How The Market Gets Interest Rate Predictions Wrong

In a few short months, stronger economic data (higher GDP, stronger job market, and stubborn inflation) changed the market’s and the Fed’s view on the future path of interest rates. The market and the Fed are now aligning on only one rate cut in 2024 – obviously this will change over the course of the year as the economic data evolves. The market, and most economists, often get interest rate predictions wrong. In this article we will discuss how borrowers should anticipate the evolution of the economy as it relates to their financing needs and discuss how community bankers should advise their clients to minimize risk and maximize their client’s profits.

Probative Value of Interest Rate Predictions

First, we are not big proponents of economic forecasts from economists, analysts, or salespeople. Every person that earns a living making interest rate predictions has some personal stake in trying to persuade the audience of their view. If a prognosticator did not want to persuade you of their view, you would never hear from them.

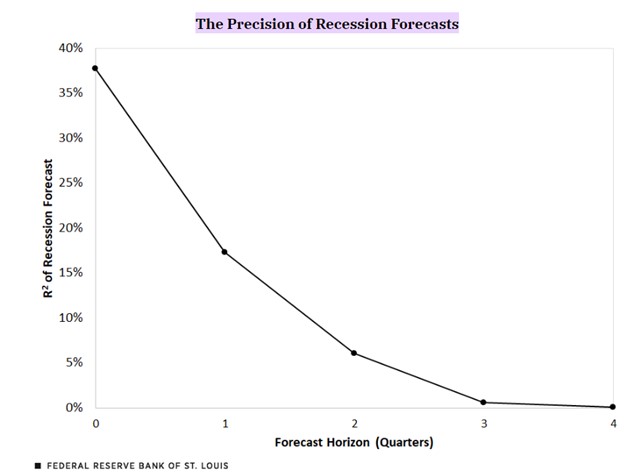

Second, studies show that economists, analysts, and members of the Federal Reserve cannot accurately predict the future path of the economy. A recent 2023 paper from the Federal Reserve Bank of St. Louis (HERE) studied the predictive prowess of economists. The paper concludes that quarter-ahead recession forecasts are fairly accurate, but the economists’ precision of forecasts beyond one quarter falls dramatically. The graph below shows the precision of recession forecasts over a four-quarter forecast horizon. Forecast precision falls dramatically from an R-squared of 38% in the first quarter to just 0.1% for the four quarters ahead. Economists can barely predict major economic developments beyond one quarter.

Third, banks and businesses cannot be adequately managed by positioning for one forecast. Instead, the analysis must attribute probabilities for various outcomes, and bank and business managers must optimize their bank’s strategy to address all possible outcomes given different probability weightings.

Fourth, during periods of transition (for example, after a pandemic that caused major economic disruption or transition from low to high inflation economic drivers) interest rate predictions become even less accurate. Below is a graph of short-term rates, and their historical levels in the blue line and forecasts of those same rates in the dotted red line at various times in history. History teaches us that short-term interest rates were not well predicted by the market’s expectations. However, in the last three years specifically, the market expectations have shifted dramatically and we have moved from “inflation is transitory” to “higher for longer” very quickly.

Our Advice

The premise of our advice is based on two simple notions, as follows: 1) long-term assets should be financed with long-term liabilities to the extent possible, and 2) relationship banking is a positive outcome for both borrower and lender, and short-term commitments are not relationship building.

We tell borrowers and lenders the following:

- Timing the market for the lowest financing cost is an impossible task for anyone who cannot see the future. The inverted yield curve is already pricing the probability that the Fed decreases interest rates in the future and a rational borrower would be indifferent (as to loan costs) between short-term and long-term financing. But there is an obvious reduction of risk for borrowers to finance long-term assets with long-term liabilities (more on this below).

- Short-term rates are not necessarily correlated with long-term rates. Therefore, what the Fed does with the overnight rate (the index which it directly controls) has little bearing on a borrower’s cost of financing term debt.

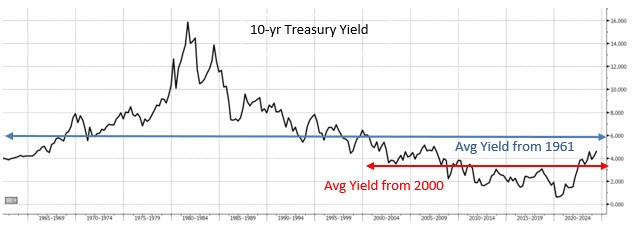

- Long-term interest rates are not above historical averages. The graph below shows 10-year Treasury rates and average rates for two periods (from 1961 to the present and from 2000 to the present). By longer-term historical averages, current 10-year rates are low. From 2000 to the present (which includes depressed rates during the pandemic and great financial crises), long-term rates are at approximately an average level. It may be unwise for borrowers to wait for a more suitable time to secure long-term financing.

- Short-term facilities do not allow borrowers to pay down the debt and build equity in the collateral. The graph below shows the principal outstanding as percentage of collateral value (starting at 75% loan-to-value (LTV)). The table below shows the amount of principal reduced for the respective terms. A shorter financing term creates a greater refinancing risk – when the borrower has potentially little (or no) equity in the project. Conversely, ten- and 15-year terms allow the borrower to pay down a substantial amount of debt, increasing equity in the project and minimizing refinancing risk. Therefore, short-term debt used to finance long-term assets increases risk.

- Short-term facilities expose the borrower to cash flow risk if interest rates are higher in the future when the borrower needs to refinance the temporary debt or if the borrower’s cash flow is impaired. The graph below shows resulting debt service coverage ratio (DSCR) in the future if interest rates increase, for loans that start at 1.1X, 1.15X, 1.2X, and 1.29X DSCR. The analysis shows that projects starting with 1.1X DSCR (7.00% fixed rate on 25yr amortization) would break 1.0X if rates rise by only 99bps. A project starting with 1.15X DSCR would break 1.0X if rates rise by 1.60%, and those with 1.2X DSCR would break 1.0X if rates rise by 2.10%. Most banks want to stress-test DSCR at 3.00% higher rates, and that would require a 1.29X starting DSCR to withstand that risk and ensure at least 1.0X DSCR. Again, short-term financing of long-term assets creates another source of risk for both the borrower and the lender.

Conclusion

Interest rate predictions are often wrong but it doesn’t matter as lenders and borrowers should not be in the predicting game. The short-term financing of long-term assets creates several shortcomings and is often the result of banks inadvertently creating an array of risks to appease a borrower’s misunderstanding of the fundamentals of finance. Community bankers have good insight into their client’s business models and personal goals. Bankers should be able to explain the pitfalls outlined above and provide appropriate advice to their clients. The lender’s primary value is being able to offer products that protect the borrower’s liquidity, minimize credit and refinancing risks, and help finance the borrower’s business for expected growth and succession planning.