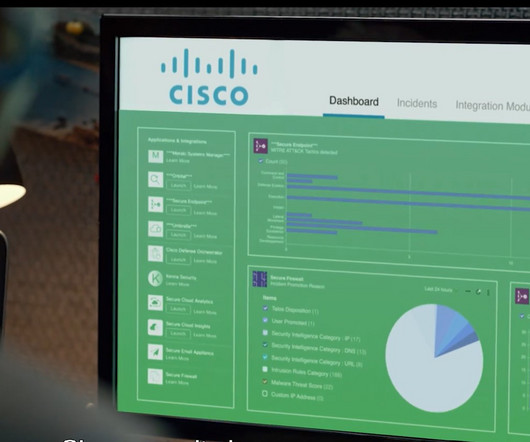

Recently, I attended the 2023 Bank Automation Summit , where one of the significant topics of discussion was how banks navigate their transition to the cloud. Security Traditionally, information was said to be most secure when separated and segmented.

Let's personalize your content